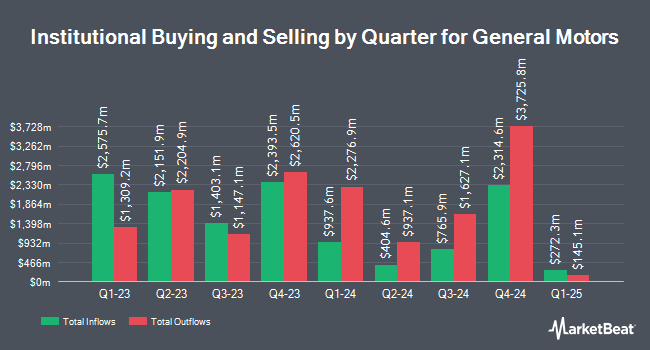

Oppenheimer & Co. Inc. trimmed its stake in General Motors (NYSE:GM - Free Report) TSE: GMM.U by 72.2% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 14,774 shares of the auto manufacturer's stock after selling 38,465 shares during the period. Oppenheimer & Co. Inc.'s holdings in General Motors were worth $662,000 at the end of the most recent reporting period.

Several other large investors have also bought and sold shares of the stock. Bank of New York Mellon Corp lifted its stake in General Motors by 1.1% in the second quarter. Bank of New York Mellon Corp now owns 12,951,561 shares of the auto manufacturer's stock valued at $601,730,000 after buying an additional 135,717 shares during the period. Dimensional Fund Advisors LP lifted its position in shares of General Motors by 9.2% during the 2nd quarter. Dimensional Fund Advisors LP now owns 12,922,021 shares of the auto manufacturer's stock valued at $600,291,000 after acquiring an additional 1,091,137 shares during the period. Diamond Hill Capital Management Inc. boosted its stake in General Motors by 3.9% during the third quarter. Diamond Hill Capital Management Inc. now owns 11,113,063 shares of the auto manufacturer's stock worth $498,310,000 after acquiring an additional 421,989 shares in the last quarter. LSV Asset Management raised its holdings in shares of General Motors by 2.6% during the second quarter. LSV Asset Management now owns 8,847,440 shares of the auto manufacturer's stock valued at $411,052,000 after purchasing an additional 223,260 shares during the period. Finally, Swedbank AB bought a new position in shares of General Motors during the 1st quarter worth about $159,750,000. 92.67% of the stock is owned by institutional investors.

Analysts Set New Price Targets

A number of research analysts recently weighed in on GM shares. JPMorgan Chase & Co. increased their price target on General Motors from $64.00 to $70.00 and gave the stock an "overweight" rating in a report on Wednesday, October 23rd. The Goldman Sachs Group lifted their price objective on shares of General Motors from $53.00 to $61.00 and gave the company a "buy" rating in a report on Tuesday, October 1st. Wedbush increased their price target on General Motors from $55.00 to $60.00 and gave the company an "outperform" rating in a research report on Wednesday, October 23rd. Wolfe Research assumed coverage on shares of General Motors in a research note on Thursday, September 5th. They issued a "peer perform" rating for the company. Finally, Sanford C. Bernstein boosted their price target on shares of General Motors from $53.00 to $55.00 and gave the stock a "market perform" rating in a report on Friday, October 25th. Four analysts have rated the stock with a sell rating, seven have issued a hold rating, ten have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus price target of $56.92.

Check Out Our Latest Stock Report on GM

Insider Activity at General Motors

In other news, CEO Mary T. Barra sold 506,824 shares of the stock in a transaction dated Wednesday, October 23rd. The shares were sold at an average price of $53.33, for a total transaction of $27,028,923.92. Following the completion of the sale, the chief executive officer now directly owns 694,548 shares in the company, valued at approximately $37,040,244.84. This represents a 42.19 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, EVP Rory Harvey sold 12,795 shares of the business's stock in a transaction dated Monday, August 26th. The shares were sold at an average price of $49.02, for a total value of $627,210.90. Following the transaction, the executive vice president now owns 8,513 shares in the company, valued at approximately $417,307.26. This represents a 60.05 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 1,036,653 shares of company stock worth $56,710,175 in the last ninety days. 0.72% of the stock is owned by company insiders.

General Motors Price Performance

Shares of General Motors stock opened at $54.88 on Thursday. The business's 50-day moving average price is $50.31 and its 200-day moving average price is $47.53. The firm has a market capitalization of $60.35 billion, a PE ratio of 5.85, a price-to-earnings-growth ratio of 0.42 and a beta of 1.40. General Motors has a 12 month low of $27.70 and a 12 month high of $59.39. The company has a current ratio of 1.21, a quick ratio of 1.03 and a debt-to-equity ratio of 1.24.

General Motors (NYSE:GM - Get Free Report) TSE: GMM.U last posted its quarterly earnings results on Tuesday, October 22nd. The auto manufacturer reported $2.96 EPS for the quarter, topping the consensus estimate of $2.49 by $0.47. General Motors had a net margin of 6.06% and a return on equity of 16.30%. The firm had revenue of $48.76 billion for the quarter, compared to the consensus estimate of $44.67 billion. During the same period last year, the firm posted $2.28 earnings per share. The business's revenue was up 10.5% compared to the same quarter last year. Sell-side analysts forecast that General Motors will post 10.35 EPS for the current fiscal year.

General Motors Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, December 19th. Stockholders of record on Friday, December 6th will be issued a $0.12 dividend. The ex-dividend date is Friday, December 6th. This represents a $0.48 annualized dividend and a dividend yield of 0.87%. General Motors's dividend payout ratio is currently 5.12%.

About General Motors

(

Free Report)

General Motors Company designs, builds, and sells trucks, crossovers, cars, and automobile parts; and provide software-enabled services and subscriptions worldwide. The company operates through GM North America, GM International, Cruise, and GM Financial segments. It markets its vehicles primarily under the Buick, Cadillac, Chevrolet, GMC, Baojun, and Wuling brand names.

Further Reading

Before you consider General Motors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and General Motors wasn't on the list.

While General Motors currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report