Paloma Partners Management Co acquired a new position in shares of Kellanova (NYSE:K - Free Report) in the third quarter, according to its most recent 13F filing with the SEC. The institutional investor acquired 6,612 shares of the company's stock, valued at approximately $534,000.

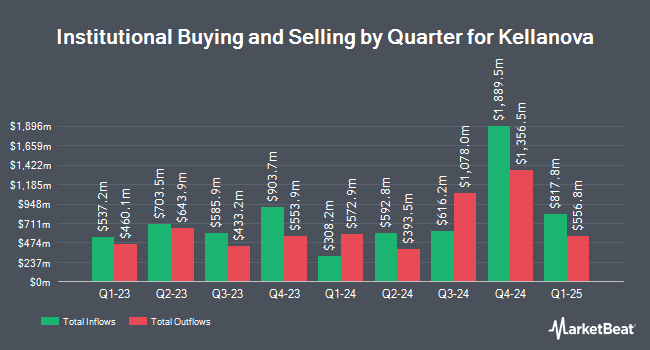

Other institutional investors and hedge funds also recently modified their holdings of the company. Atria Investments Inc acquired a new position in Kellanova in the 1st quarter worth about $1,003,000. Cetera Investment Advisers lifted its holdings in Kellanova by 393.2% during the first quarter. Cetera Investment Advisers now owns 117,392 shares of the company's stock worth $6,725,000 after acquiring an additional 93,588 shares in the last quarter. Cetera Advisors LLC lifted its holdings in shares of Kellanova by 61.5% in the first quarter. Cetera Advisors LLC now owns 24,530 shares of the company's stock valued at $1,405,000 after purchasing an additional 9,338 shares in the last quarter. Massmutual Trust Co. FSB ADV raised its holdings in Kellanova by 67.9% during the second quarter. Massmutual Trust Co. FSB ADV now owns 2,067 shares of the company's stock worth $119,000 after acquiring an additional 836 shares in the last quarter. Finally, Kingswood Wealth Advisors LLC increased its position in Kellanova by 16.1% during the second quarter. Kingswood Wealth Advisors LLC now owns 5,402 shares of the company's stock worth $312,000 after buying an additional 750 shares during the last quarter. Institutional investors own 83.87% of the company's stock.

Kellanova Trading Down 0.1 %

Shares of K stock traded down $0.12 during trading hours on Wednesday, reaching $80.47. 2,040,450 shares of the stock were exchanged, compared to its average volume of 2,979,985. The firm has a market capitalization of $27.74 billion, a price-to-earnings ratio of 27.65, a price-to-earnings-growth ratio of 2.59 and a beta of 0.38. The company has a current ratio of 0.77, a quick ratio of 0.53 and a debt-to-equity ratio of 1.34. Kellanova has a 12-month low of $52.46 and a 12-month high of $81.34. The company's 50-day moving average price is $80.82 and its 200-day moving average price is $71.78.

Kellanova (NYSE:K - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The company reported $0.91 EPS for the quarter, topping the consensus estimate of $0.85 by $0.06. Kellanova had a net margin of 7.85% and a return on equity of 37.05%. The firm had revenue of $3.23 billion during the quarter, compared to analyst estimates of $3.16 billion. During the same quarter in the previous year, the business posted $1.03 EPS. Kellanova's revenue was down .7% on a year-over-year basis. As a group, equities analysts anticipate that Kellanova will post 3.74 earnings per share for the current year.

Kellanova Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Monday, December 2nd will be given a $0.57 dividend. This represents a $2.28 dividend on an annualized basis and a dividend yield of 2.83%. The ex-dividend date is Monday, December 2nd. Kellanova's dividend payout ratio (DPR) is 78.35%.

Analyst Ratings Changes

A number of analysts recently weighed in on the company. Piper Sandler increased their price objective on Kellanova from $63.00 to $83.50 and gave the company a "neutral" rating in a report on Thursday, August 15th. Barclays lifted their price objective on shares of Kellanova from $67.00 to $83.00 and gave the company an "equal weight" rating in a research note on Thursday, August 15th. Argus lowered shares of Kellanova from a "buy" rating to a "hold" rating in a research report on Wednesday, October 2nd. The Goldman Sachs Group initiated coverage on shares of Kellanova in a report on Monday, August 12th. They set a "neutral" rating and a $75.00 target price for the company. Finally, Deutsche Bank Aktiengesellschaft raised their target price on shares of Kellanova from $76.00 to $83.50 and gave the company a "hold" rating in a research note on Thursday, August 15th. Fifteen equities research analysts have rated the stock with a hold rating and one has assigned a buy rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Hold" and an average price target of $76.35.

Check Out Our Latest Analysis on K

Insider Activity

In related news, major shareholder Kellogg W. K. Foundation Trust sold 114,583 shares of Kellanova stock in a transaction that occurred on Monday, September 9th. The shares were sold at an average price of $80.25, for a total value of $9,195,285.75. Following the completion of the transaction, the insider now owns 50,482,855 shares in the company, valued at $4,051,249,113.75. The trade was a 0.23 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Insiders sold 1,145,830 shares of company stock worth $92,516,606 over the last three months. Insiders own 1.80% of the company's stock.

Kellanova Profile

(

Free Report)

Kellanova, together with its subsidiaries, manufactures and markets snacks and convenience foods in North America, Europe, Latin America, the Asia Pacific, the Middle East, Australia, and Africa. Its principal products include crackers, crisps, savory snacks, toaster pastries, cereal bars, granola bars and bites, ready-to-eat cereals, frozen waffles, veggie foods, and noodles.

Featured Articles

Before you consider Kellanova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kellanova wasn't on the list.

While Kellanova currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.