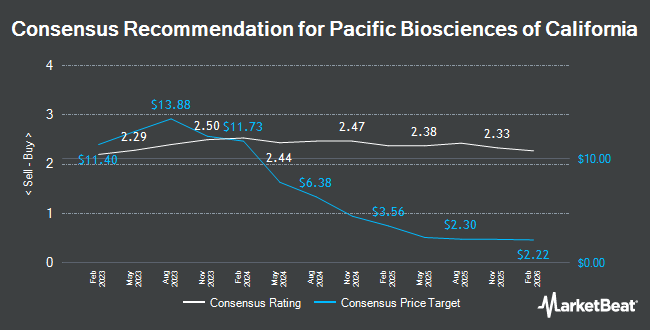

Pacific Biosciences of California (NASDAQ:PACB - Get Free Report) was downgraded by stock analysts at UBS Group from a "buy" rating to a "neutral" rating in a research note issued to investors on Monday, MarketBeat reports. They presently have a $2.00 price target on the biotechnology company's stock. UBS Group's price objective would suggest a potential downside of 18.70% from the stock's previous close.

Several other brokerages have also recently issued reports on PACB. Morgan Stanley lowered their price target on Pacific Biosciences of California from $4.00 to $2.00 and set an "equal weight" rating on the stock in a research report on Monday, August 12th. StockNews.com raised Pacific Biosciences of California to a "sell" rating in a report on Tuesday, August 13th. Piper Sandler boosted their price target on shares of Pacific Biosciences of California from $2.00 to $2.50 and gave the stock a "neutral" rating in a research report on Monday. Scotiabank reduced their price objective on shares of Pacific Biosciences of California from $8.00 to $7.00 and set a "sector outperform" rating for the company in a research report on Wednesday, August 28th. Finally, Cantor Fitzgerald reaffirmed an "overweight" rating and issued a $3.50 price objective on shares of Pacific Biosciences of California in a research note on Thursday, August 8th. One investment analyst has rated the stock with a sell rating, eight have assigned a hold rating and seven have issued a buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $3.63.

Get Our Latest Report on PACB

Pacific Biosciences of California Price Performance

Shares of Pacific Biosciences of California stock traded up $0.16 on Monday, hitting $2.46. The company had a trading volume of 15,263,144 shares, compared to its average volume of 9,550,852. Pacific Biosciences of California has a 52 week low of $1.16 and a 52 week high of $10.65. The company has a debt-to-equity ratio of 1.81, a current ratio of 8.01 and a quick ratio of 7.14. The company has a market cap of $670.42 million, a PE ratio of -1.60 and a beta of 2.01. The business has a 50-day simple moving average of $1.85 and a 200-day simple moving average of $1.75.

Insider Activity at Pacific Biosciences of California

In other Pacific Biosciences of California news, insider Jeff Eidel sold 26,760 shares of the firm's stock in a transaction dated Monday, August 19th. The stock was sold at an average price of $1.59, for a total transaction of $42,548.40. Following the completion of the sale, the insider now directly owns 869,730 shares in the company, valued at approximately $1,382,870.70. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. In related news, insider Oene Mark Van sold 38,011 shares of Pacific Biosciences of California stock in a transaction on Friday, August 16th. The stock was sold at an average price of $1.66, for a total transaction of $63,098.26. Following the completion of the sale, the insider now owns 1,630,815 shares of the company's stock, valued at approximately $2,707,152.90. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Jeff Eidel sold 26,760 shares of the business's stock in a transaction dated Monday, August 19th. The shares were sold at an average price of $1.59, for a total value of $42,548.40. Following the completion of the transaction, the insider now owns 869,730 shares in the company, valued at $1,382,870.70. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 2.40% of the stock is owned by insiders.

Institutional Inflows and Outflows

Several hedge funds have recently modified their holdings of the business. Assenagon Asset Management S.A. bought a new position in shares of Pacific Biosciences of California in the 2nd quarter valued at approximately $1,775,000. Marshall Wace LLP raised its position in shares of Pacific Biosciences of California by 226.6% in the second quarter. Marshall Wace LLP now owns 1,611,300 shares of the biotechnology company's stock valued at $2,207,000 after purchasing an additional 1,117,966 shares during the period. Koss Olinger Consulting LLC acquired a new stake in shares of Pacific Biosciences of California in the second quarter worth $1,096,000. Squarepoint Ops LLC bought a new stake in shares of Pacific Biosciences of California during the 2nd quarter worth $719,000. Finally, Federated Hermes Inc. acquired a new position in Pacific Biosciences of California in the 2nd quarter valued at $612,000.

About Pacific Biosciences of California

(

Get Free Report)

Pacific Biosciences of California, Inc designs, develops, and manufactures sequencing solution to resolve genetically complex problems. The company provides sequencing systems; consumable products, including single molecule real-time (SMRT) technology; long-red sequencing; and various reagent kits designed for specific workflow, such as preparation kit to convert DNA into SMRTbell double-stranded DNA library formats, including molecular biology reagents, such as ligase, buffers, and exonucleases.

Featured Articles

Before you consider Pacific Biosciences of California, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pacific Biosciences of California wasn't on the list.

While Pacific Biosciences of California currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.