Ossiam boosted its stake in EMCOR Group, Inc. (NYSE:EME - Free Report) by 1,937.9% during the 4th quarter, according to the company in its most recent disclosure with the SEC. The firm owned 1,345 shares of the construction company's stock after acquiring an additional 1,279 shares during the period. Ossiam's holdings in EMCOR Group were worth $610,000 as of its most recent filing with the SEC.

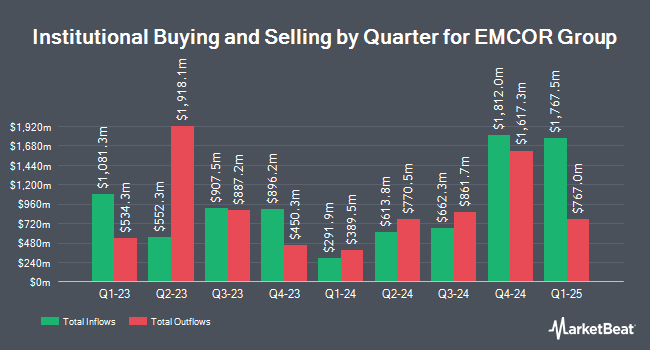

Other institutional investors and hedge funds have also recently modified their holdings of the company. Invesco Ltd. lifted its position in shares of EMCOR Group by 28.0% during the fourth quarter. Invesco Ltd. now owns 1,318,494 shares of the construction company's stock worth $598,465,000 after acquiring an additional 288,765 shares in the last quarter. Geode Capital Management LLC grew its holdings in EMCOR Group by 2.6% during the 4th quarter. Geode Capital Management LLC now owns 1,022,170 shares of the construction company's stock valued at $463,320,000 after buying an additional 25,502 shares in the last quarter. Norges Bank bought a new stake in shares of EMCOR Group during the fourth quarter valued at about $299,855,000. First Trust Advisors LP lifted its holdings in shares of EMCOR Group by 35.2% in the fourth quarter. First Trust Advisors LP now owns 496,436 shares of the construction company's stock worth $225,332,000 after buying an additional 129,186 shares in the last quarter. Finally, Allspring Global Investments Holdings LLC grew its stake in EMCOR Group by 21.3% during the fourth quarter. Allspring Global Investments Holdings LLC now owns 429,623 shares of the construction company's stock valued at $196,500,000 after acquiring an additional 75,578 shares in the last quarter. 92.59% of the stock is owned by institutional investors.

Insider Buying and Selling at EMCOR Group

In other news, CAO Maxine Lum Mauricio sold 1,250 shares of the business's stock in a transaction that occurred on Thursday, March 13th. The stock was sold at an average price of $370.07, for a total transaction of $462,587.50. Following the transaction, the chief accounting officer now directly owns 27,642 shares of the company's stock, valued at approximately $10,229,474.94. The trade was a 4.33 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Corporate insiders own 1.26% of the company's stock.

EMCOR Group Trading Up 2.8 %

Shares of NYSE:EME opened at $372.94 on Wednesday. The stock has a market capitalization of $16.96 billion, a P/E ratio of 18.94 and a beta of 1.08. The stock's 50-day moving average price is $387.91 and its 200-day moving average price is $444.78. EMCOR Group, Inc. has a 12-month low of $319.49 and a 12-month high of $545.30.

EMCOR Group (NYSE:EME - Get Free Report) last announced its quarterly earnings results on Wednesday, February 26th. The construction company reported $6.32 EPS for the quarter, topping analysts' consensus estimates of $5.53 by $0.79. The business had revenue of $3.77 billion for the quarter, compared to analysts' expectations of $3.81 billion. EMCOR Group had a return on equity of 34.99% and a net margin of 6.51%. As a group, research analysts predict that EMCOR Group, Inc. will post 20.74 EPS for the current year.

EMCOR Group declared that its Board of Directors has approved a stock buyback program on Wednesday, February 26th that authorizes the company to repurchase $500.00 million in shares. This repurchase authorization authorizes the construction company to purchase up to 2.6% of its stock through open market purchases. Stock repurchase programs are often a sign that the company's management believes its shares are undervalued.

EMCOR Group Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, April 30th. Shareholders of record on Thursday, April 17th will be issued a $0.25 dividend. This represents a $1.00 dividend on an annualized basis and a yield of 0.27%. The ex-dividend date is Thursday, April 17th. EMCOR Group's dividend payout ratio (DPR) is presently 4.64%.

Analyst Upgrades and Downgrades

EME has been the topic of several research analyst reports. Stifel Nicolaus decreased their price target on shares of EMCOR Group from $600.00 to $514.00 and set a "buy" rating on the stock in a report on Thursday, February 27th. StockNews.com cut shares of EMCOR Group from a "strong-buy" rating to a "buy" rating in a research report on Tuesday, February 25th. One equities research analyst has rated the stock with a sell rating and four have assigned a buy rating to the company. According to data from MarketBeat.com, EMCOR Group has an average rating of "Moderate Buy" and a consensus target price of $497.25.

Get Our Latest Report on EME

EMCOR Group Profile

(

Free Report)

EMCOR Group, Inc provides construction and facilities, building, and industrial services in the United States and the United Kingdom. It offers design, integration, installation, start-up, operation, and maintenance services related to power transmission, distribution, and generation systems; energy solutions; premises electrical and lighting systems; process instrumentation; low-voltage systems; voice and data communications systems; roadway and transit lighting, signaling, and fiber optic lines; computerized traffic control systems, and signal and communication equipment; heating, ventilation, air conditioning, refrigeration, and geothermal solutions; clean-room process ventilation systems; fire protection and suppression systems; plumbing, process, and high-purity piping systems; controls and filtration systems; water and wastewater treatment systems; central plant heating and cooling systems; crane and rigging services; millwright services; and steel fabrication, erection, and welding services.

Further Reading

Want to see what other hedge funds are holding EME? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for EMCOR Group, Inc. (NYSE:EME - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider EMCOR Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EMCOR Group wasn't on the list.

While EMCOR Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report