Franklin Resources Inc. grew its holdings in shares of ORIC Pharmaceuticals, Inc. (NASDAQ:ORIC - Free Report) by 26.1% during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 950,459 shares of the company's stock after acquiring an additional 196,804 shares during the quarter. Franklin Resources Inc. owned 1.35% of ORIC Pharmaceuticals worth $9,067,000 at the end of the most recent quarter.

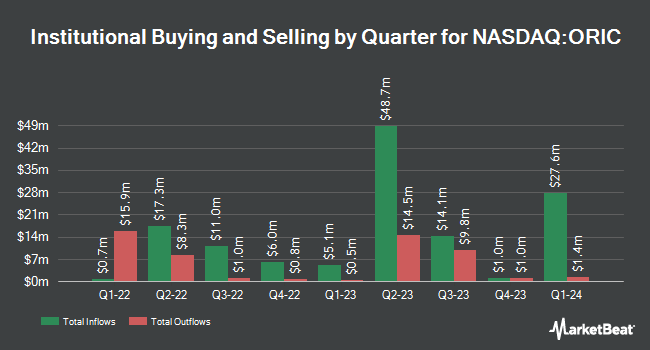

A number of other hedge funds have also recently made changes to their positions in the business. Millennium Management LLC raised its position in ORIC Pharmaceuticals by 297.4% in the 2nd quarter. Millennium Management LLC now owns 782,299 shares of the company's stock worth $5,531,000 after purchasing an additional 585,447 shares during the period. First Turn Management LLC lifted its stake in shares of ORIC Pharmaceuticals by 38.1% in the 2nd quarter. First Turn Management LLC now owns 1,515,960 shares of the company's stock valued at $10,718,000 after acquiring an additional 418,389 shares during the last quarter. Dimensional Fund Advisors LP boosted its holdings in ORIC Pharmaceuticals by 190.2% during the 2nd quarter. Dimensional Fund Advisors LP now owns 466,662 shares of the company's stock valued at $3,299,000 after acquiring an additional 305,860 shares during the period. Charles Schwab Investment Management Inc. grew its position in ORIC Pharmaceuticals by 152.7% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 410,229 shares of the company's stock worth $4,205,000 after acquiring an additional 247,863 shares during the last quarter. Finally, Monaco Asset Management SAM increased its stake in ORIC Pharmaceuticals by 132.0% in the 2nd quarter. Monaco Asset Management SAM now owns 301,650 shares of the company's stock worth $2,133,000 after purchasing an additional 171,650 shares during the period. 95.05% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several research analysts recently commented on ORIC shares. Stifel Nicolaus assumed coverage on shares of ORIC Pharmaceuticals in a research note on Friday, September 6th. They issued a "buy" rating and a $20.00 target price on the stock. Wedbush reaffirmed an "outperform" rating and set a $20.00 price objective on shares of ORIC Pharmaceuticals in a research note on Tuesday, November 12th. Wells Fargo & Company assumed coverage on ORIC Pharmaceuticals in a research note on Thursday, October 31st. They issued an "overweight" rating and a $20.00 target price on the stock. Cantor Fitzgerald reaffirmed an "overweight" rating on shares of ORIC Pharmaceuticals in a research report on Monday, September 23rd. Finally, HC Wainwright reiterated a "buy" rating and issued a $21.00 price objective on shares of ORIC Pharmaceuticals in a research report on Monday, November 4th. Eight equities research analysts have rated the stock with a buy rating, Based on data from MarketBeat, the company presently has a consensus rating of "Buy" and an average target price of $18.29.

View Our Latest Research Report on ORIC Pharmaceuticals

Insider Activity

In other ORIC Pharmaceuticals news, insider Pratik S. Multani sold 8,850 shares of ORIC Pharmaceuticals stock in a transaction on Monday, December 16th. The stock was sold at an average price of $8.28, for a total value of $73,278.00. Following the completion of the sale, the insider now owns 46,765 shares of the company's stock, valued at approximately $387,214.20. This trade represents a 15.91 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CFO Dominic Piscitelli sold 8,851 shares of the company's stock in a transaction on Monday, December 16th. The shares were sold at an average price of $8.28, for a total value of $73,286.28. Following the transaction, the chief financial officer now directly owns 106,764 shares in the company, valued at approximately $884,005.92. The trade was a 7.66 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 42,361 shares of company stock worth $350,749 over the last three months. 5.55% of the stock is currently owned by corporate insiders.

ORIC Pharmaceuticals Price Performance

ORIC stock traded up $0.52 during midday trading on Friday, hitting $8.21. The stock had a trading volume of 690,836 shares, compared to its average volume of 501,325. The firm has a market cap of $579.36 million, a price-to-earnings ratio of -4.56 and a beta of 1.13. The business has a 50-day moving average of $9.24 and a two-hundred day moving average of $9.34. ORIC Pharmaceuticals, Inc. has a 52-week low of $6.33 and a 52-week high of $16.65.

ORIC Pharmaceuticals (NASDAQ:ORIC - Get Free Report) last issued its quarterly earnings results on Tuesday, November 12th. The company reported ($0.49) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.48) by ($0.01). Research analysts predict that ORIC Pharmaceuticals, Inc. will post -1.84 earnings per share for the current year.

ORIC Pharmaceuticals Company Profile

(

Free Report)

ORIC Pharmaceuticals, Inc, a clinical-stage biopharmaceutical company, engages in the discovery and development of therapies for treatment of cancers in the United States. Its clinical stage product candidates include ORIC-114, a brain penetrant orally bioavailable irreversible inhibitor, currently under Phase 1b study, which is designed to selectively target epidermal growth factor receptor and human epidermal growth factor receptor 2 with high potency towards exon 20 insertion mutations; ORIC-944, an allosteric inhibitor of the polycomb repressive complex 2 for prostate cancer, currently under Phase 1b study; and ORIC-533, an orally bioavailable small molecule inhibitor of CD73, currently under Phase 1b study, being developed for resistance to chemotherapy- and immunotherapy-based treatment regimens.

Featured Stories

Before you consider ORIC Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ORIC Pharmaceuticals wasn't on the list.

While ORIC Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.