TCW Group Inc. boosted its stake in Oracle Co. (NYSE:ORCL - Free Report) by 3.2% in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 108,124 shares of the enterprise software provider's stock after buying an additional 3,333 shares during the quarter. TCW Group Inc.'s holdings in Oracle were worth $18,424,000 at the end of the most recent quarter.

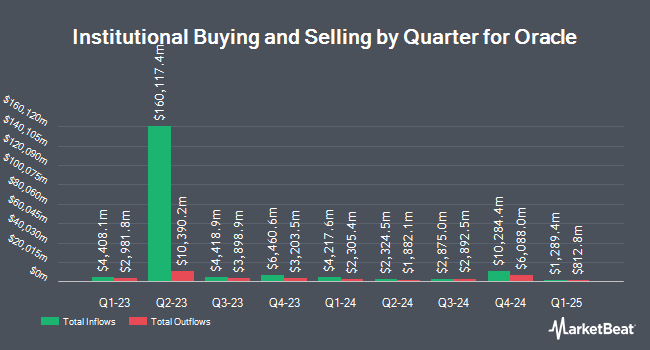

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the stock. Great Valley Advisor Group Inc. raised its holdings in Oracle by 11.7% in the 2nd quarter. Great Valley Advisor Group Inc. now owns 16,013 shares of the enterprise software provider's stock worth $2,261,000 after acquiring an additional 1,678 shares during the period. ORG Partners LLC raised its holdings in Oracle by 624.0% in the 2nd quarter. ORG Partners LLC now owns 6,719 shares of the enterprise software provider's stock worth $961,000 after acquiring an additional 5,791 shares during the period. Envestnet Portfolio Solutions Inc. raised its holdings in Oracle by 10.6% in the 2nd quarter. Envestnet Portfolio Solutions Inc. now owns 139,571 shares of the enterprise software provider's stock worth $19,707,000 after acquiring an additional 13,412 shares during the period. Cornerstone Wealth Management LLC raised its holdings in Oracle by 2.8% in the 2nd quarter. Cornerstone Wealth Management LLC now owns 3,952 shares of the enterprise software provider's stock worth $558,000 after acquiring an additional 108 shares during the period. Finally, Oak Ridge Investments LLC bought a new position in Oracle in the 2nd quarter worth $235,000. Hedge funds and other institutional investors own 42.44% of the company's stock.

Insiders Place Their Bets

In related news, EVP Maria Smith sold 6,320 shares of the firm's stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $165.00, for a total transaction of $1,042,800.00. Following the transaction, the executive vice president now directly owns 42,889 shares of the company's stock, valued at approximately $7,076,685. This trade represents a 12.84 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Insiders own 42.20% of the company's stock.

Oracle Stock Up 0.5 %

Shares of Oracle stock traded up $0.84 on Wednesday, hitting $178.58. The company had a trading volume of 13,176,670 shares, compared to its average volume of 8,403,240. The firm has a market capitalization of $494.86 billion, a P/E ratio of 46.06, a P/E/G ratio of 3.49 and a beta of 1.03. Oracle Co. has a twelve month low of $99.26 and a twelve month high of $198.31. The company has a debt-to-equity ratio of 6.68, a current ratio of 0.72 and a quick ratio of 0.72. The stock has a 50-day moving average of $179.97 and a 200-day moving average of $155.06.

Oracle (NYSE:ORCL - Get Free Report) last released its quarterly earnings results on Monday, December 9th. The enterprise software provider reported $1.47 earnings per share for the quarter, missing the consensus estimate of $1.48 by ($0.01). Oracle had a net margin of 20.40% and a return on equity of 171.38%. The company had revenue of $14.06 billion during the quarter, compared to analyst estimates of $14.12 billion. During the same quarter last year, the company earned $1.34 EPS. The firm's quarterly revenue was up 8.6% compared to the same quarter last year. Research analysts predict that Oracle Co. will post 5.06 earnings per share for the current year.

Oracle Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Thursday, January 9th. Shareholders of record on Thursday, January 23rd will be given a dividend of $0.40 per share. This represents a $1.60 annualized dividend and a yield of 0.90%. The ex-dividend date of this dividend is Thursday, January 9th. Oracle's dividend payout ratio (DPR) is currently 41.24%.

Analyst Ratings Changes

Several research firms have issued reports on ORCL. Evercore ISI raised their price target on shares of Oracle from $190.00 to $200.00 and gave the stock an "outperform" rating in a research report on Tuesday. Piper Sandler raised their price target on shares of Oracle from $185.00 to $210.00 and gave the stock an "overweight" rating in a research report on Tuesday. Mizuho raised their price target on shares of Oracle from $185.00 to $210.00 and gave the stock an "outperform" rating in a research report on Tuesday. KeyCorp raised their price target on shares of Oracle from $190.00 to $200.00 and gave the stock an "overweight" rating in a research report on Friday, November 15th. Finally, Barclays lifted their target price on shares of Oracle from $160.00 to $172.00 and gave the company an "overweight" rating in a research report on Tuesday, September 10th. Twelve investment analysts have rated the stock with a hold rating and eighteen have assigned a buy rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $181.48.

Get Our Latest Report on ORCL

About Oracle

(

Free Report)

Oracle Corporation offers products and services that address enterprise information technology environments worldwide. Its Oracle cloud software as a service offering include various cloud software applications, including Oracle Fusion cloud enterprise resource planning (ERP), Oracle Fusion cloud enterprise performance management, Oracle Fusion cloud supply chain and manufacturing management, Oracle Fusion cloud human capital management, Oracle Cerner healthcare, Oracle Advertising, and NetSuite applications suite, as well as Oracle Fusion Sales, Service, and Marketing.

Recommended Stories

Before you consider Oracle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oracle wasn't on the list.

While Oracle currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.