Pacer Advisors Inc. bought a new stake in Par Pacific Holdings, Inc. (NYSE:PARR - Free Report) during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor bought 3,515,356 shares of the company's stock, valued at approximately $61,870,000. Pacer Advisors Inc. owned about 6.24% of Par Pacific at the end of the most recent reporting period.

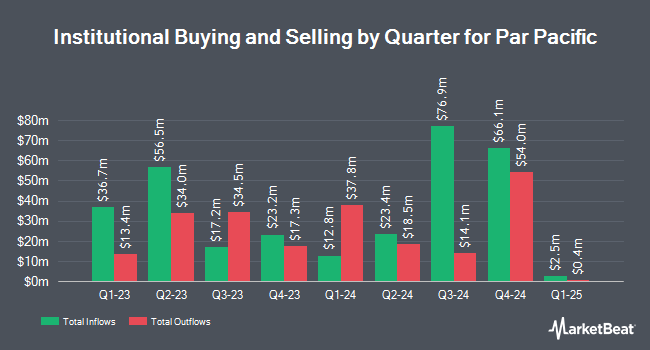

A number of other hedge funds and other institutional investors also recently bought and sold shares of the business. Acadian Asset Management LLC acquired a new stake in Par Pacific during the 1st quarter worth $978,000. Harbor Capital Advisors Inc. increased its position in shares of Par Pacific by 160.2% during the third quarter. Harbor Capital Advisors Inc. now owns 513,254 shares of the company's stock worth $9,033,000 after purchasing an additional 315,967 shares in the last quarter. WINTON GROUP Ltd lifted its holdings in shares of Par Pacific by 802.8% in the 2nd quarter. WINTON GROUP Ltd now owns 134,185 shares of the company's stock valued at $3,388,000 after purchasing an additional 119,321 shares during the last quarter. Creative Planning boosted its position in shares of Par Pacific by 246.2% in the 3rd quarter. Creative Planning now owns 33,014 shares of the company's stock valued at $581,000 after purchasing an additional 23,478 shares during the period. Finally, Victory Capital Management Inc. grew its stake in Par Pacific by 131.1% during the 2nd quarter. Victory Capital Management Inc. now owns 86,880 shares of the company's stock worth $2,194,000 after buying an additional 49,286 shares during the last quarter. 92.15% of the stock is currently owned by institutional investors and hedge funds.

Par Pacific Price Performance

Par Pacific stock traded up $0.23 during midday trading on Friday, reaching $17.60. The company's stock had a trading volume of 710,759 shares, compared to its average volume of 909,590. The firm has a market capitalization of $984.76 million, a PE ratio of 3.41 and a beta of 1.99. Par Pacific Holdings, Inc. has a fifty-two week low of $14.84 and a fifty-two week high of $40.69. The stock's 50 day simple moving average is $17.49 and its 200 day simple moving average is $22.08. The company has a debt-to-equity ratio of 0.84, a quick ratio of 0.66 and a current ratio of 1.69.

Par Pacific (NYSE:PARR - Get Free Report) last released its quarterly earnings data on Monday, November 4th. The company reported ($0.10) EPS for the quarter, topping analysts' consensus estimates of ($0.12) by $0.02. Par Pacific had a net margin of 3.74% and a return on equity of 10.06%. The firm had revenue of $2.14 billion for the quarter, compared to the consensus estimate of $1.88 billion. During the same quarter in the previous year, the firm earned $3.15 earnings per share. The firm's revenue was down 16.9% on a year-over-year basis. On average, equities research analysts forecast that Par Pacific Holdings, Inc. will post 0.95 earnings per share for the current year.

Analyst Upgrades and Downgrades

PARR has been the subject of several research analyst reports. JPMorgan Chase & Co. raised Par Pacific from a "neutral" rating to an "overweight" rating and decreased their price objective for the company from $36.00 to $30.00 in a report on Wednesday, October 2nd. The Goldman Sachs Group dropped their price target on Par Pacific from $32.00 to $28.00 and set a "neutral" rating on the stock in a research report on Wednesday, October 9th. Mizuho reduced their price objective on Par Pacific from $28.00 to $26.00 and set an "outperform" rating for the company in a research note on Wednesday, October 9th. Tudor Pickering upgraded Par Pacific to a "hold" rating in a research note on Monday, September 9th. Finally, TD Cowen cut their price target on Par Pacific from $36.00 to $32.00 and set a "buy" rating for the company in a research note on Friday, August 9th. Six analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average price target of $28.00.

View Our Latest Research Report on Par Pacific

Par Pacific Company Profile

(

Free Report)

Par Pacific Holdings, Inc owns and operates energy and infrastructure businesses. The company operates through Refining, Retail, and Logistics segments. The Refining segment owns and operates refineries that produce gasoline, distillate, asphalt, and other products primarily for consumption in Kapolei, Hawaii, Newcastle, Wyoming, Tacoma, Washington, and Billings, Montana.

Recommended Stories

Before you consider Par Pacific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Par Pacific wasn't on the list.

While Par Pacific currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.