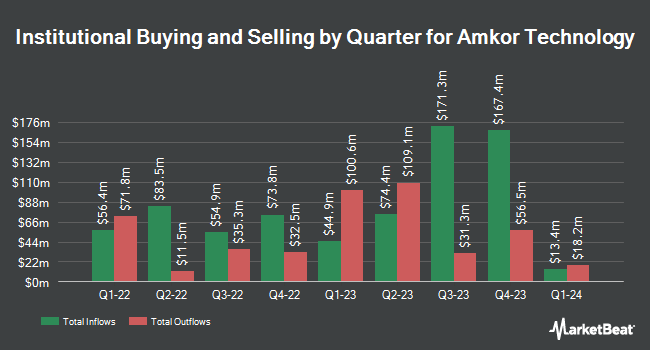

Pacer Advisors Inc. lifted its position in shares of Amkor Technology, Inc. (NASDAQ:AMKR - Free Report) by 24,383.3% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 3,787,565 shares of the semiconductor company's stock after purchasing an additional 3,772,095 shares during the period. Pacer Advisors Inc. owned 1.54% of Amkor Technology worth $115,899,000 at the end of the most recent quarter.

Other institutional investors and hedge funds also recently modified their holdings of the company. Massachusetts Financial Services Co. MA boosted its position in Amkor Technology by 5.6% during the third quarter. Massachusetts Financial Services Co. MA now owns 160,991 shares of the semiconductor company's stock worth $4,926,000 after purchasing an additional 8,598 shares during the period. Landscape Capital Management L.L.C. acquired a new stake in shares of Amkor Technology in the third quarter valued at approximately $491,000. Meeder Asset Management Inc. grew its position in Amkor Technology by 48.9% during the third quarter. Meeder Asset Management Inc. now owns 13,403 shares of the semiconductor company's stock worth $410,000 after buying an additional 4,399 shares in the last quarter. Whalen Wealth Management Inc. lifted its position in shares of Amkor Technology by 8.5% during the 3rd quarter. Whalen Wealth Management Inc. now owns 15,808 shares of the semiconductor company's stock valued at $484,000 after acquiring an additional 1,233 shares during the period. Finally, Mutual of America Capital Management LLC increased its position in shares of Amkor Technology by 3.5% in the third quarter. Mutual of America Capital Management LLC now owns 61,253 shares of the semiconductor company's stock worth $1,874,000 after purchasing an additional 2,055 shares during the period. 42.76% of the stock is owned by institutional investors.

Amkor Technology Trading Up 0.7 %

AMKR stock traded up $0.19 during mid-day trading on Friday, reaching $26.54. The company's stock had a trading volume of 801,612 shares, compared to its average volume of 1,321,807. The business's 50 day moving average price is $28.85 and its 200 day moving average price is $32.69. The company has a market cap of $6.55 billion, a price-to-earnings ratio of 17.93 and a beta of 1.85. The company has a current ratio of 2.06, a quick ratio of 1.84 and a debt-to-equity ratio of 0.21. Amkor Technology, Inc. has a 12 month low of $24.10 and a 12 month high of $44.86.

Amkor Technology (NASDAQ:AMKR - Get Free Report) last announced its quarterly earnings data on Monday, October 28th. The semiconductor company reported $0.49 earnings per share for the quarter, missing the consensus estimate of $0.50 by ($0.01). Amkor Technology had a net margin of 5.68% and a return on equity of 8.98%. The company had revenue of $1.86 billion for the quarter, compared to analyst estimates of $1.84 billion. During the same quarter in the prior year, the company posted $0.54 EPS. Amkor Technology's revenue for the quarter was up 2.2% on a year-over-year basis. On average, equities research analysts predict that Amkor Technology, Inc. will post 1.42 EPS for the current year.

Amkor Technology Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, December 23rd. Shareholders of record on Wednesday, December 4th will be paid a dividend of $0.0827 per share. This represents a $0.33 dividend on an annualized basis and a yield of 1.25%. The ex-dividend date of this dividend is Wednesday, December 4th. This is a positive change from Amkor Technology's previous quarterly dividend of $0.08. Amkor Technology's payout ratio is 20.95%.

Analysts Set New Price Targets

A number of research analysts recently issued reports on AMKR shares. JPMorgan Chase & Co. decreased their price objective on shares of Amkor Technology from $48.00 to $42.00 and set an "overweight" rating on the stock in a research note on Tuesday, October 29th. The Goldman Sachs Group lowered their price objective on shares of Amkor Technology from $36.00 to $32.00 and set a "neutral" rating for the company in a research report on Tuesday, October 29th. KeyCorp cut their target price on shares of Amkor Technology from $38.00 to $34.00 and set an "overweight" rating on the stock in a research report on Tuesday, October 29th. Morgan Stanley lowered their price target on shares of Amkor Technology from $35.00 to $26.00 and set an "equal weight" rating for the company in a report on Tuesday, October 29th. Finally, StockNews.com downgraded Amkor Technology from a "buy" rating to a "hold" rating in a report on Tuesday, October 29th. Four investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $36.29.

View Our Latest Stock Analysis on Amkor Technology

Insiders Place Their Bets

In other news, Director Winston J. Churchill sold 20,000 shares of the stock in a transaction that occurred on Tuesday, August 27th. The stock was sold at an average price of $32.97, for a total value of $659,400.00. Following the completion of the sale, the director now directly owns 19,871 shares of the company's stock, valued at $655,146.87. This represents a 50.16 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CEO Guillaume Marie Jean Rutten sold 10,000 shares of Amkor Technology stock in a transaction that occurred on Tuesday, October 15th. The shares were sold at an average price of $31.51, for a total value of $315,100.00. Following the transaction, the chief executive officer now directly owns 204,971 shares in the company, valued at approximately $6,458,636.21. The trade was a 4.65 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 31.40% of the company's stock.

Amkor Technology Company Profile

(

Free Report)

Amkor Technology, Inc provides outsourced semiconductor packaging and test services in the United States, Japan, Europe, the Middle East, Africa, and the Asia Pacific. It offers turnkey packaging and test services, including semiconductor wafer bump, wafer probe, wafer back-grind, package design, packaging, system-level and final test, and drop shipment services; flip chip scale package products for smartphones, tablets, and other mobile consumer electronic devices; flip chip stacked chip scale packages that are used to stack memory digital baseband, and as applications processors in mobile devices; flip-chip ball grid array packages for various networking, storage, computing, automotive, and consumer applications; and memory products for system memory or platform data storage.

See Also

Before you consider Amkor Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amkor Technology wasn't on the list.

While Amkor Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report