Orion Portfolio Solutions LLC lowered its position in shares of Keysight Technologies, Inc. (NYSE:KEYS - Free Report) by 50.5% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 20,233 shares of the scientific and technical instruments company's stock after selling 20,668 shares during the quarter. Orion Portfolio Solutions LLC's holdings in Keysight Technologies were worth $3,216,000 as of its most recent SEC filing.

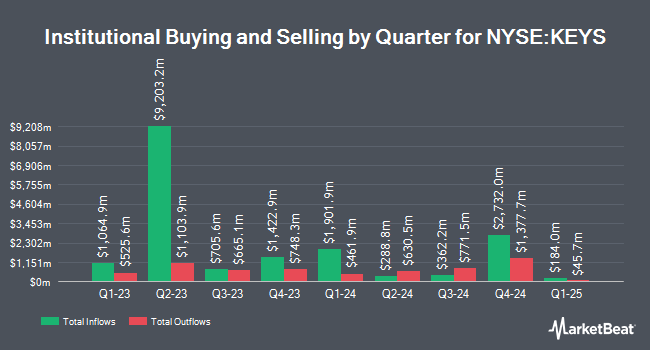

Other institutional investors have also bought and sold shares of the company. Meeder Asset Management Inc. acquired a new stake in shares of Keysight Technologies in the 2nd quarter worth about $27,000. Truvestments Capital LLC acquired a new stake in shares of Keysight Technologies in the 3rd quarter worth about $28,000. Erste Asset Management GmbH acquired a new stake in shares of Keysight Technologies in the 3rd quarter worth about $29,000. Family Firm Inc. acquired a new stake in shares of Keysight Technologies in the 2nd quarter worth about $30,000. Finally, American National Bank & Trust acquired a new stake in shares of Keysight Technologies in the 3rd quarter worth about $31,000. Institutional investors own 84.58% of the company's stock.

Insider Buying and Selling at Keysight Technologies

In related news, VP Lisa M. Poole sold 350 shares of the firm's stock in a transaction on Monday, November 25th. The shares were sold at an average price of $171.79, for a total transaction of $60,126.50. Following the completion of the transaction, the vice president now directly owns 4,820 shares of the company's stock, valued at approximately $828,027.80. This trade represents a 6.77 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, SVP Jeffrey K. Li sold 4,412 shares of the firm's stock in a transaction on Wednesday, December 4th. The shares were sold at an average price of $171.92, for a total transaction of $758,511.04. Following the transaction, the senior vice president now directly owns 30,637 shares of the company's stock, valued at $5,267,113.04. The trade was a 12.59 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 27,063 shares of company stock valued at $4,603,201. Insiders own 0.60% of the company's stock.

Analyst Ratings Changes

KEYS has been the subject of several analyst reports. StockNews.com lowered shares of Keysight Technologies from a "buy" rating to a "hold" rating in a research note on Saturday, November 23rd. Robert W. Baird increased their price objective on shares of Keysight Technologies from $163.00 to $180.00 and gave the company an "outperform" rating in a research note on Wednesday, November 20th. Susquehanna reiterated a "positive" rating and issued a $185.00 price objective on shares of Keysight Technologies in a research note on Wednesday, November 20th. Morgan Stanley increased their price objective on shares of Keysight Technologies from $165.00 to $180.00 and gave the company an "overweight" rating in a research note on Wednesday, November 20th. Finally, Bank of America increased their target price on shares of Keysight Technologies from $150.00 to $160.00 and gave the company an "underperform" rating in a research report on Wednesday, November 20th. One analyst has rated the stock with a sell rating, two have issued a hold rating and eight have given a buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $177.30.

Get Our Latest Stock Analysis on KEYS

Keysight Technologies Stock Performance

Shares of KEYS traded down $1.11 during mid-day trading on Wednesday, hitting $167.79. 1,032,432 shares of the company traded hands, compared to its average volume of 1,206,570. Keysight Technologies, Inc. has a 1 year low of $119.72 and a 1 year high of $175.39. The stock has a market cap of $29.12 billion, a price-to-earnings ratio of 47.93, a P/E/G ratio of 2.20 and a beta of 1.00. The company has a debt-to-equity ratio of 0.35, a quick ratio of 2.27 and a current ratio of 2.98. The stock has a 50-day moving average price of $160.60 and a two-hundred day moving average price of $148.01.

Keysight Technologies Profile

(

Free Report)

Keysight Technologies, Inc provides electronic design and test solutions to commercial communications, networking, aerospace, defense and government, automotive, energy, semiconductor, electronic, and education industries in the Americas, Europe, and the Asia Pacific. The company operates in two segments, Communications Solutions Group and Electronic Industrial Solutions Group.

Further Reading

Before you consider Keysight Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keysight Technologies wasn't on the list.

While Keysight Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.