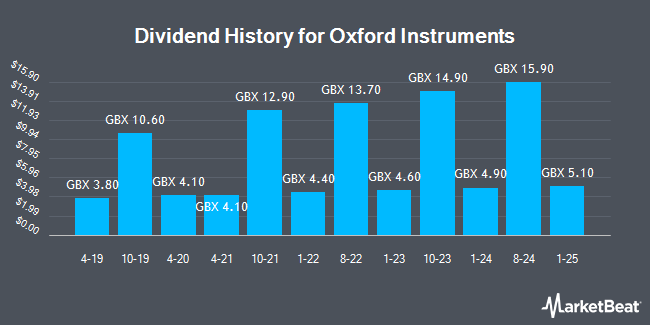

Oxford Instruments plc (LON:OXIG - Get Free Report) declared a dividend on Tuesday, November 12th,Upcoming Dividends.Co.Uk reports. Investors of record on Thursday, November 28th will be given a dividend of GBX 5.10 ($0.07) per share on Friday, January 10th. This represents a yield of 0.24%. The ex-dividend date is Thursday, November 28th. The official announcement can be accessed at this link.

Oxford Instruments Price Performance

Shares of OXIG stock traded down GBX 95 ($1.22) on Tuesday, hitting GBX 2,035 ($26.19). 483,679 shares of the stock traded hands, compared to its average volume of 99,414. Oxford Instruments has a 52 week low of GBX 1,858 ($23.91) and a 52 week high of GBX 2,765 ($35.58). The company has a debt-to-equity ratio of 12.96, a current ratio of 1.64 and a quick ratio of 1.11. The firm has a 50 day simple moving average of GBX 2,103.83 and a two-hundred day simple moving average of GBX 2,309.71. The firm has a market cap of £1.18 billion, a price-to-earnings ratio of 2,366.28, a PEG ratio of -3.56 and a beta of 0.96.

Analysts Set New Price Targets

Separately, Shore Capital reaffirmed a "buy" rating on shares of Oxford Instruments in a research note on Wednesday, October 16th.

View Our Latest Stock Report on OXIG

Oxford Instruments Company Profile

(

Get Free Report)

Oxford Instruments plc provide scientific technology products and services for academic and commercial organizations worldwide. It operates through three segments: Materials & Characterisation, Research & Discovery, and Service & Healthcare. The company offers atomic force, electron, and Raman microscopy; deposition tools comprising plasma enhanced chemical vapour deposition, chemical vapour deposition, inductively coupled plasma chemical vapour deposition, atomic layer deposition, and ion beam deposition systems; and etch tools, including inductively coupled plasma etching, reactive ion etching, deep silicon etching, atomic layer etching, and ion beam etching systems.

Recommended Stories

Before you consider Oxford Instruments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oxford Instruments wasn't on the list.

While Oxford Instruments currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.