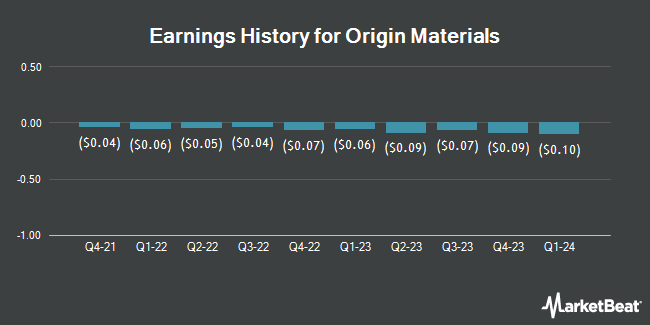

Origin Materials (NASDAQ:ORGN - Get Free Report) is expected to issue its quarterly earnings data after the market closes on Thursday, March 13th. Analysts expect the company to announce earnings of ($0.11) per share and revenue of $9.08 million for the quarter. Investors that are interested in registering for the company's conference call can do so using this link.

Origin Materials Trading Up 1.0 %

ORGN stock traded up $0.01 during trading on Wednesday, hitting $0.80. The company had a trading volume of 79,399 shares, compared to its average volume of 1,452,080. The firm has a market capitalization of $117.44 million, a price-to-earnings ratio of -1.41 and a beta of 0.88. The business has a 50 day moving average of $0.97 and a 200 day moving average of $1.21. Origin Materials has a fifty-two week low of $0.44 and a fifty-two week high of $1.90.

Wall Street Analysts Forecast Growth

Separately, Bank of America lowered shares of Origin Materials from a "buy" rating to an "underperform" rating and lowered their price objective for the company from $2.50 to $1.50 in a research note on Tuesday, January 14th.

Read Our Latest Research Report on ORGN

Insider Transactions at Origin Materials

In other news, General Counsel Joshua C. Lee sold 25,000 shares of the stock in a transaction on Friday, December 27th. The stock was sold at an average price of $1.02, for a total transaction of $25,500.00. Following the completion of the sale, the general counsel now owns 629,785 shares in the company, valued at approximately $642,380.70. This represents a 3.82 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CEO John Bissell sold 55,000 shares of Origin Materials stock in a transaction on Friday, December 27th. The stock was sold at an average price of $1.00, for a total value of $55,000.00. Following the completion of the transaction, the chief executive officer now owns 1,976,230 shares in the company, valued at $1,976,230. The trade was a 2.71 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 189,525 shares of company stock valued at $199,645. Corporate insiders own 17.49% of the company's stock.

Origin Materials Company Profile

(

Get Free Report)

Origin Materials, Inc, together with its subsidiaries, operates as a carbon-negative materials company. The company develops a proprietary biomass conversion platform to convert biomass, or plant-based carbon into building block chemicals chloromethylfurfural and hydrothermal carbon, as well as other oils and extractives and other co-products.

Further Reading

Before you consider Origin Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Origin Materials wasn't on the list.

While Origin Materials currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.