Oxford Asset Management LLP purchased a new position in shares of Synchrony Financial (NYSE:SYF - Free Report) during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor purchased 5,640 shares of the financial services provider's stock, valued at approximately $367,000.

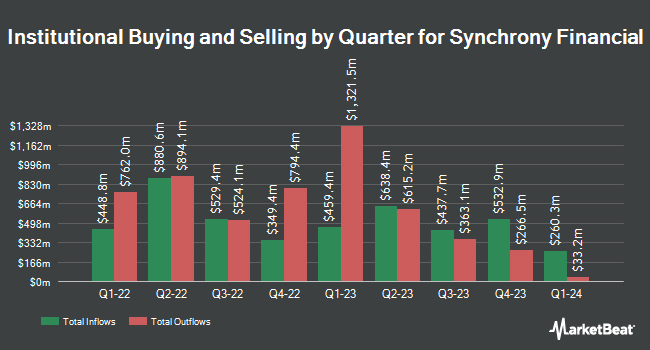

Other large investors have also recently added to or reduced their stakes in the company. Boothbay Fund Management LLC acquired a new stake in Synchrony Financial in the 4th quarter valued at about $3,314,000. Susquehanna Fundamental Investments LLC bought a new stake in Synchrony Financial in the fourth quarter valued at approximately $6,920,000. Virtus ETF Advisers LLC raised its stake in Synchrony Financial by 16.2% in the fourth quarter. Virtus ETF Advisers LLC now owns 20,266 shares of the financial services provider's stock valued at $1,317,000 after buying an additional 2,830 shares during the period. Adage Capital Partners GP L.L.C. lifted its position in shares of Synchrony Financial by 5.9% in the fourth quarter. Adage Capital Partners GP L.L.C. now owns 288,787 shares of the financial services provider's stock valued at $18,771,000 after buying an additional 16,200 shares during the last quarter. Finally, Price T Rowe Associates Inc. MD boosted its stake in shares of Synchrony Financial by 340.9% during the 4th quarter. Price T Rowe Associates Inc. MD now owns 2,512,340 shares of the financial services provider's stock worth $163,303,000 after acquiring an additional 1,942,573 shares during the period. Institutional investors and hedge funds own 96.48% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages have issued reports on SYF. JPMorgan Chase & Co. cut their price target on Synchrony Financial from $76.00 to $50.00 and set an "overweight" rating for the company in a report on Tuesday, April 8th. Cfra Research raised shares of Synchrony Financial to a "hold" rating in a report on Tuesday, April 22nd. Barclays raised shares of Synchrony Financial from an "equal weight" rating to an "overweight" rating and increased their price target for the company from $59.00 to $79.00 in a report on Monday, January 6th. The Goldman Sachs Group reduced their price objective on Synchrony Financial from $82.00 to $70.00 and set a "buy" rating for the company in a report on Tuesday, March 18th. Finally, Compass Point lowered Synchrony Financial from a "buy" rating to a "neutral" rating and set a $70.00 target price on the stock. in a research note on Tuesday, January 28th. Nine research analysts have rated the stock with a hold rating, twelve have issued a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, Synchrony Financial has a consensus rating of "Moderate Buy" and a consensus target price of $63.95.

Read Our Latest Report on SYF

Synchrony Financial Stock Performance

Shares of Synchrony Financial stock opened at $51.42 on Friday. The company has a 50 day moving average of $52.76 and a 200-day moving average of $60.29. The company has a market cap of $19.99 billion, a PE ratio of 6.02, a price-to-earnings-growth ratio of 0.71 and a beta of 1.45. The company has a current ratio of 1.24, a quick ratio of 1.24 and a debt-to-equity ratio of 1.01. Synchrony Financial has a 1-year low of $40.55 and a 1-year high of $70.93.

Synchrony Financial (NYSE:SYF - Get Free Report) last issued its earnings results on Tuesday, April 22nd. The financial services provider reported $1.89 earnings per share for the quarter, beating analysts' consensus estimates of $1.63 by $0.26. Synchrony Financial had a return on equity of 18.30% and a net margin of 15.36%. The firm had revenue of $3.72 billion for the quarter, compared to the consensus estimate of $3.80 billion. As a group, equities research analysts forecast that Synchrony Financial will post 7.67 earnings per share for the current fiscal year.

Synchrony Financial Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, May 15th. Shareholders of record on Monday, May 5th will be given a $0.30 dividend. This represents a $1.20 dividend on an annualized basis and a yield of 2.33%. The ex-dividend date is Monday, May 5th. This is a boost from Synchrony Financial's previous quarterly dividend of $0.25. Synchrony Financial's payout ratio is currently 11.71%.

Synchrony Financial Profile

(

Free Report)

Synchrony Financial, together with its subsidiaries, operates as a consumer financial services company in the United States. It provides credit products, such as credit cards, commercial credit products, and consumer installment loans. The company also offers private label credit cards, dual co-brand and general purpose credit cards, short- and long-term installment loans, and consumer banking products; and deposit products, including certificates of deposit, individual retirement accounts, money market accounts, and savings accounts, and sweep and affinity deposits, as well as accepts deposits through third-party securities brokerage firms.

Featured Stories

Want to see what other hedge funds are holding SYF? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Synchrony Financial (NYSE:SYF - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Synchrony Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Synchrony Financial wasn't on the list.

While Synchrony Financial currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.