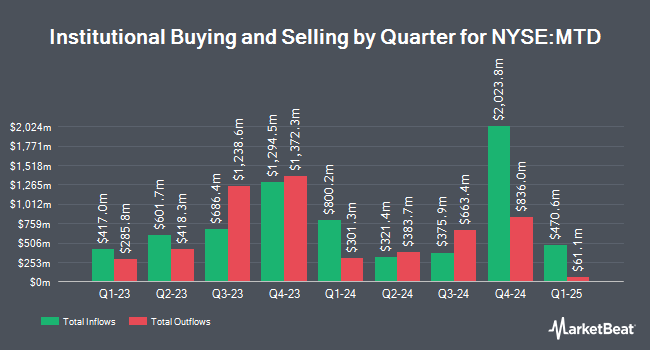

Ownership Capital B.V. cut its holdings in Mettler-Toledo International Inc. (NYSE:MTD - Free Report) by 17.6% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 72,304 shares of the medical instruments supplier's stock after selling 15,463 shares during the period. Mettler-Toledo International comprises 3.5% of Ownership Capital B.V.'s holdings, making the stock its 17th largest holding. Ownership Capital B.V. owned approximately 0.34% of Mettler-Toledo International worth $108,434,000 as of its most recent SEC filing.

Several other large investors also recently added to or reduced their stakes in MTD. EverSource Wealth Advisors LLC raised its holdings in shares of Mettler-Toledo International by 8.0% during the first quarter. EverSource Wealth Advisors LLC now owns 95 shares of the medical instruments supplier's stock worth $117,000 after purchasing an additional 7 shares during the last quarter. UMB Bank n.a. grew its holdings in shares of Mettler-Toledo International by 6.6% in the second quarter. UMB Bank n.a. now owns 113 shares of the medical instruments supplier's stock valued at $158,000 after purchasing an additional 7 shares in the last quarter. Bellevue Group AG grew its holdings in shares of Mettler-Toledo International by 32.0% in the first quarter. Bellevue Group AG now owns 33 shares of the medical instruments supplier's stock valued at $44,000 after purchasing an additional 8 shares in the last quarter. Massmutual Trust Co. FSB ADV grew its holdings in Mettler-Toledo International by 7.2% during the 2nd quarter. Massmutual Trust Co. FSB ADV now owns 119 shares of the medical instruments supplier's stock worth $166,000 after acquiring an additional 8 shares in the last quarter. Finally, DT Investment Partners LLC boosted its holdings in shares of Mettler-Toledo International by 13.3% in the 3rd quarter. DT Investment Partners LLC now owns 68 shares of the medical instruments supplier's stock valued at $102,000 after buying an additional 8 shares in the last quarter. 95.07% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other Mettler-Toledo International news, insider Christian Magloth sold 1,000 shares of Mettler-Toledo International stock in a transaction dated Thursday, August 15th. The stock was sold at an average price of $1,422.97, for a total transaction of $1,422,970.00. Following the transaction, the insider now owns 734 shares of the company's stock, valued at $1,044,459.98. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. 1.94% of the stock is owned by company insiders.

Mettler-Toledo International Trading Down 7.2 %

Mettler-Toledo International stock traded down $101.49 during mid-day trading on Friday, reaching $1,310.03. The company's stock had a trading volume of 254,186 shares, compared to its average volume of 119,785. The firm has a market cap of $27.80 billion, a price-to-earnings ratio of 36.05, a PEG ratio of 4.09 and a beta of 1.16. The business has a 50 day moving average price of $1,398.01 and a 200-day moving average price of $1,401.35. Mettler-Toledo International Inc. has a twelve month low of $953.28 and a twelve month high of $1,546.93.

Mettler-Toledo International (NYSE:MTD - Get Free Report) last announced its quarterly earnings results on Thursday, November 7th. The medical instruments supplier reported $10.21 earnings per share (EPS) for the quarter, beating the consensus estimate of $10.00 by $0.21. Mettler-Toledo International had a net margin of 20.95% and a negative return on equity of 575.61%. The company had revenue of $954.54 million during the quarter, compared to the consensus estimate of $941.93 million. On average, equities analysts expect that Mettler-Toledo International Inc. will post 40.34 EPS for the current fiscal year.

Wall Street Analyst Weigh In

Several analysts recently commented on the stock. Wells Fargo & Company assumed coverage on shares of Mettler-Toledo International in a research report on Tuesday, August 27th. They issued an "equal weight" rating and a $1,400.00 price target for the company. JPMorgan Chase & Co. upped their price target on shares of Mettler-Toledo International from $1,300.00 to $1,400.00 and gave the stock a "neutral" rating in a research note on Monday, August 5th. Evercore ISI upped their price target on shares of Mettler-Toledo International from $1,375.00 to $1,450.00 and gave the stock an "in-line" rating in a research note on Tuesday, October 1st. Finally, Stifel Nicolaus upped their price target on shares of Mettler-Toledo International from $1,510.00 to $1,550.00 and gave the stock a "buy" rating in a research note on Monday, August 5th. Two research analysts have rated the stock with a sell rating, five have given a hold rating and two have assigned a buy rating to the stock. According to MarketBeat, Mettler-Toledo International presently has a consensus rating of "Hold" and a consensus price target of $1,363.75.

Check Out Our Latest Stock Analysis on Mettler-Toledo International

Mettler-Toledo International Profile

(

Free Report)

Mettler-Toledo International Inc manufactures and supplies precision instruments and services in the Americas, Europe, Asia, and internationally. It operates through five segments: U.S. Operations, Swiss Operations, Western European Operations, Chinese Operations, and Other. The company's laboratory instruments include laboratory balances, liquid pipetting solutions, automated laboratory reactors, real-time analytics, titrators, pH meters, process analytics sensors and analyzer technologies, physical value analyzers, density and refractometry, thermal analysis systems, and other analytical instruments; and LabX, a laboratory software platform to manage and analyze data generated from its instruments.

Recommended Stories

Before you consider Mettler-Toledo International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mettler-Toledo International wasn't on the list.

While Mettler-Toledo International currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.