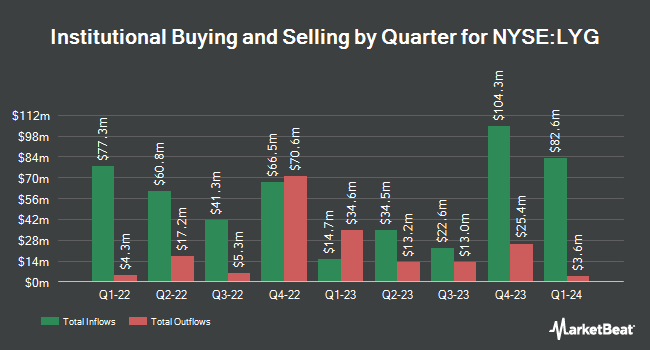

Oppenheimer Asset Management Inc. lifted its position in shares of Lloyds Banking Group plc (NYSE:LYG - Free Report) by 22.3% in the third quarter, according to its most recent disclosure with the SEC. The institutional investor owned 1,022,677 shares of the financial services provider's stock after buying an additional 186,443 shares during the quarter. Oppenheimer Asset Management Inc.'s holdings in Lloyds Banking Group were worth $3,191,000 as of its most recent SEC filing.

A number of other institutional investors also recently modified their holdings of the business. Allspring Global Investments Holdings LLC bought a new stake in shares of Lloyds Banking Group in the first quarter valued at approximately $87,000. Janney Montgomery Scott LLC grew its holdings in shares of Lloyds Banking Group by 19.3% during the 1st quarter. Janney Montgomery Scott LLC now owns 266,603 shares of the financial services provider's stock worth $691,000 after purchasing an additional 43,150 shares in the last quarter. Sei Investments Co. increased its position in shares of Lloyds Banking Group by 5.1% in the first quarter. Sei Investments Co. now owns 663,745 shares of the financial services provider's stock worth $1,719,000 after purchasing an additional 32,300 shares during the period. Russell Investments Group Ltd. increased its position in shares of Lloyds Banking Group by 138.2% in the first quarter. Russell Investments Group Ltd. now owns 26,453 shares of the financial services provider's stock worth $69,000 after purchasing an additional 15,348 shares during the period. Finally, US Bancorp DE lifted its position in Lloyds Banking Group by 25.6% during the first quarter. US Bancorp DE now owns 406,443 shares of the financial services provider's stock worth $1,053,000 after purchasing an additional 82,735 shares during the period. Institutional investors own 2.15% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts have commented on LYG shares. The Goldman Sachs Group assumed coverage on shares of Lloyds Banking Group in a report on Friday, October 4th. They issued a "neutral" rating on the stock. Kepler Capital Markets started coverage on shares of Lloyds Banking Group in a research report on Thursday, September 5th. They set a "hold" rating for the company. Citigroup downgraded Lloyds Banking Group from a "buy" rating to a "neutral" rating in a report on Monday, August 5th. Royal Bank of Canada downgraded Lloyds Banking Group from an "outperform" rating to a "sector perform" rating in a research report on Friday, July 26th. Finally, Morgan Stanley cut Lloyds Banking Group from an "overweight" rating to an "equal weight" rating in a research report on Wednesday, October 30th. Seven analysts have rated the stock with a hold rating and three have issued a buy rating to the company's stock. Based on data from MarketBeat.com, Lloyds Banking Group presently has an average rating of "Hold" and a consensus price target of $2.75.

View Our Latest Stock Analysis on LYG

Lloyds Banking Group Price Performance

Shares of NYSE LYG traded up $0.07 during mid-day trading on Friday, hitting $2.83. 6,925,077 shares of the stock traded hands, compared to its average volume of 9,659,832. Lloyds Banking Group plc has a twelve month low of $2.00 and a twelve month high of $3.24. The firm has a 50 day simple moving average of $3.00 and a two-hundred day simple moving average of $2.91. The company has a debt-to-equity ratio of 1.76, a current ratio of 1.45 and a quick ratio of 1.48. The company has a market cap of $43.50 billion, a PE ratio of 7.26 and a beta of 1.35.

Lloyds Banking Group Company Profile

(

Free Report)

Lloyds Banking Group plc, together with its subsidiaries, provides a range of banking and financial services in the United Kingdom and internationally. It operates in three segments: Retail; Commercial Banking; and Insurance, Pensions and Investments. The Retail segment offers a range of financial service products, including current accounts, savings, mortgages, motor finance, unsecured loans, leasing solutions, and credit cards to personal customers.

Featured Stories

Before you consider Lloyds Banking Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lloyds Banking Group wasn't on the list.

While Lloyds Banking Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.