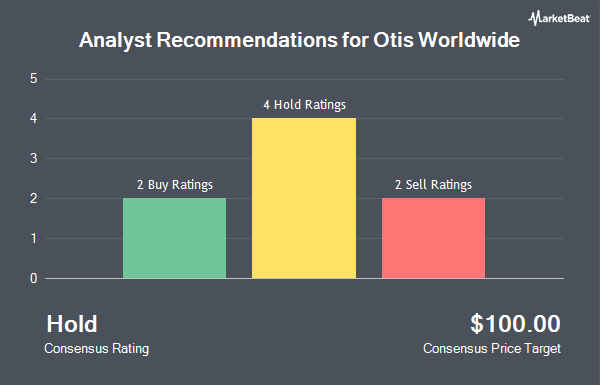

Shares of Otis Worldwide Co. (NYSE:OTIS - Get Free Report) have earned a consensus rating of "Hold" from the ten analysts that are covering the stock, Marketbeat Ratings reports. Eight investment analysts have rated the stock with a hold rating and two have assigned a buy rating to the company. The average 1 year price target among analysts that have issued a report on the stock in the last year is $102.00.

A number of research firms have recently commented on OTIS. Wolfe Research downgraded shares of Otis Worldwide from an "outperform" rating to a "peer perform" rating in a report on Tuesday, October 8th. Royal Bank of Canada reissued an "outperform" rating and set a $110.00 price target on shares of Otis Worldwide in a report on Thursday, September 19th. Morgan Stanley began coverage on shares of Otis Worldwide in a report on Friday, September 6th. They set an "equal weight" rating and a $97.00 price target for the company. Barclays cut their price target on shares of Otis Worldwide from $96.00 to $94.00 and set an "equal weight" rating for the company in a report on Thursday, October 31st. Finally, Wells Fargo & Company cut their price target on shares of Otis Worldwide from $108.00 to $105.00 and set an "equal weight" rating for the company in a report on Thursday, October 31st.

Get Our Latest Research Report on Otis Worldwide

Otis Worldwide Stock Performance

Shares of NYSE:OTIS traded up $0.40 during midday trading on Wednesday, reaching $100.56. 2,931,632 shares of the company's stock were exchanged, compared to its average volume of 2,115,823. The company's 50 day simple moving average is $99.37 and its two-hundred day simple moving average is $96.98. The firm has a market capitalization of $40.17 billion, a PE ratio of 25.08 and a beta of 1.04. Otis Worldwide has a 12 month low of $79.54 and a 12 month high of $106.33.

Otis Worldwide (NYSE:OTIS - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The company reported $0.96 EPS for the quarter, missing analysts' consensus estimates of $0.97 by ($0.01). The business had revenue of $3.55 billion for the quarter, compared to the consensus estimate of $3.59 billion. Otis Worldwide had a negative return on equity of 31.28% and a net margin of 11.48%. Otis Worldwide's revenue was up .7% on a year-over-year basis. During the same period in the previous year, the business posted $0.95 earnings per share. On average, research analysts anticipate that Otis Worldwide will post 3.86 earnings per share for the current year.

Otis Worldwide Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, December 6th. Shareholders of record on Friday, November 15th will be paid a $0.39 dividend. This represents a $1.56 dividend on an annualized basis and a yield of 1.55%. The ex-dividend date of this dividend is Friday, November 15th. Otis Worldwide's payout ratio is currently 38.90%.

Institutional Inflows and Outflows

Institutional investors have recently bought and sold shares of the stock. PineStone Asset Management Inc. lifted its position in shares of Otis Worldwide by 138.3% in the second quarter. PineStone Asset Management Inc. now owns 4,464,131 shares of the company's stock worth $429,717,000 after purchasing an additional 2,590,780 shares in the last quarter. Van ECK Associates Corp increased its holdings in Otis Worldwide by 3,673.6% during the third quarter. Van ECK Associates Corp now owns 2,261,929 shares of the company's stock worth $232,662,000 after buying an additional 2,201,988 shares during the last quarter. Massachusetts Financial Services Co. MA increased its holdings in Otis Worldwide by 12.4% during the second quarter. Massachusetts Financial Services Co. MA now owns 8,247,918 shares of the company's stock worth $793,945,000 after buying an additional 907,972 shares during the last quarter. Sarasin & Partners LLP increased its holdings in Otis Worldwide by 27.2% during the second quarter. Sarasin & Partners LLP now owns 4,135,271 shares of the company's stock worth $398,061,000 after buying an additional 883,659 shares during the last quarter. Finally, Brown Brothers Harriman & Co. increased its holdings in Otis Worldwide by 2,782.3% during the second quarter. Brown Brothers Harriman & Co. now owns 815,179 shares of the company's stock worth $78,469,000 after buying an additional 786,897 shares during the last quarter. Institutional investors own 88.03% of the company's stock.

Otis Worldwide Company Profile

(

Get Free ReportOtis Worldwide Corporation engages in manufacturing, installation, and servicing of elevators and escalators in the United States, China, and internationally. The company operates in two segments, New Equipment and Service. The New Equipment segment designs, manufactures, sells, and installs a range of passenger and freight elevators, as well as escalators and moving walkways for residential and commercial buildings, and infrastructure projects.

Recommended Stories

Before you consider Otis Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Otis Worldwide wasn't on the list.

While Otis Worldwide currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.