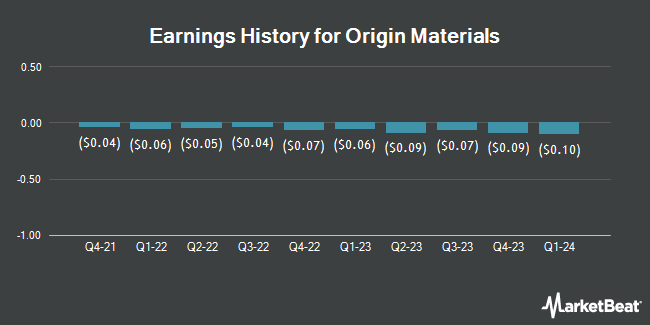

Origin Materials (NASDAQ:ORGN - Get Free Report) is set to issue its quarterly earnings data after the market closes on Thursday, November 14th. Analysts expect the company to announce earnings of ($0.11) per share for the quarter. Origin Materials has set its FY 2024 guidance at EPS.Parties that are interested in participating in the company's conference call can do so using this link.

Origin Materials (NASDAQ:ORGN - Get Free Report) last posted its quarterly earnings results on Wednesday, August 14th. The financial services provider reported ($0.14) earnings per share for the quarter, missing analysts' consensus estimates of ($0.12) by ($0.02). Origin Materials had a negative return on equity of 14.10% and a negative net margin of 37.93%. The company had revenue of $7.03 million during the quarter. On average, analysts expect Origin Materials to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Origin Materials Stock Up 2.0 %

Shares of ORGN stock traded up $0.03 on Thursday, hitting $1.29. The company's stock had a trading volume of 485,773 shares, compared to its average volume of 1,700,103. The stock has a market capitalization of $187.29 million, a price-to-earnings ratio of -14.00 and a beta of 1.00. The company has a debt-to-equity ratio of 0.01, a current ratio of 13.57 and a quick ratio of 13.48. The firm's fifty day moving average price is $1.48 and its 200-day moving average price is $1.16. Origin Materials has a fifty-two week low of $0.44 and a fifty-two week high of $1.90.

Insider Transactions at Origin Materials

In other Origin Materials news, CFO Matthew T. Plavan sold 120,000 shares of the firm's stock in a transaction dated Monday, November 4th. The shares were sold at an average price of $1.32, for a total value of $158,400.00. Following the completion of the sale, the chief financial officer now owns 1,223,088 shares in the company, valued at approximately $1,614,476.16. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. In the last quarter, insiders have sold 120,400 shares of company stock valued at $159,006. 3.90% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

Separately, Bank of America raised Origin Materials from a "neutral" rating to a "buy" rating and raised their target price for the stock from $1.35 to $3.00 in a research report on Friday, August 16th.

View Our Latest Analysis on ORGN

Origin Materials Company Profile

(

Get Free Report)

Origin Materials, Inc, together with its subsidiaries, operates as a carbon-negative materials company. The company develops a proprietary biomass conversion platform to convert biomass, or plant-based carbon into building block chemicals chloromethylfurfural and hydrothermal carbon, as well as other oils and extractives and other co-products.

Featured Stories

Before you consider Origin Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Origin Materials wasn't on the list.

While Origin Materials currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.