Oppenheimer Asset Management Inc. increased its holdings in shares of Ambev S.A. (NYSE:ABEV - Free Report) by 32.0% during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 1,067,893 shares of the company's stock after acquiring an additional 258,875 shares during the period. Oppenheimer Asset Management Inc.'s holdings in Ambev were worth $2,606,000 as of its most recent SEC filing.

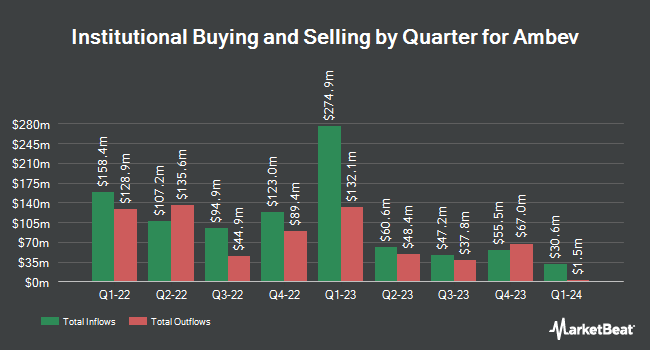

A number of other institutional investors have also recently modified their holdings of the business. Envestnet Portfolio Solutions Inc. grew its holdings in Ambev by 8.9% in the first quarter. Envestnet Portfolio Solutions Inc. now owns 70,787 shares of the company's stock valued at $176,000 after purchasing an additional 5,767 shares during the period. SG Americas Securities LLC grew its stake in Ambev by 12.5% in the 1st quarter. SG Americas Securities LLC now owns 46,857 shares of the company's stock valued at $116,000 after acquiring an additional 5,217 shares during the period. Lake Street Advisors Group LLC purchased a new stake in Ambev in the 1st quarter worth $28,000. CANADA LIFE ASSURANCE Co raised its position in Ambev by 5.2% during the first quarter. CANADA LIFE ASSURANCE Co now owns 8,545,370 shares of the company's stock worth $21,270,000 after acquiring an additional 423,792 shares during the period. Finally, Heron Bay Capital Management acquired a new position in Ambev during the first quarter worth $48,000. 8.13% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

ABEV has been the topic of several research analyst reports. UBS Group dropped their target price on shares of Ambev from $3.20 to $2.90 and set a "buy" rating on the stock in a research report on Wednesday, July 31st. StockNews.com began coverage on Ambev in a report on Friday, October 18th. They issued a "buy" rating on the stock. Four investment analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus price target of $2.75.

View Our Latest Analysis on ABEV

Ambev Price Performance

Ambev stock opened at $2.21 on Friday. The company has a fifty day simple moving average of $2.31 and a 200-day simple moving average of $2.25. The firm has a market capitalization of $34.82 billion, a price-to-earnings ratio of 12.28, a PEG ratio of 6.91 and a beta of 1.06. The company has a quick ratio of 0.89, a current ratio of 1.20 and a debt-to-equity ratio of 0.02. Ambev S.A. has a 52-week low of $2.01 and a 52-week high of $3.00.

About Ambev

(

Free Report)

Ambev SA, through its subsidiaries, engages in the production, distribution, and sale of beer, draft beer, carbonated soft drinks, malt and food, other alcoholic beverages, and non-alcoholic and non-carbonated products in Brazil, Central America and Caribbean, Latin America South, and Canada. It offers beer primarily under the Skol, Brahma, Antarctica, Brahva, Budweiser, Bud Light, Beck, Leffe, Hoegaarden, Balboa ICE, Balboa, Atlas Golden Light, Atlas, Bucanero, Cristal, Mayabe, Presidente, Presidente Light, Brahma Light, Bohemia, The One, Corona, Modelo Especial, Stella Artois, Quilmes Clásica, Paceña, Taquiña, Huari, Becker, Cusqueña, Michelob Ultra, Busch, Pilsen, Ouro Fino, Bud 66, Banks, Deputy, Patricia, Labatt Blue, Alexander Keith's, and Kokanee brands.

Featured Stories

Before you consider Ambev, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ambev wasn't on the list.

While Ambev currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.