OVERSEA CHINESE BANKING Corp Ltd bought a new position in Rio Tinto Group (NYSE:RIO - Free Report) in the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm bought 6,470 shares of the mining company's stock, valued at approximately $382,000.

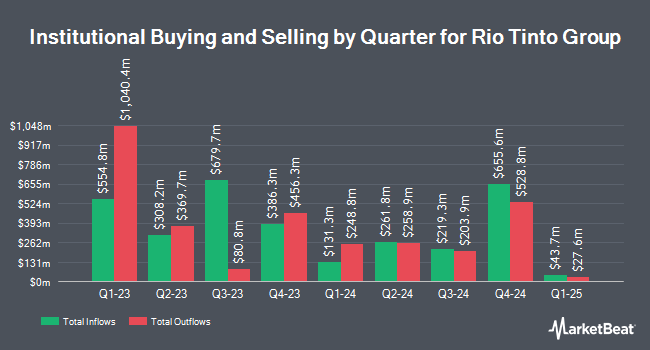

A number of other institutional investors and hedge funds have also modified their holdings of the business. Dorsey & Whitney Trust CO LLC boosted its position in Rio Tinto Group by 2.0% during the 4th quarter. Dorsey & Whitney Trust CO LLC now owns 8,113 shares of the mining company's stock worth $477,000 after acquiring an additional 160 shares during the period. Thurston Springer Miller Herd & Titak Inc. lifted its position in shares of Rio Tinto Group by 63.9% in the fourth quarter. Thurston Springer Miller Herd & Titak Inc. now owns 500 shares of the mining company's stock worth $29,000 after purchasing an additional 195 shares in the last quarter. Cohen Investment Advisors LLC boosted its holdings in shares of Rio Tinto Group by 3.8% during the fourth quarter. Cohen Investment Advisors LLC now owns 5,352 shares of the mining company's stock worth $315,000 after purchasing an additional 198 shares during the period. Mount Yale Investment Advisors LLC increased its stake in Rio Tinto Group by 2.0% in the 4th quarter. Mount Yale Investment Advisors LLC now owns 10,191 shares of the mining company's stock valued at $599,000 after buying an additional 200 shares during the period. Finally, GAMMA Investing LLC lifted its position in Rio Tinto Group by 12.2% in the 4th quarter. GAMMA Investing LLC now owns 1,861 shares of the mining company's stock worth $109,000 after buying an additional 203 shares in the last quarter. Hedge funds and other institutional investors own 19.33% of the company's stock.

Rio Tinto Group Stock Performance

RIO stock traded up $0.69 on Tuesday, reaching $62.86. 1,866,028 shares of the company were exchanged, compared to its average volume of 2,754,348. The company has a debt-to-equity ratio of 0.23, a current ratio of 1.63 and a quick ratio of 1.16. Rio Tinto Group has a 12 month low of $57.85 and a 12 month high of $74.24. The stock's fifty day moving average price is $61.96 and its 200 day moving average price is $62.90. The firm has a market capitalization of $78.77 billion, a PE ratio of 9.75, a PEG ratio of 0.42 and a beta of 0.60.

Rio Tinto Group Increases Dividend

The business also recently announced a semi-annual dividend, which will be paid on Thursday, April 17th. Investors of record on Friday, March 7th will be paid a $2.23 dividend. This represents a dividend yield of 7%. The ex-dividend date of this dividend is Friday, March 7th. This is a boost from Rio Tinto Group's previous semi-annual dividend of $1.77. Rio Tinto Group's dividend payout ratio (DPR) is presently 69.15%.

Analyst Upgrades and Downgrades

A number of equities analysts have recently weighed in on the stock. JPMorgan Chase & Co. started coverage on shares of Rio Tinto Group in a research note on Tuesday, March 18th. They issued an "overweight" rating on the stock. StockNews.com cut Rio Tinto Group from a "strong-buy" rating to a "buy" rating in a research report on Saturday, February 22nd. Jefferies Financial Group reduced their price objective on shares of Rio Tinto Group from $83.00 to $73.00 and set a "buy" rating for the company in a research note on Monday, January 6th. Finally, Clarkson Capital raised shares of Rio Tinto Group to a "strong-buy" rating in a report on Friday, February 28th. Three analysts have rated the stock with a hold rating, five have given a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, Rio Tinto Group has a consensus rating of "Moderate Buy" and an average price target of $73.00.

Check Out Our Latest Report on Rio Tinto Group

About Rio Tinto Group

(

Free Report)

Rio Tinto Group engages in exploring, mining, and processing mineral resources worldwide. The company operates through Iron Ore, Aluminium, Copper, and Minerals Segments. The Iron Ore segment engages in the iron ore mining, and salt and gypsum production in Western Australia. The Aluminum segment is involved in bauxite mining; alumina refining; and aluminium smelting.

See Also

Before you consider Rio Tinto Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rio Tinto Group wasn't on the list.

While Rio Tinto Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.