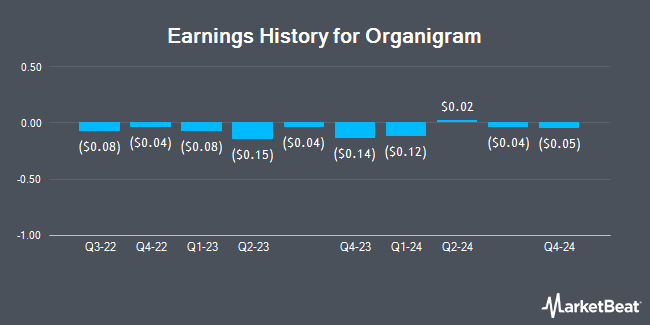

Organigram (NASDAQ:OGI - Get Free Report) announced its earnings results on Tuesday. The company reported ($0.05) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.03) by ($0.02), Zacks reports. Organigram had a negative net margin of 28.58% and a negative return on equity of 11.68%.

Organigram Trading Down 4.8 %

Shares of NASDAQ:OGI traded down $0.07 during trading on Friday, hitting $1.29. 1,779,050 shares of the company were exchanged, compared to its average volume of 877,104. The stock has a market cap of $162.12 million, a price-to-earnings ratio of -3.38 and a beta of 1.00. Organigram has a fifty-two week low of $1.27 and a fifty-two week high of $2.91. The firm has a fifty day moving average price of $1.56 and a two-hundred day moving average price of $1.66.

About Organigram

(

Get Free Report)

Organigram Holdings Inc, through its subsidiaries, engages in the production and sale of cannabis and cannabis-derived products in Canada. It offers medical cannabis products, including whole flower, milled flower, pre-rolls, infused pre-rolls, vapes, gummies, and concentrates for medical retailers; adult use recreational cannabis under the SHRED, Holy Mountain, Big Bag O' Buds, Monjour, Trailblazer, SHRED'ems, Edison Cannabis Co, Edison JOLTS, Tremblant, and Laurentian brands.

Featured Articles

Before you consider Organigram, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Organigram wasn't on the list.

While Organigram currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.