Pacer Advisors Inc. cut its stake in Carter's, Inc. (NYSE:CRI - Free Report) by 7.5% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,118,222 shares of the textile maker's stock after selling 90,875 shares during the period. Pacer Advisors Inc. owned 3.10% of Carter's worth $72,662,000 as of its most recent SEC filing.

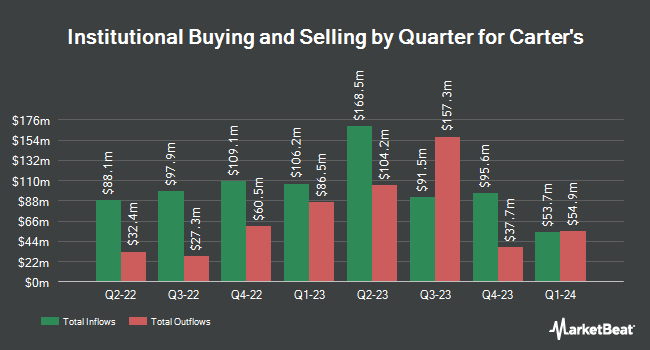

Other hedge funds also recently added to or reduced their stakes in the company. Landscape Capital Management L.L.C. acquired a new stake in shares of Carter's in the 3rd quarter worth approximately $4,391,000. B. Metzler seel. Sohn & Co. Holding AG purchased a new position in Carter's in the 3rd quarter worth about $1,046,000. Caprock Group LLC lifted its position in shares of Carter's by 42.2% in the 3rd quarter. Caprock Group LLC now owns 8,222 shares of the textile maker's stock valued at $534,000 after acquiring an additional 2,442 shares in the last quarter. Pathstone Holdings LLC grew its position in Carter's by 6.3% during the 3rd quarter. Pathstone Holdings LLC now owns 24,748 shares of the textile maker's stock worth $1,608,000 after purchasing an additional 1,474 shares in the last quarter. Finally, Empowered Funds LLC lifted its holdings in shares of Carter's by 10.4% in the third quarter. Empowered Funds LLC now owns 122,231 shares of the textile maker's stock valued at $7,943,000 after purchasing an additional 11,480 shares in the last quarter.

Analyst Ratings Changes

Several analysts recently commented on the stock. Bank of America lowered their price objective on shares of Carter's from $65.00 to $54.00 and set an "underperform" rating on the stock in a research report on Monday, July 29th. Wells Fargo & Company dropped their price objective on Carter's from $72.00 to $65.00 and set an "equal weight" rating on the stock in a report on Monday, October 28th. Finally, Citigroup upgraded shares of Carter's from a "sell" rating to a "neutral" rating and set a $50.00 price objective for the company in a report on Tuesday, November 12th. One research analyst has rated the stock with a sell rating and seven have assigned a hold rating to the company. According to MarketBeat.com, the company currently has an average rating of "Hold" and an average price target of $67.67.

Check Out Our Latest Stock Report on CRI

Carter's Stock Performance

Shares of Carter's stock traded up $1.56 during trading on Friday, reaching $54.00. The company's stock had a trading volume of 1,704,049 shares, compared to its average volume of 977,376. The business's fifty day moving average price is $60.58 and its 200-day moving average price is $63.31. Carter's, Inc. has a one year low of $50.27 and a one year high of $88.03. The firm has a market cap of $1.95 billion, a price-to-earnings ratio of 8.57, a price-to-earnings-growth ratio of 3.13 and a beta of 1.24. The company has a debt-to-equity ratio of 0.60, a quick ratio of 0.96 and a current ratio of 2.21.

Carter's Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 6th. Shareholders of record on Monday, November 25th will be paid a dividend of $0.80 per share. This represents a $3.20 dividend on an annualized basis and a yield of 5.93%. The ex-dividend date is Monday, November 25th. Carter's's dividend payout ratio is 50.79%.

About Carter's

(

Free Report)

Carter's, Inc, together with its subsidiaries, designs, sources, and markets branded childrenswear under the Carter's, OshKosh, Skip Hop, Child of Mine, Just One You, Simple Joys, Little Planet, and other brands in the United States and internationally. It operates through three segments: U.S.

Featured Articles

Before you consider Carter's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carter's wasn't on the list.

While Carter's currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.