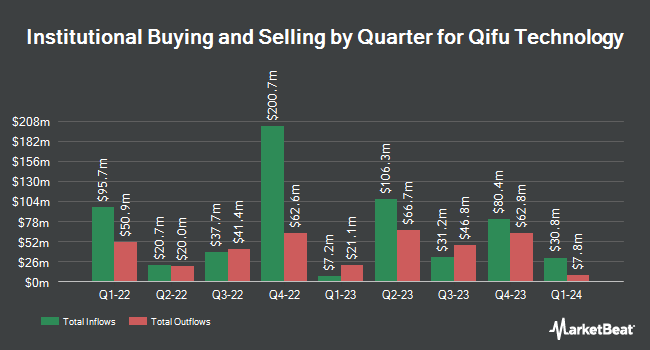

OVERSEA CHINESE BANKING Corp Ltd grew its position in shares of Qifu Technology, Inc. (NASDAQ:QFIN - Free Report) by 41.7% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 109,561 shares of the company's stock after purchasing an additional 32,248 shares during the period. OVERSEA CHINESE BANKING Corp Ltd owned approximately 0.07% of Qifu Technology worth $3,266,000 at the end of the most recent reporting period.

Several other large investors have also recently made changes to their positions in QFIN. Mitsubishi UFJ Asset Management Co. Ltd. raised its position in shares of Qifu Technology by 88.2% during the 1st quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 102,000 shares of the company's stock valued at $1,880,000 after buying an additional 47,800 shares in the last quarter. Quantbot Technologies LP bought a new stake in shares of Qifu Technology in the 1st quarter valued at approximately $634,000. AQR Capital Management LLC bought a new stake in shares of Qifu Technology in the 2nd quarter valued at approximately $25,560,000. Hsbc Holdings PLC boosted its holdings in shares of Qifu Technology by 9.8% in the 2nd quarter. Hsbc Holdings PLC now owns 424,904 shares of the company's stock worth $8,377,000 after purchasing an additional 37,948 shares during the period. Finally, Mirae Asset Global Investments Co. Ltd. increased its position in shares of Qifu Technology by 117.3% during the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 49,198 shares of the company's stock valued at $959,000 after purchasing an additional 26,558 shares during the last quarter. 74.81% of the stock is owned by institutional investors.

Qifu Technology Stock Down 1.1 %

QFIN traded down $0.33 during trading on Wednesday, reaching $30.36. The company had a trading volume of 1,234,679 shares, compared to its average volume of 1,295,827. The business has a 50 day simple moving average of $30.10 and a 200-day simple moving average of $23.99. The stock has a market cap of $4.90 billion, a P/E ratio of 7.34, a PEG ratio of 0.42 and a beta of 0.61. Qifu Technology, Inc. has a 52 week low of $13.71 and a 52 week high of $35.23.

Qifu Technology (NASDAQ:QFIN - Get Free Report) last released its earnings results on Tuesday, August 13th. The company reported $1.22 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.99 by $0.23. The firm had revenue of $572.44 million during the quarter, compared to analyst estimates of $582.69 million. Qifu Technology had a net margin of 28.06% and a return on equity of 21.82%. As a group, equities research analysts expect that Qifu Technology, Inc. will post 5.04 EPS for the current fiscal year.

Qifu Technology Company Profile

(

Free Report)

Qifu Technology, Inc, through its subsidiaries, operates credit-tech platform under the 360 Jietiao brand in the People's Republic of China. It provides credit-driven services that matches borrowers with financial institutions to conduct customer acquisition, initial and credit screening, advanced risk assessment, credit assessment, fund matching, and other post-facilitation services; and platform services, including loan facilitation and post-facilitation services to financial institution partners under intelligence credit engine, referral services, and risk management software-as-a-service.

See Also

Before you consider Qifu Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Qifu Technology wasn't on the list.

While Qifu Technology currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.