Orion Portfolio Solutions LLC acquired a new stake in Elastic (NYSE:ESTC - Free Report) during the 3rd quarter, according to its most recent disclosure with the SEC. The fund acquired 5,218 shares of the company's stock, valued at approximately $401,000.

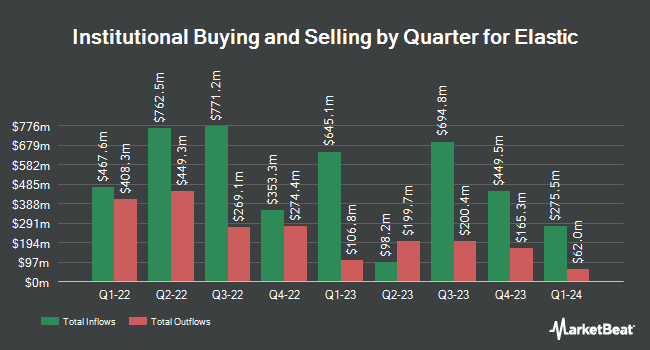

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the stock. Signaturefd LLC boosted its holdings in Elastic by 44.1% during the second quarter. Signaturefd LLC now owns 389 shares of the company's stock worth $44,000 after purchasing an additional 119 shares during the last quarter. QRG Capital Management Inc. boosted its stake in shares of Elastic by 7.0% during the 3rd quarter. QRG Capital Management Inc. now owns 3,063 shares of the company's stock worth $235,000 after buying an additional 201 shares during the last quarter. Oppenheimer & Co. Inc. grew its holdings in shares of Elastic by 3.3% in the 3rd quarter. Oppenheimer & Co. Inc. now owns 6,810 shares of the company's stock valued at $523,000 after acquiring an additional 219 shares in the last quarter. Headlands Technologies LLC grew its holdings in shares of Elastic by 75.4% in the 2nd quarter. Headlands Technologies LLC now owns 628 shares of the company's stock valued at $72,000 after acquiring an additional 270 shares in the last quarter. Finally, Asset Dedication LLC increased its position in shares of Elastic by 1,333.3% in the second quarter. Asset Dedication LLC now owns 301 shares of the company's stock valued at $34,000 after acquiring an additional 280 shares during the last quarter. 97.03% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several research analysts recently commented on the company. UBS Group reduced their price target on Elastic from $135.00 to $95.00 and set a "buy" rating for the company in a research report on Friday, August 30th. Bank of America raised their target price on shares of Elastic from $94.00 to $120.00 and gave the company a "neutral" rating in a research note on Friday, November 22nd. Barclays boosted their target price on shares of Elastic from $105.00 to $138.00 and gave the stock an "overweight" rating in a report on Monday, November 25th. Stifel Nicolaus increased their price target on shares of Elastic from $98.00 to $132.00 and gave the company a "buy" rating in a research note on Friday, November 22nd. Finally, Rosenblatt Securities restated a "buy" rating and set a $120.00 price objective on shares of Elastic in a research note on Wednesday, November 20th. Five investment analysts have rated the stock with a hold rating, nineteen have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, Elastic currently has an average rating of "Moderate Buy" and a consensus price target of $126.50.

Check Out Our Latest Research Report on ESTC

Insider Buying and Selling at Elastic

In other Elastic news, insider Carolyn Herzog sold 11,145 shares of the firm's stock in a transaction that occurred on Tuesday, November 26th. The shares were sold at an average price of $111.34, for a total value of $1,240,884.30. Following the sale, the insider now owns 92,011 shares in the company, valued at $10,244,504.74. This trade represents a 10.80 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this link. Also, CTO Shay Banon sold 150,000 shares of the company's stock in a transaction on Tuesday, November 26th. The stock was sold at an average price of $110.92, for a total transaction of $16,638,000.00. Following the transaction, the chief technology officer now owns 2,604,978 shares of the company's stock, valued at $288,944,159.76. This trade represents a 5.44 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 168,162 shares of company stock valued at $18,637,562. 15.90% of the stock is currently owned by corporate insiders.

Elastic Price Performance

Shares of NYSE:ESTC traded down $0.20 during midday trading on Thursday, hitting $103.71. The stock had a trading volume of 1,183,132 shares, compared to its average volume of 1,349,045. The company has a quick ratio of 1.99, a current ratio of 1.99 and a debt-to-equity ratio of 0.70. The company has a market capitalization of $10.75 billion, a P/E ratio of 188.56 and a beta of 1.02. The company's 50-day moving average price is $93.37 and its 200-day moving average price is $97.37. Elastic has a fifty-two week low of $69.00 and a fifty-two week high of $136.06.

About Elastic

(

Free Report)

Elastic N.V., a data analytics company, delivers solutions designed to run in public or private clouds in multi-cloud environments. It primarily offers Elastic Stack, a set of software products that ingest and store data from various sources and formats, as well as performs search, analysis, and visualization on that data.

Featured Stories

Before you consider Elastic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elastic wasn't on the list.

While Elastic currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.