Consensus Cloud Solutions (NASDAQ:CCSI - Free Report) had its price target raised by Oppenheimer from $23.00 to $27.00 in a research report report published on Friday,Benzinga reports. The brokerage currently has an outperform rating on the stock.

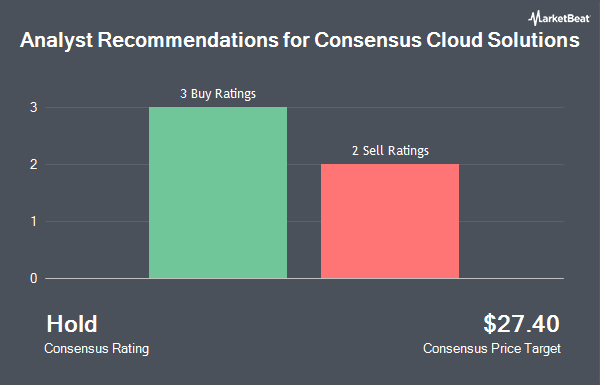

Other analysts have also recently issued research reports about the stock. BTIG Research raised shares of Consensus Cloud Solutions from a "neutral" rating to a "buy" rating and set a $30.00 price objective on the stock in a report on Wednesday, August 21st. JPMorgan Chase & Co. lowered shares of Consensus Cloud Solutions from a "neutral" rating to an "underweight" rating and raised their price target for the company from $19.00 to $21.00 in a research note on Monday, September 9th. Two research analysts have rated the stock with a sell rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat, Consensus Cloud Solutions has a consensus rating of "Hold" and a consensus price target of $26.00.

Check Out Our Latest Analysis on Consensus Cloud Solutions

Consensus Cloud Solutions Trading Down 3.9 %

CCSI traded down $1.03 on Friday, hitting $25.05. 176,107 shares of the company's stock were exchanged, compared to its average volume of 237,747. The stock has a fifty day moving average of $22.43 and a two-hundred day moving average of $19.82. Consensus Cloud Solutions has a twelve month low of $11.62 and a twelve month high of $28.09. The firm has a market cap of $483.39 million, a PE ratio of 5.33 and a beta of 1.38.

Consensus Cloud Solutions (NASDAQ:CCSI - Get Free Report) last announced its quarterly earnings results on Thursday, August 8th. The company reported $1.26 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.11 by $0.15. Consensus Cloud Solutions had a negative return on equity of 57.77% and a net margin of 25.72%. The business had revenue of $87.50 million for the quarter, compared to the consensus estimate of $87.10 million. On average, analysts predict that Consensus Cloud Solutions will post 4.86 EPS for the current year.

Institutional Trading of Consensus Cloud Solutions

Institutional investors have recently made changes to their positions in the stock. Capital Performance Advisors LLP acquired a new position in shares of Consensus Cloud Solutions during the third quarter valued at approximately $29,000. National Bank of Canada FI bought a new stake in shares of Consensus Cloud Solutions in the 2nd quarter worth $33,000. SG Americas Securities LLC bought a new position in Consensus Cloud Solutions during the third quarter valued at about $148,000. CWM LLC grew its holdings in Consensus Cloud Solutions by 388.4% during the second quarter. CWM LLC now owns 8,792 shares of the company's stock worth $151,000 after acquiring an additional 6,992 shares during the period. Finally, Massachusetts Financial Services Co. MA bought a new stake in Consensus Cloud Solutions in the second quarter worth about $188,000. 93.93% of the stock is owned by institutional investors and hedge funds.

Consensus Cloud Solutions Company Profile

(

Get Free Report)

Consensus Cloud Solutions, Inc, together with its subsidiaries, provides information delivery services with a software-as-a-service platform worldwide. The company offers eFax Corporate, a digital cloud-fax technology; Unite, a single platform that allows the user to choose between various protocols to send and receive healthcare information and can integrate into an existing electronic health record system or stand-alone if no EHR is present.

See Also

Before you consider Consensus Cloud Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Consensus Cloud Solutions wasn't on the list.

While Consensus Cloud Solutions currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.