Pacer Advisors Inc. reduced its holdings in shares of Scholastic Co. (NASDAQ:SCHL - Free Report) by 26.6% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 821,987 shares of the company's stock after selling 298,504 shares during the quarter. Pacer Advisors Inc. owned 2.92% of Scholastic worth $26,312,000 at the end of the most recent reporting period.

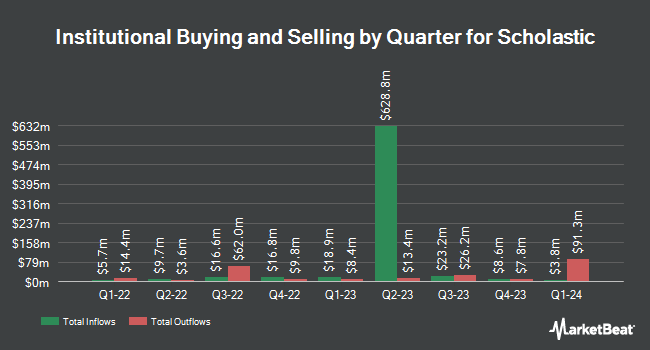

Several other institutional investors and hedge funds have also modified their holdings of the business. nVerses Capital LLC bought a new position in shares of Scholastic in the second quarter worth about $35,000. Meeder Asset Management Inc. acquired a new position in Scholastic during the 3rd quarter worth approximately $46,000. Innealta Capital LLC bought a new position in Scholastic in the 2nd quarter valued at approximately $64,000. Quent Capital LLC acquired a new stake in Scholastic in the first quarter valued at approximately $215,000. Finally, Commonwealth Equity Services LLC bought a new stake in shares of Scholastic during the second quarter worth $279,000. 82.57% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Separately, StockNews.com cut Scholastic from a "buy" rating to a "hold" rating in a research note on Saturday, October 5th.

Read Our Latest Stock Analysis on SCHL

Scholastic Trading Up 0.6 %

Shares of NASDAQ:SCHL traded up $0.16 during midday trading on Friday, hitting $25.46. 234,162 shares of the stock were exchanged, compared to its average volume of 218,213. The business's 50-day moving average price is $27.05 and its 200 day moving average price is $31.30. Scholastic Co. has a 12 month low of $23.69 and a 12 month high of $41.79. The company has a debt-to-equity ratio of 0.24, a quick ratio of 0.64 and a current ratio of 1.14. The stock has a market capitalization of $716.44 million, a price-to-earnings ratio of 45.47 and a beta of 1.06.

Scholastic (NASDAQ:SCHL - Get Free Report) last released its quarterly earnings results on Thursday, September 26th. The company reported ($2.13) EPS for the quarter, beating analysts' consensus estimates of ($2.48) by $0.35. Scholastic had a return on equity of 4.32% and a net margin of 1.49%. The firm had revenue of $237.20 million for the quarter, compared to analyst estimates of $233.49 million. During the same quarter in the previous year, the company posted ($2.20) EPS. Analysts predict that Scholastic Co. will post 1.41 earnings per share for the current year.

Scholastic Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Thursday, October 31st will be given a $0.20 dividend. The ex-dividend date of this dividend is Thursday, October 31st. This represents a $0.80 dividend on an annualized basis and a dividend yield of 3.14%. Scholastic's dividend payout ratio (DPR) is currently 142.86%.

About Scholastic

(

Free Report)

Scholastic Corporation publishes and distributes children's books worldwide. It operates in three segments: Children's Book Publishing and Distribution, Education Solutions, and International. The Children's Book Publishing and Distribution segment engages in publication and distribution of children's print, digital, and audio books, as well as media and interactive products through its school reading events and trade channel; and operation of school-based book clubs and book fairs in the United States.

Read More

Before you consider Scholastic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Scholastic wasn't on the list.

While Scholastic currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.