Dynamic Technology Lab Private Ltd boosted its position in shares of Pan American Silver Corp. (NYSE:PAAS - Free Report) TSE: PAAS by 383.6% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 58,274 shares of the basic materials company's stock after purchasing an additional 46,224 shares during the period. Dynamic Technology Lab Private Ltd's holdings in Pan American Silver were worth $1,216,000 at the end of the most recent quarter.

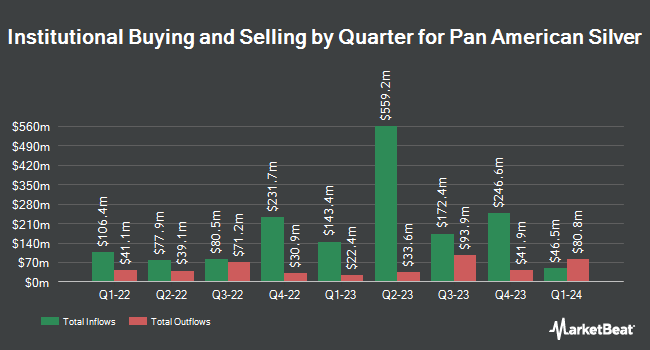

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in PAAS. Van ECK Associates Corp grew its holdings in Pan American Silver by 6.3% during the 3rd quarter. Van ECK Associates Corp now owns 39,512,808 shares of the basic materials company's stock worth $824,632,000 after acquiring an additional 2,328,306 shares during the last quarter. Vanguard Group Inc. lifted its holdings in Pan American Silver by 1.2% in the first quarter. Vanguard Group Inc. now owns 13,225,480 shares of the basic materials company's stock valued at $199,440,000 after buying an additional 159,908 shares during the period. Mackenzie Financial Corp grew its holdings in Pan American Silver by 51.1% during the 2nd quarter. Mackenzie Financial Corp now owns 3,124,517 shares of the basic materials company's stock worth $62,107,000 after acquiring an additional 1,056,981 shares during the period. TD Asset Management Inc raised its position in shares of Pan American Silver by 22.1% during the 2nd quarter. TD Asset Management Inc now owns 2,186,157 shares of the basic materials company's stock valued at $43,440,000 after acquiring an additional 395,589 shares during the last quarter. Finally, Driehaus Capital Management LLC acquired a new position in shares of Pan American Silver in the 2nd quarter valued at $38,116,000. 55.43% of the stock is currently owned by institutional investors and hedge funds.

Pan American Silver Stock Down 0.8 %

Shares of Pan American Silver stock traded down $0.17 during trading hours on Wednesday, reaching $21.55. 2,477,001 shares of the company's stock were exchanged, compared to its average volume of 4,061,376. The company has a current ratio of 2.06, a quick ratio of 0.96 and a debt-to-equity ratio of 0.16. The company has a 50 day moving average of $22.50 and a two-hundred day moving average of $21.47. The stock has a market cap of $7.82 billion, a P/E ratio of -127.93 and a beta of 1.33. Pan American Silver Corp. has a fifty-two week low of $12.16 and a fifty-two week high of $26.05.

Pan American Silver Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, November 29th. Shareholders of record on Monday, November 18th will be given a dividend of $0.10 per share. This represents a $0.40 annualized dividend and a dividend yield of 1.86%. The ex-dividend date of this dividend is Monday, November 18th. Pan American Silver's dividend payout ratio (DPR) is -235.28%.

Wall Street Analysts Forecast Growth

Several equities research analysts have weighed in on PAAS shares. StockNews.com upgraded shares of Pan American Silver from a "hold" rating to a "buy" rating in a report on Monday. Jefferies Financial Group boosted their price objective on Pan American Silver from $21.00 to $23.00 and gave the company a "hold" rating in a research report on Friday, October 4th. Finally, Royal Bank of Canada raised their target price on shares of Pan American Silver from $25.00 to $27.00 and gave the stock an "outperform" rating in a report on Tuesday, September 10th. One analyst has rated the stock with a hold rating and five have assigned a buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $25.42.

Check Out Our Latest Analysis on PAAS

Pan American Silver Profile

(

Free Report)

Pan American Silver Corp. engages in the exploration, mine development, extraction, processing, refining, and reclamation of silver, gold, zinc, lead, and copper mines in Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil. The company was formerly known as Pan American Minerals Corp. and changed its name to Pan American Silver Corp.

Recommended Stories

Before you consider Pan American Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pan American Silver wasn't on the list.

While Pan American Silver currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.