Pacer Advisors Inc. cut its stake in DigitalBridge Group, Inc. (NYSE:DBRG - Free Report) by 13.7% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 1,098,882 shares of the company's stock after selling 174,284 shares during the period. Pacer Advisors Inc. owned approximately 0.63% of DigitalBridge Group worth $15,527,000 as of its most recent SEC filing.

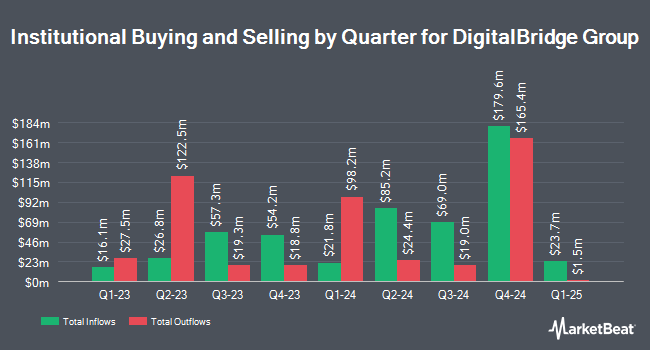

Other hedge funds and other institutional investors also recently bought and sold shares of the company. DekaBank Deutsche Girozentrale acquired a new position in DigitalBridge Group in the first quarter worth about $1,247,000. Manning & Napier Advisors LLC acquired a new position in shares of DigitalBridge Group in the 2nd quarter worth approximately $3,234,000. Comerica Bank lifted its position in shares of DigitalBridge Group by 2,778.9% during the 1st quarter. Comerica Bank now owns 154,279 shares of the company's stock worth $2,973,000 after buying an additional 148,920 shares during the period. Tidal Investments LLC boosted its stake in DigitalBridge Group by 377.2% in the 1st quarter. Tidal Investments LLC now owns 58,692 shares of the company's stock valued at $1,131,000 after buying an additional 46,392 shares in the last quarter. Finally, Sei Investments Co. grew its position in DigitalBridge Group by 121.1% in the second quarter. Sei Investments Co. now owns 669,601 shares of the company's stock valued at $9,174,000 after acquiring an additional 366,745 shares during the period. 92.69% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several brokerages have recently commented on DBRG. Wells Fargo & Company reduced their target price on shares of DigitalBridge Group from $18.00 to $16.00 and set an "overweight" rating on the stock in a research note on Monday, November 4th. Deutsche Bank Aktiengesellschaft reduced their price target on shares of DigitalBridge Group from $17.00 to $16.00 and set a "buy" rating on the stock in a research report on Thursday, August 15th. JPMorgan Chase & Co. raised their price objective on shares of DigitalBridge Group from $22.00 to $23.00 and gave the stock an "overweight" rating in a report on Tuesday, October 1st. Raymond James reduced their target price on DigitalBridge Group from $19.00 to $16.00 and set a "strong-buy" rating on the stock in a report on Tuesday, November 5th. Finally, Keefe, Bruyette & Woods cut DigitalBridge Group from an "outperform" rating to a "market perform" rating and dropped their price target for the company from $17.75 to $14.00 in a report on Wednesday, November 6th. One investment analyst has rated the stock with a hold rating, six have assigned a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Buy" and an average price target of $18.13.

Read Our Latest Research Report on DBRG

DigitalBridge Group Trading Up 3.0 %

Shares of DigitalBridge Group stock traded up $0.36 during midday trading on Friday, reaching $12.33. The company had a trading volume of 2,737,435 shares, compared to its average volume of 3,425,269. The stock has a fifty day simple moving average of $14.30 and a 200 day simple moving average of $13.58. DigitalBridge Group, Inc. has a 1-year low of $11.07 and a 1-year high of $20.99. The company has a market capitalization of $2.15 billion, a price-to-earnings ratio of 16.89, a price-to-earnings-growth ratio of 2.11 and a beta of 1.94.

DigitalBridge Group Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Tuesday, December 31st will be paid a $0.01 dividend. The ex-dividend date of this dividend is Tuesday, December 31st. This represents a $0.04 annualized dividend and a dividend yield of 0.32%. DigitalBridge Group's dividend payout ratio (DPR) is currently 5.48%.

DigitalBridge Group Company Profile

(

Free Report)

DigitalBridge is an infrastructure investment firm specializing in digital infrastructure assets. They provide services to institutional investors. They primarily invest in data centers, cell towers, fiber networks, small cells, and edge infrastructure. DigitalBridge Group, Inc was founded in 1991 and is headquartered in Boca Raton, Florida with additional offices in Los Angles, California, and New York New York.

Further Reading

Before you consider DigitalBridge Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DigitalBridge Group wasn't on the list.

While DigitalBridge Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.