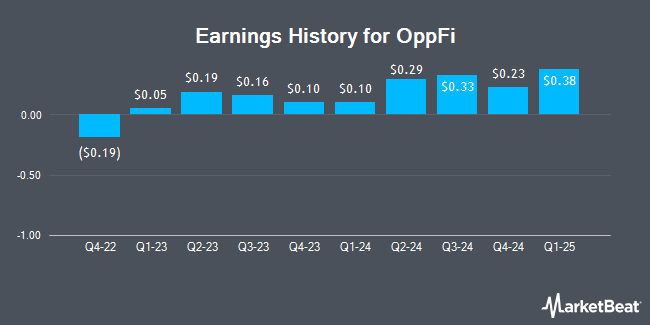

OppFi (NYSE:OPFI - Get Free Report) is anticipated to announce its earnings results before the market opens on Wednesday, March 5th. Analysts expect the company to announce earnings of $0.14 per share and revenue of $133.50 million for the quarter. Investors interested in participating in the company's conference call can do so using this link.

OppFi Price Performance

NYSE:OPFI traded down $0.27 during trading hours on Friday, reaching $9.86. 2,099,141 shares of the company were exchanged, compared to its average volume of 2,493,546. The firm has a market cap of $850.07 million, a price-to-earnings ratio of 61.63 and a beta of 1.56. OppFi has a 52-week low of $2.35 and a 52-week high of $17.73. The stock has a 50 day simple moving average of $11.13 and a 200 day simple moving average of $7.48.

Insider Activity

In other news, Director David Vennettilli sold 22,301 shares of the firm's stock in a transaction on Monday, December 2nd. The shares were sold at an average price of $7.68, for a total value of $171,271.68. Following the transaction, the director now owns 121,524 shares of the company's stock, valued at approximately $933,304.32. This trade represents a 15.51 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. Insiders own 84.00% of the company's stock.

Analyst Ratings Changes

A number of equities analysts have weighed in on OPFI shares. Citizens Jmp downgraded shares of OppFi from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, February 12th. Northland Securities increased their price target on shares of OppFi from $8.00 to $10.00 and gave the stock an "outperform" rating in a research note on Friday, December 13th. Finally, JMP Securities downgraded shares of OppFi from an "outperform" rating to a "market perform" rating in a research note on Wednesday, February 12th.

Check Out Our Latest Stock Analysis on OPFI

OppFi Company Profile

(

Get Free Report)

OppFi Inc operates a cialty finance platform that allows banks to offer credit access. Its platform facilitates the OppLoans, an installment loan product; SalaryTap, a payroll deduction secured installment loan product; and OppFi Card, a credit card product. OppFi Inc was founded in 2012 and is headquartered in Chicago, Illinois.

See Also

Before you consider OppFi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OppFi wasn't on the list.

While OppFi currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.