Oppenheimer Asset Management Inc. cut its holdings in Rollins, Inc. (NYSE:ROL - Free Report) by 12.2% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The firm owned 186,897 shares of the business services provider's stock after selling 25,912 shares during the quarter. Oppenheimer Asset Management Inc.'s holdings in Rollins were worth $9,453,000 as of its most recent SEC filing.

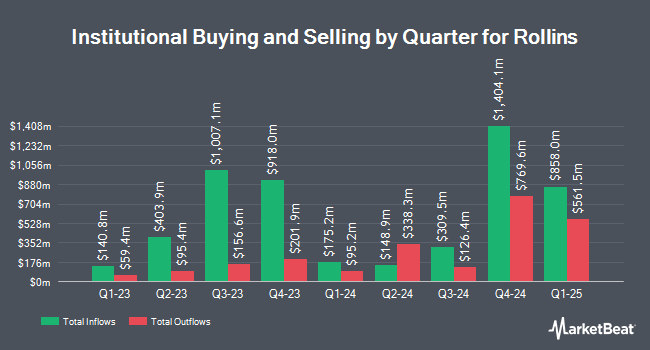

A number of other institutional investors and hedge funds have also recently modified their holdings of the business. Fiera Capital Corp bought a new position in Rollins in the third quarter worth approximately $43,225,000. Intech Investment Management LLC grew its position in Rollins by 502.8% in the 1st quarter. Intech Investment Management LLC now owns 572,181 shares of the business services provider's stock valued at $26,475,000 after purchasing an additional 477,256 shares during the period. Cetera Investment Advisers increased its stake in Rollins by 4,697.4% during the 1st quarter. Cetera Investment Advisers now owns 324,109 shares of the business services provider's stock valued at $14,997,000 after purchasing an additional 317,353 shares in the last quarter. M&G Plc acquired a new position in Rollins during the first quarter worth $14,072,000. Finally, DekaBank Deutsche Girozentrale raised its holdings in Rollins by 350.8% during the first quarter. DekaBank Deutsche Girozentrale now owns 368,521 shares of the business services provider's stock worth $17,118,000 after buying an additional 286,780 shares during the last quarter. 51.79% of the stock is currently owned by institutional investors.

Insider Buying and Selling at Rollins

In other Rollins news, insider Elizabeth B. Chandler sold 4,685 shares of the business's stock in a transaction on Tuesday, September 3rd. The stock was sold at an average price of $50.74, for a total value of $237,716.90. Following the sale, the insider now directly owns 89,338 shares in the company, valued at $4,533,010.12. The trade was a 4.98 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Corporate insiders own 4.69% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have recently issued reports on ROL shares. Barclays assumed coverage on shares of Rollins in a report on Monday, November 4th. They set an "equal weight" rating and a $50.00 price objective for the company. Royal Bank of Canada reissued an "outperform" rating and set a $52.00 price objective on shares of Rollins in a report on Thursday, July 25th. StockNews.com lowered Rollins from a "buy" rating to a "hold" rating in a report on Thursday, October 24th. Finally, Wells Fargo & Company upped their price target on Rollins from $54.00 to $56.00 and gave the stock an "overweight" rating in a report on Tuesday, October 15th. Four research analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of $49.83.

Check Out Our Latest Stock Report on ROL

Rollins Stock Performance

Shares of ROL stock traded down $1.16 during trading on Thursday, hitting $50.13. The company's stock had a trading volume of 1,523,390 shares, compared to its average volume of 1,707,901. The company has a current ratio of 0.78, a quick ratio of 0.72 and a debt-to-equity ratio of 0.34. The company has a market cap of $24.28 billion, a PE ratio of 52.78 and a beta of 0.70. The business has a fifty day moving average of $49.56 and a 200-day moving average of $48.63. Rollins, Inc. has a 52 week low of $38.95 and a 52 week high of $52.16.

Rollins (NYSE:ROL - Get Free Report) last announced its quarterly earnings data on Wednesday, October 23rd. The business services provider reported $0.29 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.30 by ($0.01). The business had revenue of $916.27 million during the quarter, compared to the consensus estimate of $911.15 million. Rollins had a net margin of 14.18% and a return on equity of 38.67%. The firm's revenue for the quarter was up 9.0% compared to the same quarter last year. During the same quarter last year, the company earned $0.28 EPS. As a group, research analysts anticipate that Rollins, Inc. will post 0.99 earnings per share for the current year.

Rollins Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Tuesday, November 12th will be given a $0.165 dividend. This is a positive change from Rollins's previous quarterly dividend of $0.15. The ex-dividend date is Tuesday, November 12th. This represents a $0.66 annualized dividend and a yield of 1.32%. Rollins's payout ratio is currently 68.75%.

About Rollins

(

Free Report)

Rollins, Inc, through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally. The company offers pest control services to residential properties protecting from common pests, including rodents, insects, and wildlife.

See Also

Before you consider Rollins, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rollins wasn't on the list.

While Rollins currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.