CDAM UK Ltd lowered its stake in shares of Open Text Co. (NASDAQ:OTEX - Free Report) TSE: OTC by 4.6% in the third quarter, according to its most recent 13F filing with the SEC. The fund owned 2,212,637 shares of the software maker's stock after selling 107,480 shares during the period. Open Text makes up approximately 10.9% of CDAM UK Ltd's portfolio, making the stock its 3rd biggest holding. CDAM UK Ltd owned about 0.83% of Open Text worth $73,637,000 as of its most recent SEC filing.

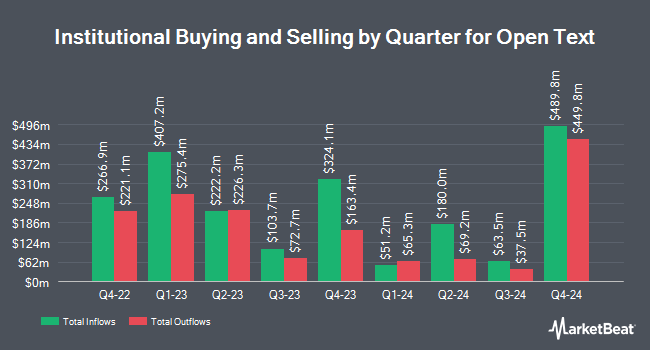

Several other institutional investors and hedge funds have also recently modified their holdings of the stock. Brandes Investment Partners LP grew its position in Open Text by 236.8% in the 2nd quarter. Brandes Investment Partners LP now owns 1,834,835 shares of the software maker's stock worth $55,059,000 after purchasing an additional 1,290,011 shares in the last quarter. The Manufacturers Life Insurance Company grew its holdings in shares of Open Text by 25.1% in the second quarter. The Manufacturers Life Insurance Company now owns 5,578,835 shares of the software maker's stock valued at $167,277,000 after acquiring an additional 1,118,479 shares in the last quarter. Cooke & Bieler LP increased its position in shares of Open Text by 18.6% during the second quarter. Cooke & Bieler LP now owns 5,536,769 shares of the software maker's stock valued at $166,325,000 after acquiring an additional 867,978 shares during the last quarter. JARISLOWSKY FRASER Ltd lifted its holdings in Open Text by 5.1% during the second quarter. JARISLOWSKY FRASER Ltd now owns 15,702,510 shares of the software maker's stock worth $471,415,000 after acquiring an additional 767,822 shares during the period. Finally, National Bank of Canada FI boosted its position in Open Text by 17.5% in the second quarter. National Bank of Canada FI now owns 4,021,893 shares of the software maker's stock worth $120,390,000 after purchasing an additional 599,790 shares during the last quarter. 70.37% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of equities research analysts have recently commented on the company. TD Securities lowered their target price on Open Text from $40.00 to $38.00 and set a "buy" rating on the stock in a research note on Friday, November 1st. National Bank Financial lowered shares of Open Text from an "outperform" rating to a "sector perform" rating in a research report on Friday, August 2nd. BMO Capital Markets reduced their price objective on shares of Open Text from $33.00 to $32.00 and set a "market perform" rating for the company in a research note on Friday, November 1st. Royal Bank of Canada downgraded Open Text from an "outperform" rating to a "sector perform" rating and dropped their target price for the stock from $45.00 to $33.00 in a research report on Friday, November 1st. Finally, Barclays reduced their price target on Open Text from $36.00 to $34.00 and set an "equal weight" rating for the company in a research report on Friday, November 1st. Eight research analysts have rated the stock with a hold rating and four have issued a buy rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and a consensus price target of $35.90.

Read Our Latest Report on OTEX

Open Text Price Performance

Shares of NASDAQ:OTEX traded up $0.83 on Monday, hitting $30.28. The company's stock had a trading volume of 765,483 shares, compared to its average volume of 644,736. Open Text Co. has a 1 year low of $27.50 and a 1 year high of $45.47. The company has a debt-to-equity ratio of 1.54, a current ratio of 0.79 and a quick ratio of 0.79. The company has a market capitalization of $8.05 billion, a PE ratio of 16.87 and a beta of 1.13. The company has a 50-day simple moving average of $31.89 and a 200 day simple moving average of $31.02.

Open Text (NASDAQ:OTEX - Get Free Report) TSE: OTC last released its quarterly earnings results on Thursday, October 31st. The software maker reported $0.93 EPS for the quarter, topping analysts' consensus estimates of $0.80 by $0.13. The business had revenue of $1.27 billion during the quarter, compared to analysts' expectations of $1.28 billion. Open Text had a net margin of 8.35% and a return on equity of 24.34%. The business's quarterly revenue was down 11.0% compared to the same quarter last year. During the same quarter in the previous year, the company earned $0.90 EPS. Sell-side analysts forecast that Open Text Co. will post 3.37 EPS for the current fiscal year.

Open Text Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, December 20th. Shareholders of record on Friday, November 29th will be given a dividend of $0.262 per share. This is an increase from Open Text's previous quarterly dividend of $0.19. The ex-dividend date of this dividend is Friday, November 29th. This represents a $1.05 dividend on an annualized basis and a yield of 3.46%. Open Text's dividend payout ratio (DPR) is presently 60.69%.

Open Text Profile

(

Free Report)

Open Text Corporation provides information management software and solutions. The company offers content services, which includes content collaboration and intelligent capture to records management, collaboration, e-signatures, and archiving; and operates experience cloud platform that provides customer experience and web content management, digital asset management, customer analytics, AI and insights, e-discovery, digital fax, omnichannel communications, secure messaging, and voice of customer, as well as customer journey, testing, and segmentation.

Read More

Before you consider Open Text, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Open Text wasn't on the list.

While Open Text currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.