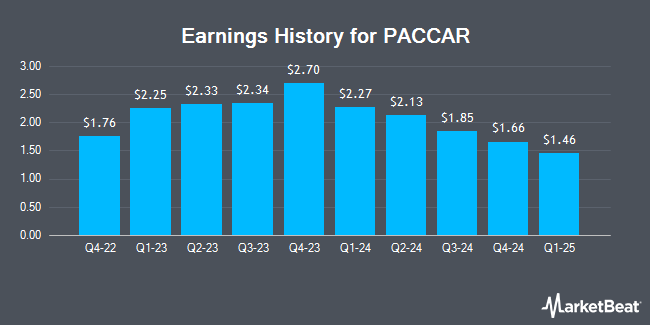

PACCAR (NASDAQ:PCAR - Get Free Report) issued its quarterly earnings results on Tuesday. The company reported $1.66 earnings per share for the quarter, missing the consensus estimate of $1.70 by ($0.04), Zacks reports. PACCAR had a net margin of 13.51% and a return on equity of 27.24%.

PACCAR Stock Down 2.4 %

NASDAQ:PCAR traded down $2.66 during mid-day trading on Tuesday, hitting $107.25. 4,427,368 shares of the company's stock traded hands, compared to its average volume of 2,342,274. The company has a fifty day moving average of $110.51 and a 200 day moving average of $104.42. PACCAR has a twelve month low of $90.04 and a twelve month high of $125.50. The company has a market capitalization of $56.23 billion, a P/E ratio of 11.98, a P/E/G ratio of 2.77 and a beta of 0.93. The company has a debt-to-equity ratio of 0.54, a quick ratio of 1.03 and a current ratio of 1.25.

PACCAR Increases Dividend

The firm also recently announced a dividend, which was paid on Wednesday, January 8th. Investors of record on Friday, December 20th were given a dividend of $3.00 per share. This is a positive change from PACCAR's previous dividend of $0.89. The ex-dividend date was Friday, December 20th. PACCAR's dividend payout ratio is currently 13.41%.

Analyst Ratings Changes

Several equities analysts have recently weighed in on PCAR shares. Royal Bank of Canada restated a "sector perform" rating and set a $119.00 price target on shares of PACCAR in a report on Monday, November 4th. JPMorgan Chase & Co. lifted their price objective on PACCAR from $122.00 to $125.00 and gave the company an "overweight" rating in a research report on Monday, January 13th. BNP Paribas raised PACCAR to a "hold" rating in a research note on Wednesday, October 16th. Jefferies Financial Group cut PACCAR from a "buy" rating to a "hold" rating and set a $120.00 target price for the company. in a report on Friday, December 6th. Finally, Truist Financial boosted their price objective on PACCAR from $110.00 to $112.00 and gave the company a "hold" rating in a report on Thursday, January 16th. Seven analysts have rated the stock with a hold rating and seven have given a buy rating to the stock. According to data from MarketBeat, PACCAR has a consensus rating of "Moderate Buy" and a consensus target price of $121.23.

Get Our Latest Stock Analysis on PACCAR

Insider Activity at PACCAR

In other news, CEO R Preston Feight sold 27,191 shares of the company's stock in a transaction dated Friday, November 1st. The stock was sold at an average price of $103.52, for a total value of $2,814,812.32. Following the sale, the chief executive officer now owns 171,776 shares in the company, valued at $17,782,251.52. This represents a 13.67 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. 2.02% of the stock is currently owned by corporate insiders.

About PACCAR

(

Get Free Report)

PACCAR Inc designs, manufactures, and distributes light, medium, and heavy-duty commercial trucks in the United States, Canada, Europe, Mexico, South America, Australia, and internationally. It operates through three segments: Truck, Parts, and Financial Services. The Truck segment designs, manufactures, and distributes trucks for the over-the-road and off-highway hauling of commercial and consumer goods.

Further Reading

Before you consider PACCAR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PACCAR wasn't on the list.

While PACCAR currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.