Owens Corning (NYSE:OC - Free Report) had its price objective boosted by The Goldman Sachs Group from $178.00 to $198.00 in a report released on Thursday morning,Benzinga reports. They currently have a neutral rating on the construction company's stock.

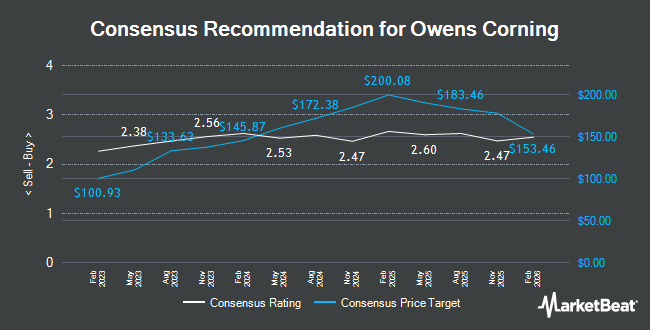

A number of other research analysts have also issued reports on the stock. Benchmark reaffirmed a "hold" rating on shares of Owens Corning in a research note on Wednesday, August 7th. Evercore ISI upped their price objective on shares of Owens Corning from $189.00 to $196.00 and gave the company an "in-line" rating in a research note on Thursday. Royal Bank of Canada boosted their price target on Owens Corning from $213.00 to $217.00 and gave the company an "outperform" rating in a report on Thursday. Citigroup upgraded Owens Corning from a "neutral" rating to a "buy" rating and raised their price objective for the stock from $178.00 to $191.00 in a report on Thursday, July 11th. Finally, StockNews.com downgraded Owens Corning from a "buy" rating to a "hold" rating in a research report on Friday, November 1st. Eight research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat.com, Owens Corning presently has a consensus rating of "Hold" and an average target price of $192.62.

Check Out Our Latest Stock Analysis on OC

Owens Corning Price Performance

OC traded up $2.82 during midday trading on Thursday, reaching $187.46. 919,943 shares of the company's stock were exchanged, compared to its average volume of 682,967. The business's 50-day moving average price is $174.98 and its 200 day moving average price is $173.36. The stock has a market capitalization of $16.30 billion, a PE ratio of 15.87, a P/E/G ratio of 2.20 and a beta of 1.41. Owens Corning has a 1-year low of $120.17 and a 1-year high of $191.44. The company has a debt-to-equity ratio of 0.91, a current ratio of 1.37 and a quick ratio of 0.79.

Owens Corning (NYSE:OC - Get Free Report) last announced its earnings results on Wednesday, November 6th. The construction company reported $4.38 EPS for the quarter, beating analysts' consensus estimates of $4.01 by $0.37. Owens Corning had a return on equity of 26.33% and a net margin of 10.66%. The firm had revenue of $3.05 billion for the quarter, compared to analysts' expectations of $3.04 billion. During the same quarter in the prior year, the firm earned $4.15 EPS. Owens Corning's quarterly revenue was up 22.9% on a year-over-year basis. As a group, equities analysts anticipate that Owens Corning will post 15.34 EPS for the current fiscal year.

Owens Corning Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, November 4th. Investors of record on Friday, October 18th were given a dividend of $0.60 per share. The ex-dividend date was Friday, October 18th. This represents a $2.40 dividend on an annualized basis and a yield of 1.28%. Owens Corning's dividend payout ratio (DPR) is 20.32%.

Insider Buying and Selling at Owens Corning

In other news, insider Marcio A. Sandri sold 3,051 shares of the company's stock in a transaction dated Thursday, September 19th. The stock was sold at an average price of $176.50, for a total value of $538,501.50. Following the completion of the sale, the insider now owns 57,079 shares of the company's stock, valued at $10,074,443.50. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. In other news, insider Marcio A. Sandri sold 3,051 shares of the company's stock in a transaction on Thursday, September 19th. The shares were sold at an average price of $176.50, for a total value of $538,501.50. Following the completion of the transaction, the insider now directly owns 57,079 shares in the company, valued at approximately $10,074,443.50. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, insider Marcio A. Sandri sold 3,050 shares of Owens Corning stock in a transaction on Tuesday, September 17th. The stock was sold at an average price of $170.00, for a total transaction of $518,500.00. Following the sale, the insider now directly owns 60,130 shares in the company, valued at $10,222,100. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 0.89% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On Owens Corning

A number of institutional investors have recently made changes to their positions in OC. Pacer Advisors Inc. grew its stake in Owens Corning by 38.9% in the second quarter. Pacer Advisors Inc. now owns 1,592,536 shares of the construction company's stock worth $276,655,000 after purchasing an additional 446,073 shares in the last quarter. Point72 Asset Management L.P. boosted its holdings in Owens Corning by 168.3% in the second quarter. Point72 Asset Management L.P. now owns 741,262 shares of the construction company's stock worth $128,772,000 after purchasing an additional 464,981 shares during the period. Skandinaviska Enskilda Banken AB publ raised its holdings in shares of Owens Corning by 6.4% during the second quarter. Skandinaviska Enskilda Banken AB publ now owns 716,704 shares of the construction company's stock worth $124,506,000 after purchasing an additional 43,180 shares during the period. AustralianSuper Pty Ltd grew its position in shares of Owens Corning by 2.2% during the 2nd quarter. AustralianSuper Pty Ltd now owns 590,977 shares of the construction company's stock valued at $102,665,000 after buying an additional 12,707 shares during the last quarter. Finally, Victory Capital Management Inc. boosted its stake in Owens Corning by 54.1% in the third quarter. Victory Capital Management Inc. now owns 523,001 shares of the construction company's stock valued at $92,320,000 after acquiring an additional 183,666 shares during the period. 88.40% of the stock is owned by institutional investors and hedge funds.

About Owens Corning

(

Get Free Report)

Owens Corning manufactures and sells building and construction materials in the United States, Europe, the Asia Pacific, and internationally. It operates in three segments: Roofing, Insulation, and Composites. The Roofing segment manufactures and sells laminate and strip asphalt roofing shingles, oxidized asphalt materials, and roofing components used in residential and commercial construction, and specialty applications.

Featured Articles

Before you consider Owens Corning, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Owens Corning wasn't on the list.

While Owens Corning currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.