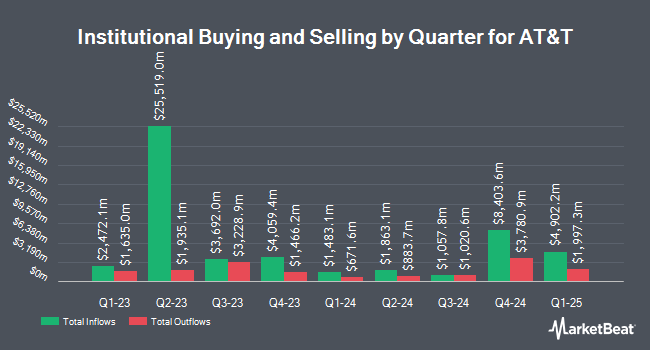

Oppenheimer & Co. Inc. grew its holdings in shares of AT&T Inc. (NYSE:T - Free Report) by 22.6% during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 1,182,235 shares of the technology company's stock after acquiring an additional 218,312 shares during the quarter. Oppenheimer & Co. Inc.'s holdings in AT&T were worth $26,009,000 at the end of the most recent quarter.

Several other large investors have also recently made changes to their positions in the business. Koshinski Asset Management Inc. increased its stake in shares of AT&T by 20.8% in the first quarter. Koshinski Asset Management Inc. now owns 76,401 shares of the technology company's stock worth $1,345,000 after buying an additional 13,150 shares during the period. TBH Global Asset Management LLC increased its stake in shares of AT&T by 28.9% in the first quarter. TBH Global Asset Management LLC now owns 26,158 shares of the technology company's stock worth $460,000 after buying an additional 5,868 shares during the period. Ledyard National Bank increased its stake in shares of AT&T by 135.3% in the first quarter. Ledyard National Bank now owns 70,315 shares of the technology company's stock worth $1,238,000 after buying an additional 40,426 shares during the period. Kingsview Wealth Management LLC increased its stake in shares of AT&T by 2.6% in the first quarter. Kingsview Wealth Management LLC now owns 224,144 shares of the technology company's stock worth $3,945,000 after buying an additional 5,702 shares during the period. Finally, HBK Sorce Advisory LLC increased its position in AT&T by 3.8% during the 1st quarter. HBK Sorce Advisory LLC now owns 234,431 shares of the technology company's stock valued at $4,126,000 after purchasing an additional 8,596 shares during the period. 57.10% of the stock is owned by hedge funds and other institutional investors.

AT&T Price Performance

T stock traded up $0.15 during midday trading on Wednesday, hitting $22.30. The company's stock had a trading volume of 28,934,241 shares, compared to its average volume of 35,560,203. The company has a quick ratio of 0.67, a current ratio of 0.73 and a debt-to-equity ratio of 1.09. The firm has a market capitalization of $160.01 billion, a price-to-earnings ratio of 18.13, a price-to-earnings-growth ratio of 3.33 and a beta of 0.59. AT&T Inc. has a 12 month low of $15.52 and a 12 month high of $22.73. The company has a 50 day moving average of $21.79 and a two-hundred day moving average of $19.63.

AT&T (NYSE:T - Get Free Report) last posted its earnings results on Wednesday, October 23rd. The technology company reported $0.60 EPS for the quarter, beating analysts' consensus estimates of $0.57 by $0.03. The firm had revenue of $30.20 billion during the quarter, compared to the consensus estimate of $30.50 billion. AT&T had a return on equity of 13.97% and a net margin of 7.42%. The company's quarterly revenue was down .5% compared to the same quarter last year. During the same period in the prior year, the company earned $0.64 EPS. On average, analysts expect that AT&T Inc. will post 2.22 EPS for the current year.

AT&T Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, November 1st. Investors of record on Thursday, October 10th were given a $0.2775 dividend. The ex-dividend date of this dividend was Thursday, October 10th. This represents a $1.11 dividend on an annualized basis and a yield of 4.98%. AT&T's dividend payout ratio is presently 90.24%.

Analysts Set New Price Targets

A number of brokerages have issued reports on T. JPMorgan Chase & Co. boosted their price objective on shares of AT&T from $21.00 to $24.00 and gave the company an "overweight" rating in a research report on Thursday, July 25th. Oppenheimer boosted their target price on shares of AT&T from $23.00 to $24.00 and gave the company an "outperform" rating in a report on Thursday, October 24th. Redburn Atlantic upgraded shares of AT&T to a "strong sell" rating in a report on Monday, September 16th. Scotiabank cut shares of AT&T from a "strong-buy" rating to a "hold" rating in a report on Tuesday, August 6th. Finally, Wells Fargo & Company dropped their target price on shares of AT&T from $25.00 to $24.00 and set an "overweight" rating on the stock in a report on Thursday, October 24th. One investment analyst has rated the stock with a sell rating, eight have assigned a hold rating, ten have assigned a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, AT&T currently has an average rating of "Moderate Buy" and an average target price of $23.40.

Get Our Latest Research Report on AT&T

AT&T Company Profile

(

Free Report)

AT&T Inc provides telecommunications and technology services worldwide. The company operates through two segments, Communications and Latin America. The Communications segment offers wireless voice and data communications services; and sells handsets, wireless data cards, wireless computing devices, carrying cases/protective covers, and wireless chargers through its own company-owned stores, agents, and third-party retail stores.

Featured Articles

Before you consider AT&T, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AT&T wasn't on the list.

While AT&T currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.