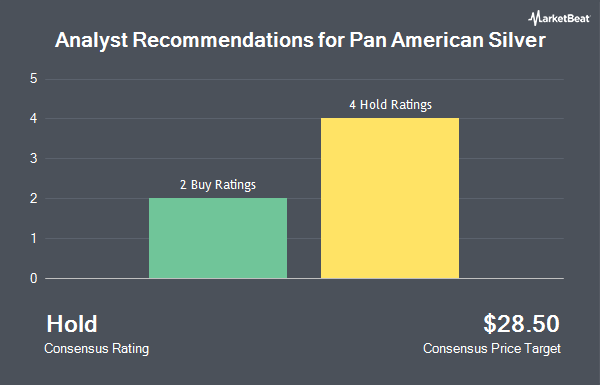

Pan American Silver Corp. (NYSE:PAAS - Get Free Report) TSE: PAAS has earned an average rating of "Moderate Buy" from the six analysts that are currently covering the stock, Marketbeat.com reports. One research analyst has rated the stock with a hold rating and five have assigned a buy rating to the company. The average 12-month price objective among brokers that have issued a report on the stock in the last year is $24.93.

PAAS has been the topic of a number of research analyst reports. Scotiabank raised their price target on Pan American Silver from $23.00 to $26.00 and gave the company a "sector outperform" rating in a report on Tuesday, July 16th. Royal Bank of Canada raised their target price on shares of Pan American Silver from $25.00 to $27.00 and gave the company an "outperform" rating in a research note on Tuesday, September 10th. Finally, Jefferies Financial Group upped their price target on shares of Pan American Silver from $21.00 to $23.00 and gave the stock a "hold" rating in a research note on Friday, October 4th.

Read Our Latest Analysis on Pan American Silver

Pan American Silver Stock Performance

NYSE PAAS traded down $0.18 on Tuesday, hitting $21.51. The stock had a trading volume of 1,385,661 shares, compared to its average volume of 4,057,884. The company's 50-day moving average is $21.97 and its two-hundred day moving average is $21.23. Pan American Silver has a one year low of $12.16 and a one year high of $26.05. The stock has a market cap of $7.81 billion, a price-to-earnings ratio of -127.46 and a beta of 1.33. The company has a quick ratio of 0.92, a current ratio of 2.06 and a debt-to-equity ratio of 0.16.

Pan American Silver Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, November 29th. Shareholders of record on Monday, November 18th will be given a $0.10 dividend. The ex-dividend date of this dividend is Monday, November 18th. This represents a $0.40 annualized dividend and a yield of 1.86%. Pan American Silver's dividend payout ratio (DPR) is -235.28%.

Institutional Investors Weigh In On Pan American Silver

Institutional investors and hedge funds have recently modified their holdings of the stock. Integrated Investment Consultants LLC purchased a new position in shares of Pan American Silver in the third quarter worth approximately $838,000. Foundry Partners LLC boosted its stake in Pan American Silver by 22.7% in the 3rd quarter. Foundry Partners LLC now owns 320,069 shares of the basic materials company's stock worth $6,680,000 after purchasing an additional 59,304 shares during the period. Advisors Asset Management Inc. grew its position in Pan American Silver by 3.7% during the 3rd quarter. Advisors Asset Management Inc. now owns 26,751 shares of the basic materials company's stock worth $558,000 after purchasing an additional 951 shares in the last quarter. Swiss National Bank raised its stake in Pan American Silver by 0.3% during the 3rd quarter. Swiss National Bank now owns 1,097,619 shares of the basic materials company's stock valued at $22,955,000 after purchasing an additional 3,400 shares during the period. Finally, CIBC Asset Management Inc lifted its holdings in shares of Pan American Silver by 0.3% in the third quarter. CIBC Asset Management Inc now owns 598,855 shares of the basic materials company's stock valued at $12,510,000 after purchasing an additional 2,020 shares in the last quarter. Institutional investors and hedge funds own 55.43% of the company's stock.

Pan American Silver Company Profile

(

Get Free ReportPan American Silver Corp. engages in the exploration, mine development, extraction, processing, refining, and reclamation of silver, gold, zinc, lead, and copper mines in Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil. The company was formerly known as Pan American Minerals Corp. and changed its name to Pan American Silver Corp.

Featured Stories

Before you consider Pan American Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pan American Silver wasn't on the list.

While Pan American Silver currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.