Paloma Partners Management Co bought a new stake in shares of VeriSign, Inc. (NASDAQ:VRSN - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund bought 2,706 shares of the information services provider's stock, valued at approximately $514,000.

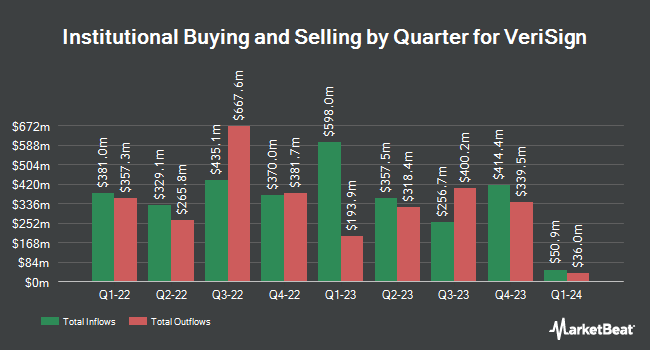

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Blue Trust Inc. lifted its holdings in shares of VeriSign by 291.1% during the second quarter. Blue Trust Inc. now owns 176 shares of the information services provider's stock valued at $33,000 after purchasing an additional 131 shares in the last quarter. UMB Bank n.a. lifted its holdings in shares of VeriSign by 117.2% during the second quarter. UMB Bank n.a. now owns 202 shares of the information services provider's stock valued at $36,000 after purchasing an additional 109 shares in the last quarter. Rothschild Investment LLC bought a new position in shares of VeriSign during the second quarter valued at $38,000. Migdal Insurance & Financial Holdings Ltd. bought a new position in VeriSign in the second quarter valued at about $39,000. Finally, Concord Wealth Partners lifted its holdings in VeriSign by 93.2% in the third quarter. Concord Wealth Partners now owns 226 shares of the information services provider's stock valued at $43,000 after acquiring an additional 109 shares during the period. 92.90% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling

In other news, EVP Danny R. Mcpherson sold 2,092 shares of the firm's stock in a transaction that occurred on Monday, December 2nd. The stock was sold at an average price of $192.43, for a total value of $402,563.56. Following the completion of the sale, the executive vice president now directly owns 26,157 shares of the company's stock, valued at $5,033,391.51. This trade represents a 7.41 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, EVP Thomas C. Indelicarto sold 1,228 shares of the firm's stock in a transaction that occurred on Tuesday, October 15th. The stock was sold at an average price of $190.00, for a total value of $233,320.00. Following the sale, the executive vice president now directly owns 33,593 shares of the company's stock, valued at $6,382,670. This represents a 3.53 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 5,776 shares of company stock worth $1,102,524. 0.84% of the stock is owned by corporate insiders.

VeriSign Trading Down 0.5 %

VRSN stock traded down $0.99 during trading on Wednesday, reaching $187.00. The stock had a trading volume of 505,787 shares, compared to its average volume of 664,070. VeriSign, Inc. has a 52 week low of $167.04 and a 52 week high of $220.91. The stock's 50 day moving average is $184.80 and its two-hundred day moving average is $181.01. The firm has a market cap of $17.97 billion, a PE ratio of 21.74 and a beta of 0.92.

VeriSign (NASDAQ:VRSN - Get Free Report) last posted its earnings results on Thursday, October 24th. The information services provider reported $2.07 earnings per share for the quarter, beating analysts' consensus estimates of $2.01 by $0.06. The company had revenue of $390.60 million for the quarter, compared to the consensus estimate of $390.19 million. VeriSign had a negative return on equity of 45.59% and a net margin of 55.74%. VeriSign's revenue was up 3.8% on a year-over-year basis. During the same quarter in the prior year, the company earned $1.83 earnings per share.

VeriSign Profile

(

Free Report)

VeriSign, Inc, together with its subsidiaries, provides domain name registry services and internet infrastructure that enables internet navigation for various recognized domain names worldwide. The company enables the security, stability, and resiliency of internet infrastructure and services, including providing root zone maintainer services, operating two of thirteen internet root servers; and offering registration services and authoritative resolution for the .com and .net domains, which supports global e-commerce.

Featured Articles

Before you consider VeriSign, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VeriSign wasn't on the list.

While VeriSign currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.