Paloma Partners Management Co grew its holdings in Constellation Brands, Inc. (NYSE:STZ - Free Report) by 568.4% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 30,000 shares of the company's stock after acquiring an additional 25,512 shares during the period. Paloma Partners Management Co's holdings in Constellation Brands were worth $7,731,000 as of its most recent SEC filing.

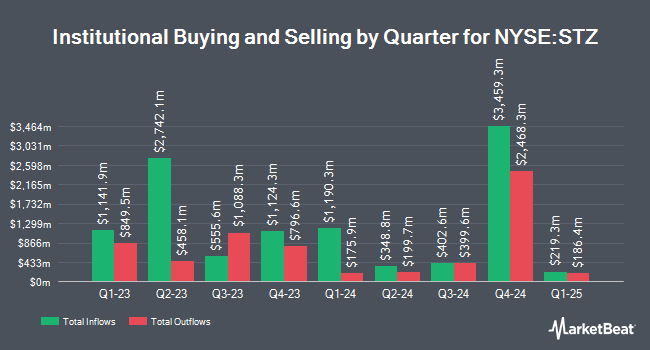

Other hedge funds also recently added to or reduced their stakes in the company. Legal & General Group Plc lifted its holdings in Constellation Brands by 5.7% in the 2nd quarter. Legal & General Group Plc now owns 1,335,976 shares of the company's stock worth $343,717,000 after buying an additional 72,637 shares in the last quarter. Dimensional Fund Advisors LP grew its stake in Constellation Brands by 31.8% during the 2nd quarter. Dimensional Fund Advisors LP now owns 1,002,332 shares of the company's stock valued at $257,865,000 after purchasing an additional 241,982 shares in the last quarter. International Assets Investment Management LLC boosted its stake in shares of Constellation Brands by 23,184.7% during the 3rd quarter. International Assets Investment Management LLC now owns 499,689 shares of the company's stock valued at $128,765,000 after buying an additional 497,543 shares during the last quarter. Manning & Napier Advisors LLC bought a new position in Constellation Brands during the 2nd quarter valued at $119,394,000. Finally, Raymond James & Associates grew its holdings in Constellation Brands by 14.4% during the 2nd quarter. Raymond James & Associates now owns 443,084 shares of the company's stock worth $113,997,000 after acquiring an additional 55,932 shares in the last quarter. 77.34% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at Constellation Brands

In other Constellation Brands news, EVP James A. Jr. Sabia sold 36,086 shares of Constellation Brands stock in a transaction on Thursday, November 14th. The stock was sold at an average price of $242.99, for a total value of $8,768,537.14. Following the completion of the transaction, the executive vice president now owns 16,042 shares in the company, valued at approximately $3,898,045.58. The trade was a 69.23 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, major shareholder Wildstar Partners Llc sold 660 shares of the business's stock in a transaction on Wednesday, November 20th. The stock was sold at an average price of $241.00, for a total value of $159,060.00. Following the completion of the transaction, the insider now directly owns 1,736,884 shares in the company, valued at approximately $418,589,044. This represents a 0.04 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 189,956 shares of company stock worth $46,058,091. Company insiders own 12.19% of the company's stock.

Analysts Set New Price Targets

A number of brokerages have recently issued reports on STZ. Wells Fargo & Company cut their target price on shares of Constellation Brands from $300.00 to $295.00 and set an "overweight" rating on the stock in a research note on Tuesday, November 26th. Truist Financial reduced their target price on Constellation Brands from $265.00 to $255.00 and set a "hold" rating on the stock in a report on Friday, October 4th. UBS Group lowered their price target on Constellation Brands from $320.00 to $295.00 and set a "buy" rating for the company in a report on Monday, September 9th. Roth Mkm restated a "buy" rating and set a $298.00 price objective on shares of Constellation Brands in a research note on Friday, October 4th. Finally, BNP Paribas initiated coverage on shares of Constellation Brands in a research note on Monday, November 25th. They set a "neutral" rating and a $261.00 target price for the company. Five equities research analysts have rated the stock with a hold rating and fourteen have issued a buy rating to the stock. According to MarketBeat, Constellation Brands presently has a consensus rating of "Moderate Buy" and a consensus price target of $289.16.

Check Out Our Latest Research Report on Constellation Brands

Constellation Brands Stock Down 1.8 %

STZ traded down $4.37 during midday trading on Monday, hitting $236.58. 537,851 shares of the company's stock traded hands, compared to its average volume of 1,203,758. Constellation Brands, Inc. has a one year low of $224.76 and a one year high of $274.87. The stock's fifty day simple moving average is $241.72 and its 200-day simple moving average is $246.71. The company has a debt-to-equity ratio of 1.31, a current ratio of 1.25 and a quick ratio of 0.53. The company has a market cap of $42.95 billion, a PE ratio of 77.98, a price-to-earnings-growth ratio of 1.70 and a beta of 0.90.

Constellation Brands (NYSE:STZ - Get Free Report) last issued its quarterly earnings data on Thursday, October 3rd. The company reported $4.32 earnings per share for the quarter, beating analysts' consensus estimates of $4.08 by $0.24. Constellation Brands had a return on equity of 25.34% and a net margin of 5.29%. The business had revenue of $2.92 billion for the quarter, compared to the consensus estimate of $2.95 billion. During the same period last year, the business earned $3.70 EPS. The firm's revenue was up 2.9% compared to the same quarter last year. As a group, equities analysts anticipate that Constellation Brands, Inc. will post 13.57 earnings per share for the current fiscal year.

Constellation Brands Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Thursday, November 21st. Shareholders of record on Tuesday, November 5th were issued a dividend of $1.01 per share. This represents a $4.04 dividend on an annualized basis and a yield of 1.71%. The ex-dividend date of this dividend was Tuesday, November 5th. Constellation Brands's dividend payout ratio (DPR) is 130.74%.

About Constellation Brands

(

Free Report)

Constellation Brands, Inc, together with its subsidiaries, produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy. The company provides beer primarily under the Corona Extra, Corona Familiar, Corona Hard Seltzer, Corona Light, Corona Non-Alcoholic, Corona Premier, Corona Refresca, Modelo Especial, Modelo Chelada, Modelo Negra, Modelo Oro, Victoria, Vicky Chamoy, and Pacifico brands.

Read More

Before you consider Constellation Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Constellation Brands wasn't on the list.

While Constellation Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report