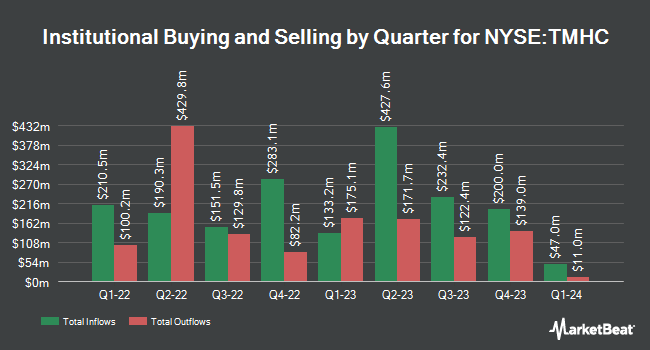

Oppenheimer & Co. Inc. lessened its stake in shares of Taylor Morrison Home Co. (NYSE:TMHC - Free Report) by 21.7% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 29,145 shares of the construction company's stock after selling 8,068 shares during the quarter. Oppenheimer & Co. Inc.'s holdings in Taylor Morrison Home were worth $2,048,000 at the end of the most recent reporting period.

Several other large investors also recently made changes to their positions in the business. MQS Management LLC purchased a new position in Taylor Morrison Home during the 3rd quarter valued at about $768,000. Aigen Investment Management LP acquired a new stake in Taylor Morrison Home during the third quarter worth $789,000. Arcus Capital Partners LLC bought a new stake in Taylor Morrison Home in the third quarter valued at about $318,000. Meritage Portfolio Management raised its holdings in shares of Taylor Morrison Home by 9.2% in the 3rd quarter. Meritage Portfolio Management now owns 11,235 shares of the construction company's stock worth $789,000 after buying an additional 949 shares in the last quarter. Finally, AIA Group Ltd boosted its position in Taylor Morrison Home by 94.1% in the third quarter. AIA Group Ltd now owns 7,548 shares of the construction company's stock valued at $530,000 after buying an additional 3,659 shares in the last quarter. Institutional investors own 95.16% of the company's stock.

Wall Street Analysts Forecast Growth

TMHC has been the subject of a number of research reports. Royal Bank of Canada lifted their price objective on Taylor Morrison Home from $74.00 to $77.00 and gave the stock an "outperform" rating in a research report on Thursday, October 24th. Barclays increased their price target on shares of Taylor Morrison Home from $72.00 to $75.00 and gave the company an "equal weight" rating in a research note on Thursday, October 24th. StockNews.com upgraded Taylor Morrison Home from a "hold" rating to a "buy" rating in a research report on Thursday, October 24th. BTIG Research raised their price objective on Taylor Morrison Home from $78.00 to $86.00 and gave the stock a "buy" rating in a research note on Thursday, October 24th. Finally, Wedbush upgraded shares of Taylor Morrison Home from a "neutral" rating to an "outperform" rating and upped their price objective for the stock from $65.00 to $85.00 in a research report on Friday, October 25th. Two equities research analysts have rated the stock with a hold rating and seven have given a buy rating to the company. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $77.33.

Read Our Latest Analysis on Taylor Morrison Home

Insider Transactions at Taylor Morrison Home

In other Taylor Morrison Home news, EVP Darrell Sherman sold 68,433 shares of the firm's stock in a transaction that occurred on Wednesday, October 30th. The shares were sold at an average price of $70.50, for a total value of $4,824,526.50. Following the transaction, the executive vice president now directly owns 109,217 shares of the company's stock, valued at $7,699,798.50. This trade represents a 38.52 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Director William H. Lyon sold 9,075 shares of Taylor Morrison Home stock in a transaction that occurred on Thursday, November 7th. The shares were sold at an average price of $72.08, for a total transaction of $654,126.00. Following the sale, the director now directly owns 2,136,241 shares in the company, valued at approximately $153,980,251.28. The trade was a 0.42 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 104,337 shares of company stock worth $7,356,683 in the last three months. Insiders own 3.50% of the company's stock.

Taylor Morrison Home Stock Down 0.2 %

Taylor Morrison Home stock traded down $0.16 during trading hours on Friday, hitting $70.02. 519,815 shares of the stock traded hands, compared to its average volume of 961,317. The firm's 50-day moving average price is $68.99 and its two-hundred day moving average price is $63.19. The company has a market cap of $7.25 billion, a PE ratio of 9.26 and a beta of 1.96. The company has a current ratio of 6.24, a quick ratio of 0.69 and a debt-to-equity ratio of 0.37. Taylor Morrison Home Co. has a one year low of $44.32 and a one year high of $74.69.

Taylor Morrison Home (NYSE:TMHC - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The construction company reported $2.37 earnings per share for the quarter, beating analysts' consensus estimates of $2.06 by $0.31. The business had revenue of $2.12 billion during the quarter, compared to analyst estimates of $1.96 billion. Taylor Morrison Home had a net margin of 10.39% and a return on equity of 15.91%. The company's quarterly revenue was up 26.6% compared to the same quarter last year. During the same period in the previous year, the business earned $1.62 EPS. On average, research analysts forecast that Taylor Morrison Home Co. will post 8.44 EPS for the current year.

Taylor Morrison Home Profile

(

Free Report)

Taylor Morrison Home Corporation, together with its subsidiaries, operates as a public homebuilder in the United States. The company designs, builds, and sells single and multi-family detached and attached homes; and develops lifestyle and master-planned communities. It develops and constructs multi-use properties consisting of commercial space, retail, and multi-family properties under the Urban Form brand name.

See Also

Before you consider Taylor Morrison Home, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Taylor Morrison Home wasn't on the list.

While Taylor Morrison Home currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.