Ovintiv (NYSE:OVV - Free Report) had its price objective decreased by UBS Group from $59.00 to $56.00 in a research note issued to investors on Monday morning,Benzinga reports. UBS Group currently has a buy rating on the stock.

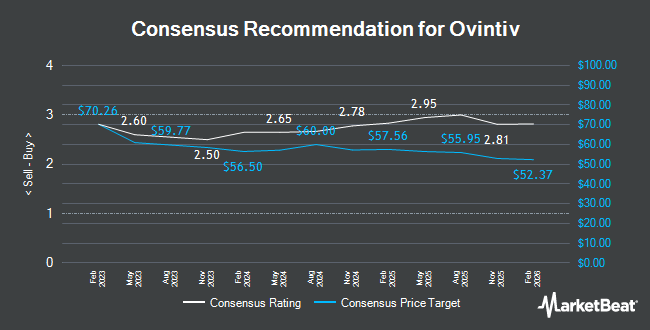

A number of other research analysts have also recently weighed in on OVV. Truist Financial lifted their target price on Ovintiv from $57.00 to $59.00 and gave the company a "buy" rating in a report on Friday, November 15th. Evercore ISI decreased their target price on Ovintiv from $60.00 to $54.00 and set an "outperform" rating for the company in a report on Monday, September 30th. Morgan Stanley cut their price target on shares of Ovintiv from $53.00 to $51.00 and set an "equal weight" rating on the stock in a report on Monday, September 16th. Siebert Williams Shank raised shares of Ovintiv to a "strong-buy" rating in a research report on Tuesday, October 15th. Finally, Barclays increased their price objective on shares of Ovintiv from $53.00 to $57.00 and gave the stock an "overweight" rating in a research report on Friday, November 15th. Five research analysts have rated the stock with a hold rating, twelve have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $56.47.

Get Our Latest Analysis on Ovintiv

Ovintiv Trading Down 0.0 %

NYSE:OVV traded down $0.01 during trading hours on Monday, reaching $41.34. 3,557,199 shares of the company were exchanged, compared to its average volume of 3,075,263. The firm has a market cap of $10.76 billion, a price-to-earnings ratio of 5.55 and a beta of 2.63. The stock has a 50 day simple moving average of $42.38 and a 200 day simple moving average of $43.76. Ovintiv has a 52-week low of $36.90 and a 52-week high of $55.95. The company has a debt-to-equity ratio of 0.46, a current ratio of 0.52 and a quick ratio of 0.52.

Ovintiv Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Friday, December 13th will be paid a dividend of $0.30 per share. This represents a $1.20 annualized dividend and a dividend yield of 2.90%. The ex-dividend date is Friday, December 13th. Ovintiv's dividend payout ratio is presently 15.92%.

Institutional Investors Weigh In On Ovintiv

Several hedge funds have recently modified their holdings of OVV. Cetera Investment Advisers lifted its stake in Ovintiv by 678.9% during the first quarter. Cetera Investment Advisers now owns 37,113 shares of the company's stock valued at $1,926,000 after buying an additional 32,348 shares in the last quarter. CWM LLC boosted its position in shares of Ovintiv by 146.6% in the second quarter. CWM LLC now owns 12,762 shares of the company's stock worth $598,000 after buying an additional 7,587 shares during the period. Diversified Trust Co purchased a new position in shares of Ovintiv during the second quarter valued at $321,000. Wealth Enhancement Advisory Services LLC raised its position in Ovintiv by 36.2% during the second quarter. Wealth Enhancement Advisory Services LLC now owns 10,470 shares of the company's stock valued at $491,000 after buying an additional 2,782 shares during the period. Finally, Envestnet Portfolio Solutions Inc. raised its position in Ovintiv by 55.6% during the second quarter. Envestnet Portfolio Solutions Inc. now owns 6,411 shares of the company's stock valued at $300,000 after buying an additional 2,292 shares during the period. 83.81% of the stock is owned by hedge funds and other institutional investors.

About Ovintiv

(

Get Free Report)

Ovintiv Inc, together with its subsidiaries, explores, develops, produces, and markets natural gas, oil, and natural gas liquids in the United States and Canada. The company operates through USA Operations, Canadian Operations, and Market Optimization segments. Its principal assets include Permian in west Texas and Anadarko in west-central Oklahoma; and Montney in northeast British Columbia and northwest Alberta.

Read More

Before you consider Ovintiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ovintiv wasn't on the list.

While Ovintiv currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.