Optimize Financial Inc bought a new position in Ulta Beauty, Inc. (NASDAQ:ULTA - Free Report) in the 4th quarter, according to its most recent filing with the SEC. The institutional investor bought 1,374 shares of the specialty retailer's stock, valued at approximately $598,000.

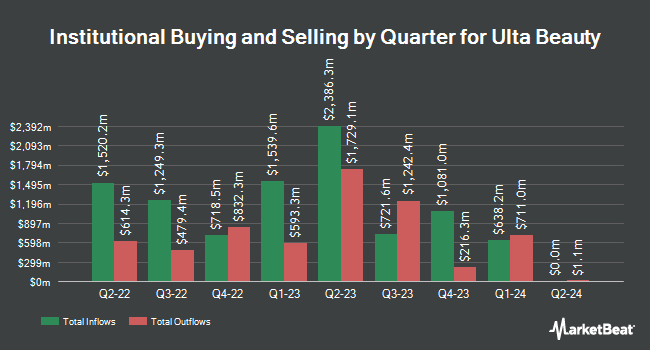

A number of other hedge funds and other institutional investors have also made changes to their positions in the company. Sterling Capital Management LLC lifted its stake in Ulta Beauty by 4.2% in the fourth quarter. Sterling Capital Management LLC now owns 1,043 shares of the specialty retailer's stock worth $454,000 after acquiring an additional 42 shares during the period. Quinn Opportunity Partners LLC bought a new stake in shares of Ulta Beauty in the 4th quarter valued at about $652,000. First Foundation Advisors lifted its position in shares of Ulta Beauty by 51.5% in the 4th quarter. First Foundation Advisors now owns 12,118 shares of the specialty retailer's stock worth $5,270,000 after purchasing an additional 4,121 shares during the period. Zuckerman Investment Group LLC boosted its stake in shares of Ulta Beauty by 10.8% during the fourth quarter. Zuckerman Investment Group LLC now owns 110,211 shares of the specialty retailer's stock valued at $44,982,000 after purchasing an additional 10,744 shares in the last quarter. Finally, Treasurer of the State of North Carolina increased its holdings in Ulta Beauty by 7.2% during the fourth quarter. Treasurer of the State of North Carolina now owns 32,255 shares of the specialty retailer's stock valued at $14,029,000 after buying an additional 2,160 shares during the period. Institutional investors own 90.39% of the company's stock.

Insiders Place Their Bets

In other Ulta Beauty news, insider Jodi J. Caro sold 902 shares of the company's stock in a transaction that occurred on Tuesday, April 1st. The stock was sold at an average price of $369.16, for a total value of $332,982.32. Following the sale, the insider now owns 7,632 shares in the company, valued at approximately $2,817,429.12. This represents a 10.57 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. 0.39% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

A number of analysts have weighed in on the company. Piper Sandler lowered their target price on Ulta Beauty from $425.00 to $364.00 and set a "neutral" rating for the company in a report on Friday, March 14th. Stifel Nicolaus decreased their price objective on Ulta Beauty from $475.00 to $400.00 and set a "hold" rating for the company in a research note on Friday, March 14th. DA Davidson cut their target price on Ulta Beauty from $510.00 to $415.00 and set a "buy" rating on the stock in a research note on Friday, March 14th. Canaccord Genuity Group decreased their price target on shares of Ulta Beauty from $538.00 to $526.00 and set a "buy" rating for the company in a research report on Friday, March 14th. Finally, Wells Fargo & Company lowered their price target on shares of Ulta Beauty from $360.00 to $310.00 and set an "underweight" rating on the stock in a report on Friday, March 14th. One research analyst has rated the stock with a sell rating, twelve have issued a hold rating and thirteen have issued a buy rating to the company. According to MarketBeat.com, Ulta Beauty has a consensus rating of "Hold" and a consensus target price of $427.61.

View Our Latest Analysis on Ulta Beauty

Ulta Beauty Price Performance

NASDAQ:ULTA traded down $8.16 during midday trading on Tuesday, hitting $358.09. The company's stock had a trading volume of 658,273 shares, compared to its average volume of 1,057,893. Ulta Beauty, Inc. has a fifty-two week low of $309.01 and a fifty-two week high of $460.00. The firm has a market cap of $16.22 billion, a P/E ratio of 14.33, a P/E/G ratio of 0.89 and a beta of 1.16. The firm's 50 day moving average is $358.37 and its 200-day moving average is $382.86.

Ulta Beauty (NASDAQ:ULTA - Get Free Report) last released its quarterly earnings data on Thursday, March 13th. The specialty retailer reported $8.46 EPS for the quarter, beating the consensus estimate of $7.13 by $1.33. Ulta Beauty had a net margin of 10.58% and a return on equity of 51.95%. The business had revenue of $3.49 billion for the quarter, compared to the consensus estimate of $3.47 billion. During the same period in the prior year, the firm earned $8.08 EPS. The business's revenue for the quarter was down 1.9% on a year-over-year basis. As a group, analysts forecast that Ulta Beauty, Inc. will post 23.96 EPS for the current year.

Ulta Beauty Company Profile

(

Free Report)

Ulta Beauty, Inc operates as a specialty beauty retailer in the United States. The company offers branded and private label beauty products, including cosmetics, fragrance, haircare, skincare, bath and body products, professional hair products, and salon styling tools through its Ulta Beauty stores, shop-in-shops, Ulta.com website, and its mobile applications.

Featured Articles

Before you consider Ulta Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ulta Beauty wasn't on the list.

While Ulta Beauty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.