Orion Portfolio Solutions LLC cut its stake in shares of GoDaddy Inc. (NYSE:GDDY - Free Report) by 21.4% in the third quarter, according to its most recent disclosure with the SEC. The firm owned 14,983 shares of the technology company's stock after selling 4,082 shares during the period. Orion Portfolio Solutions LLC's holdings in GoDaddy were worth $2,349,000 at the end of the most recent quarter.

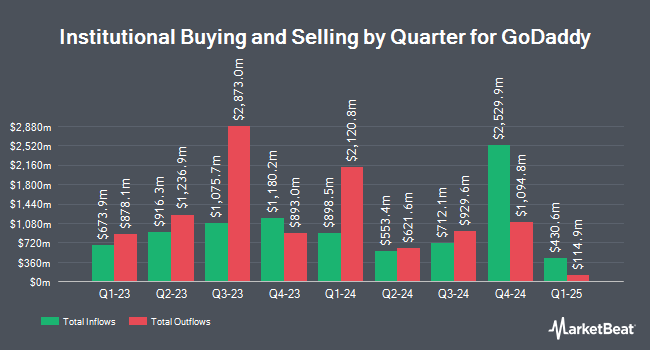

Several other hedge funds and other institutional investors have also added to or reduced their stakes in GDDY. Federated Hermes Inc. raised its position in shares of GoDaddy by 35.6% in the second quarter. Federated Hermes Inc. now owns 1,501,277 shares of the technology company's stock valued at $209,743,000 after buying an additional 394,399 shares during the last quarter. Wedge Capital Management L L P NC grew its stake in GoDaddy by 2,279.5% during the 3rd quarter. Wedge Capital Management L L P NC now owns 401,249 shares of the technology company's stock valued at $62,908,000 after acquiring an additional 384,386 shares in the last quarter. Mizuho Securities USA LLC raised its holdings in GoDaddy by 3,227.3% in the 3rd quarter. Mizuho Securities USA LLC now owns 361,710 shares of the technology company's stock valued at $56,709,000 after acquiring an additional 350,839 shares during the last quarter. FMR LLC lifted its stake in GoDaddy by 19.8% in the 3rd quarter. FMR LLC now owns 1,660,283 shares of the technology company's stock worth $260,299,000 after purchasing an additional 274,014 shares in the last quarter. Finally, Dimensional Fund Advisors LP boosted its holdings in shares of GoDaddy by 37.7% during the 2nd quarter. Dimensional Fund Advisors LP now owns 861,066 shares of the technology company's stock worth $120,305,000 after purchasing an additional 235,934 shares during the last quarter. 90.28% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling

In other GoDaddy news, CAO Phontip Palitwanon sold 770 shares of the stock in a transaction that occurred on Tuesday, December 3rd. The shares were sold at an average price of $196.64, for a total value of $151,412.80. Following the sale, the chief accounting officer now directly owns 23,059 shares of the company's stock, valued at approximately $4,534,321.76. This represents a 3.23 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this link. Also, COO Roger Chen sold 1,000 shares of GoDaddy stock in a transaction on Monday, September 16th. The stock was sold at an average price of $152.17, for a total transaction of $152,170.00. Following the sale, the chief operating officer now directly owns 187,632 shares of the company's stock, valued at approximately $28,551,961.44. This trade represents a 0.53 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 23,503 shares of company stock valued at $4,102,853 in the last ninety days. Company insiders own 0.61% of the company's stock.

GoDaddy Trading Up 0.3 %

Shares of NYSE GDDY traded up $0.57 during trading on Thursday, reaching $208.91. The stock had a trading volume of 853,634 shares, compared to its average volume of 1,462,986. The company has a debt-to-equity ratio of 10.61, a quick ratio of 0.56 and a current ratio of 0.56. The company has a market cap of $29.33 billion, a P/E ratio of 16.16 and a beta of 1.15. GoDaddy Inc. has a fifty-two week low of $99.90 and a fifty-two week high of $210.30. The business's 50-day moving average price is $178.53 and its 200-day moving average price is $159.48.

GoDaddy (NYSE:GDDY - Get Free Report) last released its earnings results on Wednesday, October 30th. The technology company reported $1.32 earnings per share for the quarter, beating the consensus estimate of $1.25 by $0.07. The company had revenue of $1.15 billion during the quarter, compared to the consensus estimate of $1.14 billion. GoDaddy had a return on equity of 267.29% and a net margin of 41.74%. GoDaddy's revenue was up 7.3% compared to the same quarter last year. During the same period in the previous year, the company posted $0.89 EPS. On average, equities research analysts predict that GoDaddy Inc. will post 4.95 EPS for the current fiscal year.

Analyst Ratings Changes

Several research firms recently commented on GDDY. Barclays increased their price target on GoDaddy from $165.00 to $185.00 and gave the company an "overweight" rating in a report on Wednesday, September 25th. StockNews.com cut shares of GoDaddy from a "strong-buy" rating to a "buy" rating in a research report on Friday, November 8th. Piper Sandler boosted their target price on shares of GoDaddy from $172.00 to $176.00 and gave the company a "neutral" rating in a report on Thursday, October 31st. Jefferies Financial Group raised their price target on shares of GoDaddy from $170.00 to $200.00 and gave the stock a "buy" rating in a report on Wednesday, December 4th. Finally, JPMorgan Chase & Co. lifted their price target on shares of GoDaddy from $175.00 to $224.00 and gave the company an "overweight" rating in a research report on Wednesday, December 4th. Five research analysts have rated the stock with a hold rating, ten have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, GoDaddy currently has an average rating of "Moderate Buy" and an average price target of $181.57.

View Our Latest Stock Report on GDDY

GoDaddy Company Profile

(

Free Report)

GoDaddy Inc engages in the design and development of cloud-based products in the United States and internationally. It operates through two segments: Applications and Commerce, and Core Platform. The Applications and Commerce segment provides applications products, including Websites + Marketing, a mobile-optimized online tool that enables customers to build websites and e-commerce enabled online stores; and Managed WordPress, a streamlined and optimized website building that allows customers to easily build and manage a faster WordPress site; Managed WooCommerce Stores to sell anything and anywhere online; and marketing tools and services, such as GoDaddy Studio mobile application, search engine optimization, Meta and Google My Business, and email and social media marketing designed to help businesses acquire and engage customers and create content.

See Also

Before you consider GoDaddy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GoDaddy wasn't on the list.

While GoDaddy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.