Natixis Advisors LLC lifted its stake in Onto Innovation Inc. (NYSE:ONTO - Free Report) by 3.4% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 253,600 shares of the semiconductor company's stock after purchasing an additional 8,456 shares during the period. Natixis Advisors LLC owned about 0.51% of Onto Innovation worth $52,637,000 at the end of the most recent quarter.

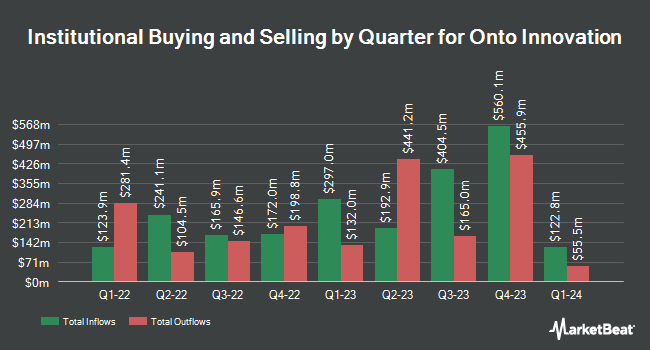

Several other large investors also recently bought and sold shares of ONTO. Vaughan Nelson Investment Management L.P. raised its holdings in shares of Onto Innovation by 24.6% in the 2nd quarter. Vaughan Nelson Investment Management L.P. now owns 202,425 shares of the semiconductor company's stock valued at $44,444,000 after purchasing an additional 39,955 shares in the last quarter. Envestnet Portfolio Solutions Inc. boosted its holdings in shares of Onto Innovation by 98.5% in the 2nd quarter. Envestnet Portfolio Solutions Inc. now owns 5,547 shares of the semiconductor company's stock valued at $1,218,000 after buying an additional 2,753 shares in the last quarter. Public Employees Retirement Association of Colorado grew its position in shares of Onto Innovation by 45.7% in the 2nd quarter. Public Employees Retirement Association of Colorado now owns 105,267 shares of the semiconductor company's stock valued at $23,112,000 after buying an additional 33,025 shares during the last quarter. Bessemer Group Inc. lifted its position in Onto Innovation by 7.0% in the first quarter. Bessemer Group Inc. now owns 119,890 shares of the semiconductor company's stock valued at $21,709,000 after acquiring an additional 7,815 shares during the last quarter. Finally, State Board of Administration of Florida Retirement System boosted its stake in Onto Innovation by 27.2% in the first quarter. State Board of Administration of Florida Retirement System now owns 17,789 shares of the semiconductor company's stock valued at $3,221,000 after acquiring an additional 3,800 shares in the last quarter. Hedge funds and other institutional investors own 98.35% of the company's stock.

Onto Innovation Trading Down 3.8 %

Shares of NYSE ONTO opened at $158.54 on Friday. The company's 50-day moving average price is $196.76 and its 200 day moving average price is $205.94. Onto Innovation Inc. has a 52 week low of $131.78 and a 52 week high of $238.93. The stock has a market cap of $7.83 billion, a price-to-earnings ratio of 42.96, a PEG ratio of 1.02 and a beta of 1.37.

Onto Innovation (NYSE:ONTO - Get Free Report) last announced its earnings results on Thursday, October 31st. The semiconductor company reported $1.34 earnings per share for the quarter, beating the consensus estimate of $1.31 by $0.03. The firm had revenue of $252.20 million during the quarter, compared to the consensus estimate of $250.85 million. Onto Innovation had a net margin of 19.44% and a return on equity of 13.38%. The firm's revenue for the quarter was up 21.7% on a year-over-year basis. During the same quarter in the previous year, the company posted $0.96 EPS. As a group, research analysts expect that Onto Innovation Inc. will post 5.19 earnings per share for the current year.

Insider Activity at Onto Innovation

In related news, SVP Srinivas Vedula sold 1,275 shares of Onto Innovation stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $207.24, for a total transaction of $264,231.00. Following the sale, the senior vice president now owns 16,050 shares of the company's stock, valued at $3,326,202. The trade was a 7.36 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Company insiders own 0.72% of the company's stock.

Analyst Ratings Changes

ONTO has been the topic of several research analyst reports. Benchmark reaffirmed a "buy" rating and set a $230.00 price target on shares of Onto Innovation in a research report on Friday, November 1st. Jefferies Financial Group dropped their price objective on shares of Onto Innovation from $265.00 to $245.00 and set a "buy" rating on the stock in a research note on Friday, November 1st. Needham & Company LLC dropped their price target on Onto Innovation from $245.00 to $230.00 and set a "buy" rating on the stock in a research report on Friday, November 1st. Finally, Oppenheimer lifted their target price on Onto Innovation from $260.00 to $275.00 and gave the company an "outperform" rating in a research note on Friday, November 1st. One research analyst has rated the stock with a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat.com, Onto Innovation currently has a consensus rating of "Moderate Buy" and an average target price of $254.29.

View Our Latest Analysis on Onto Innovation

Onto Innovation Company Profile

(

Free Report)

Onto Innovation Inc engages in the design, development, manufacture, and support of process control tools that performs optical metrology. The company offers lithography systems and process control analytical software. It also offers process and yield management solutions, and device packaging and test facilities through standalone systems for optical metrology, macro-defect inspection, packaging lithography, and transparent and opaque thin film measurements.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Onto Innovation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Onto Innovation wasn't on the list.

While Onto Innovation currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.