Oppenheimer Asset Management Inc. increased its position in shares of Procore Technologies, Inc. (NYSE:PCOR - Free Report) by 56.5% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 58,947 shares of the company's stock after buying an additional 21,287 shares during the period. Oppenheimer Asset Management Inc.'s holdings in Procore Technologies were worth $3,638,000 at the end of the most recent quarter.

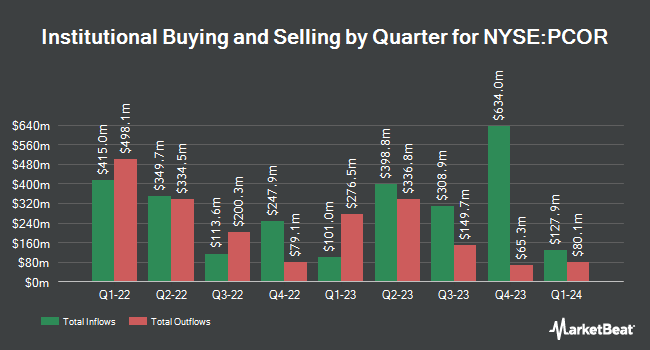

Other institutional investors and hedge funds have also recently made changes to their positions in the company. GAMMA Investing LLC raised its stake in Procore Technologies by 76.4% in the third quarter. GAMMA Investing LLC now owns 404 shares of the company's stock worth $25,000 after buying an additional 175 shares in the last quarter. V Square Quantitative Management LLC bought a new position in shares of Procore Technologies in the 3rd quarter worth $26,000. Signaturefd LLC lifted its stake in shares of Procore Technologies by 52.0% during the 2nd quarter. Signaturefd LLC now owns 631 shares of the company's stock worth $42,000 after purchasing an additional 216 shares during the last quarter. Rothschild Investment LLC bought a new stake in Procore Technologies during the second quarter valued at about $51,000. Finally, International Assets Investment Management LLC grew its stake in Procore Technologies by 6,069.2% in the third quarter. International Assets Investment Management LLC now owns 802 shares of the company's stock valued at $49,000 after purchasing an additional 789 shares during the last quarter. 81.10% of the stock is currently owned by institutional investors.

Insider Activity at Procore Technologies

In other news, Director Connor Kevin J. O sold 25,000 shares of the stock in a transaction dated Monday, August 19th. The shares were sold at an average price of $57.53, for a total transaction of $1,438,250.00. Following the sale, the director now directly owns 1,380,078 shares of the company's stock, valued at $79,395,887.34. This represents a 1.78 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, CEO Craig F. Jr. Courtemanche sold 22,993 shares of Procore Technologies stock in a transaction dated Thursday, August 22nd. The shares were sold at an average price of $59.14, for a total value of $1,359,806.02. Following the completion of the transaction, the chief executive officer now owns 793,123 shares of the company's stock, valued at approximately $46,905,294.22. This represents a 2.82 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 132,695 shares of company stock worth $8,283,143. 29.00% of the stock is owned by corporate insiders.

Analyst Ratings Changes

Several research firms recently commented on PCOR. TD Cowen boosted their price objective on shares of Procore Technologies from $65.00 to $70.00 and gave the stock a "buy" rating in a research note on Monday, October 28th. Baird R W raised Procore Technologies to a "strong-buy" rating in a research report on Tuesday, September 24th. Macquarie restated a "neutral" rating and set a $70.00 target price on shares of Procore Technologies in a research note on Tuesday, July 30th. KeyCorp decreased their price target on Procore Technologies from $79.00 to $68.00 and set an "overweight" rating for the company in a research note on Friday, August 2nd. Finally, Scotiabank lowered their price target on Procore Technologies from $90.00 to $70.00 and set a "sector outperform" rating for the company in a report on Friday, August 2nd. Five equities research analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $69.94.

Get Our Latest Stock Report on PCOR

Procore Technologies Stock Performance

Shares of Procore Technologies stock traded down $2.46 during trading on Friday, hitting $69.15. 2,132,542 shares of the company's stock were exchanged, compared to its average volume of 1,575,321. The stock has a market capitalization of $10.28 billion, a price-to-earnings ratio of -138.30 and a beta of 0.71. The business has a 50-day simple moving average of $62.53 and a 200-day simple moving average of $63.82. Procore Technologies, Inc. has a 52-week low of $49.46 and a 52-week high of $83.35. The company has a debt-to-equity ratio of 0.03, a quick ratio of 1.57 and a current ratio of 1.57.

Procore Technologies (NYSE:PCOR - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The company reported ($0.11) earnings per share for the quarter, meeting analysts' consensus estimates of ($0.11). The business had revenue of $295.89 million during the quarter, compared to analyst estimates of $287.42 million. Procore Technologies had a negative return on equity of 2.51% and a negative net margin of 6.59%. On average, research analysts forecast that Procore Technologies, Inc. will post -0.23 EPS for the current year.

About Procore Technologies

(

Free Report)

Procore Technologies, Inc engages in the provision of a cloud-based construction management platform and related software products in the United States and internationally. The company's platform enables owners, general and specialty contractors, architects, and engineers to collaborate on construction projects.

Featured Stories

Before you consider Procore Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Procore Technologies wasn't on the list.

While Procore Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.