Paloma Partners Management Co purchased a new stake in Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor purchased 31,252 shares of the company's stock, valued at approximately $641,000.

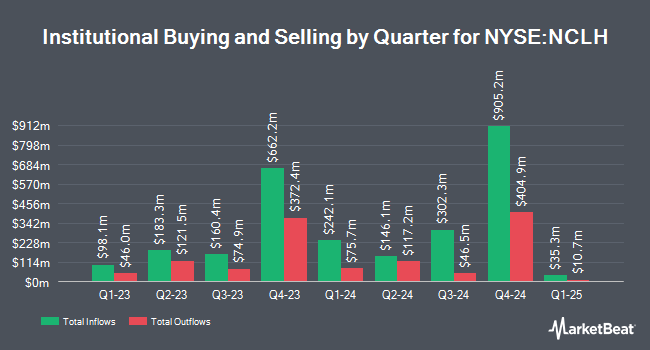

Other institutional investors and hedge funds have also bought and sold shares of the company. Avior Wealth Management LLC increased its position in shares of Norwegian Cruise Line by 34.1% during the 3rd quarter. Avior Wealth Management LLC now owns 1,686 shares of the company's stock valued at $35,000 after purchasing an additional 429 shares during the last quarter. Louisiana State Employees Retirement System increased its holdings in Norwegian Cruise Line by 2.1% in the 3rd quarter. Louisiana State Employees Retirement System now owns 24,800 shares of the company's stock worth $509,000 after acquiring an additional 500 shares during the last quarter. Thrivent Financial for Lutherans increased its holdings in Norwegian Cruise Line by 1.1% in the 3rd quarter. Thrivent Financial for Lutherans now owns 46,016 shares of the company's stock worth $944,000 after acquiring an additional 509 shares during the last quarter. Mount Lucas Management LP increased its holdings in Norwegian Cruise Line by 2.4% in the 3rd quarter. Mount Lucas Management LP now owns 22,055 shares of the company's stock worth $452,000 after acquiring an additional 516 shares during the last quarter. Finally, Sumitomo Mitsui Trust Group Inc. increased its holdings in Norwegian Cruise Line by 1.2% in the 3rd quarter. Sumitomo Mitsui Trust Group Inc. now owns 44,757 shares of the company's stock worth $918,000 after acquiring an additional 521 shares during the last quarter. 69.58% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several equities research analysts recently weighed in on the company. Deutsche Bank Aktiengesellschaft lifted their price objective on Norwegian Cruise Line from $21.00 to $24.00 and gave the stock a "hold" rating in a report on Friday, November 1st. JPMorgan Chase & Co. raised their target price on Norwegian Cruise Line from $23.00 to $25.00 and gave the stock a "neutral" rating in a research note on Monday, September 16th. The Goldman Sachs Group raised their target price on Norwegian Cruise Line from $24.00 to $29.00 and gave the stock a "neutral" rating in a research note on Friday, November 1st. Macquarie raised their target price on Norwegian Cruise Line from $24.00 to $30.00 and gave the stock an "outperform" rating in a research note on Friday, November 1st. Finally, Barclays raised their target price on Norwegian Cruise Line from $26.00 to $28.00 and gave the stock an "equal weight" rating in a research note on Friday, November 1st. One equities research analyst has rated the stock with a sell rating, nine have issued a hold rating, six have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and a consensus target price of $28.27.

View Our Latest Stock Report on Norwegian Cruise Line

Insider Activity at Norwegian Cruise Line

In other Norwegian Cruise Line news, CFO Mark Kempa sold 15,000 shares of the stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $27.86, for a total transaction of $417,900.00. Following the transaction, the chief financial officer now owns 253,386 shares of the company's stock, valued at $7,059,333.96. This trade represents a 5.59 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Andrea Demarco sold 29,000 shares of Norwegian Cruise Line stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $27.76, for a total transaction of $805,040.00. Following the transaction, the insider now owns 97,304 shares in the company, valued at $2,701,159.04. The trade was a 22.96 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 82,344 shares of company stock valued at $2,269,731 over the last ninety days. Insiders own 0.52% of the company's stock.

Norwegian Cruise Line Price Performance

NCLH stock traded up $0.28 during trading on Wednesday, hitting $27.66. The stock had a trading volume of 9,305,219 shares, compared to its average volume of 12,707,694. The company has a debt-to-equity ratio of 10.35, a current ratio of 0.20 and a quick ratio of 0.17. Norwegian Cruise Line Holdings Ltd. has a twelve month low of $14.69 and a twelve month high of $28.64. The stock has a market capitalization of $12.16 billion, a P/E ratio of 25.38, a PEG ratio of 0.32 and a beta of 2.65. The company's 50-day moving average price is $24.63 and its two-hundred day moving average price is $20.17.

Norwegian Cruise Line (NYSE:NCLH - Get Free Report) last posted its earnings results on Thursday, October 31st. The company reported $0.99 earnings per share for the quarter, beating the consensus estimate of $0.94 by $0.05. The firm had revenue of $2.81 billion during the quarter, compared to the consensus estimate of $2.77 billion. Norwegian Cruise Line had a net margin of 5.87% and a return on equity of 99.31%. The firm's revenue for the quarter was up 10.7% on a year-over-year basis. During the same quarter last year, the firm earned $0.71 EPS. As a group, research analysts predict that Norwegian Cruise Line Holdings Ltd. will post 1.51 EPS for the current fiscal year.

Norwegian Cruise Line Profile

(

Free Report)

Norwegian Cruise Line Holdings Ltd., together with its subsidiaries, operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally. The company operates through the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands. It offers itineraries ranging from three days to a 180-days calling on various ports, including Scandinavia, Northern Europe, the Mediterranean, the Greek Isles, Alaska, Canada and New England, Hawaii, Asia, Tahiti and the South Pacific, Australia and New Zealand, Africa, India, South America, the Panama Canal, and the Caribbean.

Featured Articles

Before you consider Norwegian Cruise Line, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Norwegian Cruise Line wasn't on the list.

While Norwegian Cruise Line currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.