Leerink Partners cut shares of Opthea (NASDAQ:OPT - Free Report) from an outperform rating to a market perform rating in a report issued on Tuesday morning, Marketbeat.com reports. Leerink Partners currently has $1.00 price objective on the stock, down from their prior price objective of $12.00.

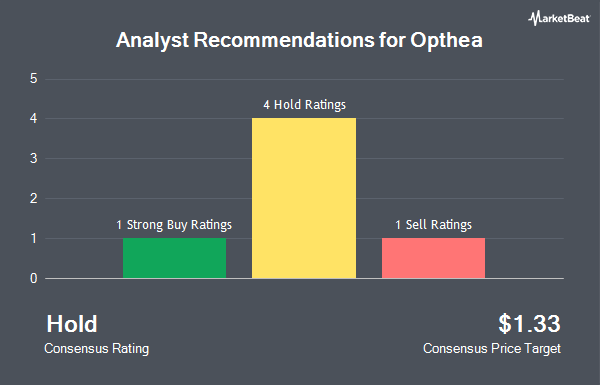

OPT has been the topic of several other research reports. Jefferies Financial Group reissued an "underperform" rating and set a $1.00 price target (down previously from $8.00) on shares of Opthea in a research report on Tuesday. Oppenheimer lowered Opthea from an "outperform" rating to a "market perform" rating in a report on Monday, March 24th. HC Wainwright reiterated a "buy" rating and issued a $12.00 price target on shares of Opthea in a research note on Friday, February 28th. Finally, Canaccord Genuity Group upgraded shares of Opthea to a "strong-buy" rating in a research report on Tuesday, December 17th. One equities research analyst has rated the stock with a sell rating, four have assigned a hold rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $1.33.

Read Our Latest Report on OPT

Opthea Stock Performance

OPT remained flat at $3.41 during mid-day trading on Tuesday. The company has a 50 day simple moving average of $4.40 and a 200-day simple moving average of $4.07. Opthea has a 52-week low of $1.79 and a 52-week high of $6.30.

Institutional Trading of Opthea

A number of large investors have recently made changes to their positions in OPT. Hsbc Holdings PLC acquired a new position in Opthea during the fourth quarter worth approximately $556,000. Jane Street Group LLC acquired a new position in shares of Opthea in the 3rd quarter valued at $114,000. Citadel Advisors LLC purchased a new stake in Opthea in the 4th quarter valued at $79,000. Twin Lakes Capital Management LLC acquired a new stake in Opthea during the 3rd quarter worth $81,000. Finally, OLD Mission Capital LLC purchased a new position in Opthea during the 4th quarter worth $42,000. 55.95% of the stock is owned by institutional investors and hedge funds.

Opthea Company Profile

(

Get Free Report)

Opthea Limited, a clinical stage biopharmaceutical company, engages in the development and commercialization of therapies primarily for eye disease in Australia. The company's development activities are based on the intellectual property portfolio covering Vascular Endothelial Growth Factors (VEGF) VEGF-C, VEGF-D, and VEGF Receptor-3 for the treatment of diseases associated with blood and lymphatic vessel growth, as well as vascular leakage.

See Also

Before you consider Opthea, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Opthea wasn't on the list.

While Opthea currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.