Equities researchers at UBS Group initiated coverage on shares of Pagaya Technologies (NASDAQ:PGY - Get Free Report) in a research note issued to investors on Friday, MarketBeat Ratings reports. The firm set a "neutral" rating and a $11.00 price target on the stock. UBS Group's price target would indicate a potential upside of 22.91% from the company's previous close.

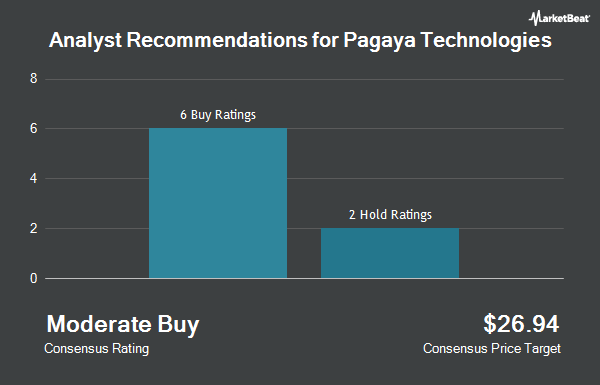

Other analysts also recently issued reports about the stock. JMP Securities restated a "market outperform" rating and issued a $25.00 target price on shares of Pagaya Technologies in a report on Tuesday, September 3rd. B. Riley reduced their price objective on Pagaya Technologies from $48.00 to $36.00 and set a "buy" rating on the stock in a research note on Monday, September 30th. Benchmark restated a "buy" rating and set a $21.00 price objective on shares of Pagaya Technologies in a research report on Wednesday, October 16th. Oppenheimer assumed coverage on Pagaya Technologies in a report on Tuesday, October 1st. They issued an "outperform" rating and a $12.00 target price for the company. Finally, Canaccord Genuity Group decreased their price target on Pagaya Technologies from $32.00 to $25.00 and set a "buy" rating on the stock in a report on Wednesday, November 13th. Three equities research analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $20.00.

Read Our Latest Research Report on Pagaya Technologies

Pagaya Technologies Price Performance

PGY traded up $0.24 during trading hours on Friday, hitting $8.95. The company's stock had a trading volume of 3,232,412 shares, compared to its average volume of 1,422,088. The stock has a market cap of $659.22 million, a price-to-earnings ratio of -3.52 and a beta of 6.11. The business's 50-day moving average price is $10.80 and its 200-day moving average price is $12.04. The company has a current ratio of 1.17, a quick ratio of 1.17 and a debt-to-equity ratio of 0.82. Pagaya Technologies has a 12 month low of $8.20 and a 12 month high of $20.00.

Insider Transactions at Pagaya Technologies

In related news, insider Yahav Yulzari sold 150,000 shares of the business's stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of $15.50, for a total value of $2,325,000.00. Following the completion of the sale, the insider now owns 161,637 shares in the company, valued at approximately $2,505,373.50. The trade was a 48.13 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Tami Rosen sold 7,659 shares of the firm's stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $12.00, for a total value of $91,908.00. Following the transaction, the insider now owns 65,857 shares in the company, valued at $790,284. The trade was a 10.42 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 186,045 shares of company stock worth $2,755,982. 49.56% of the stock is currently owned by insiders.

Hedge Funds Weigh In On Pagaya Technologies

Hedge funds and other institutional investors have recently modified their holdings of the business. Point72 Asset Management L.P. boosted its position in Pagaya Technologies by 4,374.9% during the third quarter. Point72 Asset Management L.P. now owns 311,859 shares of the company's stock valued at $3,296,000 after purchasing an additional 304,890 shares in the last quarter. Centiva Capital LP purchased a new stake in shares of Pagaya Technologies during the third quarter valued at about $617,000. ARK Investment Management LLC boosted its holdings in shares of Pagaya Technologies by 36.2% in the 2nd quarter. ARK Investment Management LLC now owns 221,810 shares of the company's stock valued at $2,830,000 after buying an additional 58,939 shares in the last quarter. Yarra Square Partners LP grew its position in shares of Pagaya Technologies by 29.9% in the 2nd quarter. Yarra Square Partners LP now owns 619,345 shares of the company's stock worth $7,903,000 after buying an additional 142,500 shares during the last quarter. Finally, Millennium Management LLC raised its stake in shares of Pagaya Technologies by 455.9% during the 2nd quarter. Millennium Management LLC now owns 218,549 shares of the company's stock worth $2,789,000 after acquiring an additional 179,235 shares in the last quarter. 57.14% of the stock is currently owned by institutional investors.

Pagaya Technologies Company Profile

(

Get Free Report)

Pagaya Technologies Ltd., a product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial institutions and investors in the United States, Israel, the Cayman Islands, and internationally. The company develops and implements proprietary artificial intelligence technology and related software solutions to assist partners to originate loans and other assets.

Featured Stories

Before you consider Pagaya Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pagaya Technologies wasn't on the list.

While Pagaya Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.