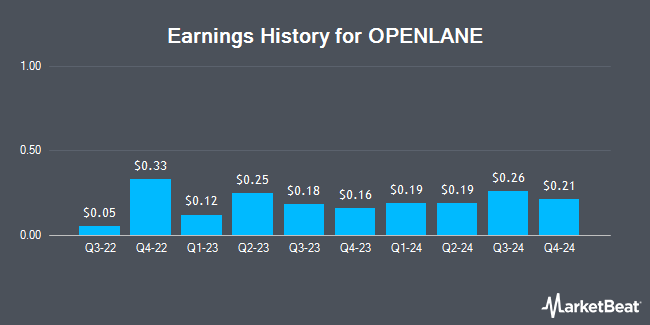

OPENLANE (NYSE:KAR - Get Free Report) is projected to issue its quarterly earnings data after the market closes on Wednesday, February 19th. Analysts expect OPENLANE to post earnings of $0.20 per share and revenue of $416.64 million for the quarter. Individual that wish to listen to the company's earnings conference call can do so using this link.

OPENLANE Stock Performance

KAR stock traded up $0.05 during mid-day trading on Friday, hitting $20.61. The company had a trading volume of 445,730 shares, compared to its average volume of 470,382. The firm has a market cap of $2.20 billion, a PE ratio of 79.25, a price-to-earnings-growth ratio of 1.84 and a beta of 1.52. OPENLANE has a 12 month low of $12.86 and a 12 month high of $21.51. The stock's fifty day moving average price is $20.40 and its two-hundred day moving average price is $18.46.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently commented on the stock. JPMorgan Chase & Co. lifted their price target on shares of OPENLANE from $21.00 to $23.00 and gave the stock an "overweight" rating in a report on Wednesday, November 20th. Barrington Research restated an "outperform" rating and issued a $25.00 target price on shares of OPENLANE in a research note on Friday. Stephens began coverage on OPENLANE in a report on Wednesday, January 22nd. They issued an "equal weight" rating and a $20.00 price objective for the company. Finally, StockNews.com raised shares of OPENLANE from a "hold" rating to a "buy" rating in a report on Friday. Two investment analysts have rated the stock with a hold rating and four have issued a buy rating to the company. According to data from MarketBeat, OPENLANE currently has a consensus rating of "Moderate Buy" and an average price target of $21.60.

Read Our Latest Research Report on KAR

About OPENLANE

(

Get Free Report)

OPENLANE, Inc, together with its subsidiaries, operates as a digital marketplace for used vehicles, which connects sellers and buyers in North America, Europe, the Philippines, and Uruguay. The company operates through two segments, Marketplace and Finance. The Marketplace segment offers digital marketplace services for buying and selling used vehicles.

Recommended Stories

Before you consider OPENLANE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OPENLANE wasn't on the list.

While OPENLANE currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.