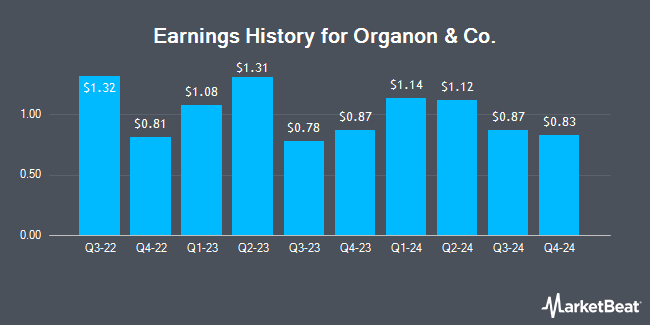

Organon & Co. (NYSE:OGN - Get Free Report) posted its earnings results on Thursday. The company reported $0.83 EPS for the quarter, missing the consensus estimate of $0.92 by ($0.09), Zacks reports. The firm had revenue of $1.59 billion during the quarter, compared to the consensus estimate of $1.57 billion. Organon & Co. had a net margin of 20.30% and a return on equity of 644.70%. Organon & Co. updated its FY 2025 guidance to EPS.

Organon & Co. Stock Down 6.3 %

NYSE:OGN traded down $1.03 on Monday, hitting $15.30. The stock had a trading volume of 4,424,393 shares, compared to its average volume of 2,305,809. The business's fifty day moving average is $15.35 and its 200 day moving average is $17.42. The company has a market cap of $3.94 billion, a PE ratio of 3.03, a P/E/G ratio of 0.83 and a beta of 0.76. The company has a quick ratio of 1.21, a current ratio of 1.70 and a debt-to-equity ratio of 17.73. Organon & Co. has a 52 week low of $13.87 and a 52 week high of $23.10.

Organon & Co. Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Thursday, March 13th. Shareholders of record on Monday, February 24th will be issued a $0.28 dividend. The ex-dividend date is Monday, February 24th. This represents a $1.12 annualized dividend and a yield of 7.32%. Organon & Co.'s payout ratio is currently 22.22%.

Analyst Upgrades and Downgrades

Several equities research analysts have recently weighed in on OGN shares. Morgan Stanley decreased their price target on Organon & Co. from $17.00 to $16.00 and set an "equal weight" rating for the company in a research note on Friday. Barclays decreased their price target on Organon & Co. from $26.00 to $24.00 and set an "overweight" rating for the company in a research note on Friday. Finally, TD Cowen raised Organon & Co. to a "hold" rating in a research note on Wednesday, January 15th. One equities research analyst has rated the stock with a sell rating, three have assigned a hold rating, two have assigned a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus price target of $20.80.

Get Our Latest Report on Organon & Co.

About Organon & Co.

(

Get Free Report)

Organon & Co is a science based global pharmaceutical company, which develops and delivers innovative health solutions through a portfolio of prescription therapies within women's health, biosimilars and established brands. The company was founded on March 11, 2020, and is headquartered in Jersey City, NJ.

See Also

Before you consider Organon & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Organon & Co. wasn't on the list.

While Organon & Co. currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.