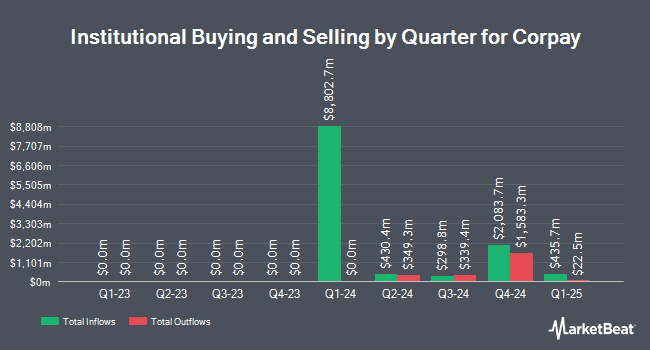

Oppenheimer Asset Management Inc. boosted its position in Corpay, Inc. (NYSE:CPAY - Free Report) by 66.7% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 5,888 shares of the company's stock after buying an additional 2,355 shares during the quarter. Oppenheimer Asset Management Inc.'s holdings in Corpay were worth $1,842,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors have also recently bought and sold shares of the company. Whittier Trust Co. of Nevada Inc. grew its holdings in shares of Corpay by 22.7% during the third quarter. Whittier Trust Co. of Nevada Inc. now owns 184 shares of the company's stock valued at $58,000 after purchasing an additional 34 shares during the last quarter. Mather Group LLC. grew its holdings in shares of Corpay by 21.2% during the third quarter. Mather Group LLC. now owns 200 shares of the company's stock valued at $63,000 after purchasing an additional 35 shares during the last quarter. Epic Trust Investment Advisors LLC grew its holdings in shares of Corpay by 4.1% during the second quarter. Epic Trust Investment Advisors LLC now owns 998 shares of the company's stock valued at $266,000 after purchasing an additional 39 shares during the last quarter. Massmutual Trust Co. FSB ADV grew its holdings in shares of Corpay by 21.6% during the second quarter. Massmutual Trust Co. FSB ADV now owns 242 shares of the company's stock valued at $64,000 after purchasing an additional 43 shares during the last quarter. Finally, Signaturefd LLC grew its holdings in shares of Corpay by 22.3% during the third quarter. Signaturefd LLC now owns 252 shares of the company's stock valued at $79,000 after purchasing an additional 46 shares during the last quarter. 98.84% of the stock is owned by institutional investors.

Analysts Set New Price Targets

CPAY has been the subject of several recent research reports. BMO Capital Markets upped their target price on Corpay from $350.00 to $390.00 and gave the company an "outperform" rating in a report on Thursday, October 3rd. Wolfe Research upgraded Corpay from an "underperform" rating to a "peer perform" rating in a research report on Tuesday, September 3rd. Morgan Stanley boosted their price objective on Corpay from $325.00 to $350.00 and gave the stock an "equal weight" rating in a research report on Monday, November 11th. Wells Fargo & Company boosted their price objective on Corpay from $285.00 to $320.00 and gave the stock an "equal weight" rating in a research report on Monday, October 21st. Finally, Jefferies Financial Group boosted their price objective on Corpay from $375.00 to $425.00 and gave the stock a "buy" rating in a research report on Wednesday, October 16th. Four analysts have rated the stock with a hold rating, ten have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $363.93.

Get Our Latest Stock Report on CPAY

Insider Activity

In other news, Director Joseph W. Farrelly sold 2,975 shares of the stock in a transaction on Wednesday, November 13th. The stock was sold at an average price of $375.18, for a total value of $1,116,160.50. Following the completion of the sale, the director now owns 10,530 shares in the company, valued at $3,950,645.40. This represents a 22.03 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Corporate insiders own 6.10% of the company's stock.

Corpay Price Performance

Shares of NYSE CPAY traded down $1.46 during trading on Monday, hitting $361.90. The company had a trading volume of 228,238 shares, compared to its average volume of 473,631. The company has a market cap of $25.23 billion, a P/E ratio of 26.06, a PEG ratio of 1.42 and a beta of 1.21. Corpay, Inc. has a 52 week low of $230.68 and a 52 week high of $375.98. The business's 50-day moving average is $331.97 and its 200 day moving average is $298.77. The company has a debt-to-equity ratio of 1.69, a quick ratio of 1.02 and a current ratio of 1.05.

About Corpay

(

Free Report)

Corpay, Inc operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally. The company offers vehicle payment solutions, which include fuel, tolls, parking, fleet maintenance, and long-haul transportation services, as well as prepaid food and transportation vouchers and cards.

Featured Articles

Before you consider Corpay, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corpay wasn't on the list.

While Corpay currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.