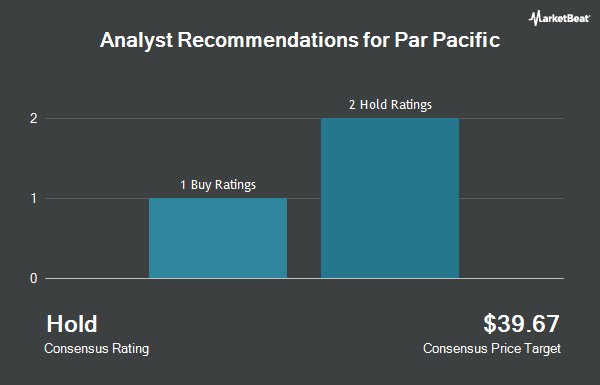

Par Pacific Holdings, Inc. (NYSE:PARR - Get Free Report) has received an average rating of "Hold" from the eight ratings firms that are covering the stock, MarketBeat reports. Five equities research analysts have rated the stock with a hold recommendation and three have issued a buy recommendation on the company. The average 1 year price objective among brokerages that have issued ratings on the stock in the last year is $28.00.

A number of brokerages recently issued reports on PARR. StockNews.com raised shares of Par Pacific from a "sell" rating to a "hold" rating in a report on Thursday, November 14th. UBS Group lowered their price target on Par Pacific from $40.00 to $29.00 and set a "neutral" rating for the company in a research report on Monday, August 19th. Piper Sandler downgraded Par Pacific from an "overweight" rating to a "neutral" rating and cut their price objective for the company from $37.00 to $23.00 in a report on Friday, September 20th. Tudor, Pickering, Holt & Co. cut Par Pacific from a "buy" rating to a "hold" rating in a report on Monday, September 9th. Finally, TD Cowen cut their price objective on Par Pacific from $36.00 to $32.00 and set a "buy" rating on the stock in a research report on Friday, August 9th.

Check Out Our Latest Stock Analysis on Par Pacific

Institutional Trading of Par Pacific

Several institutional investors have recently modified their holdings of PARR. Headlands Technologies LLC boosted its holdings in shares of Par Pacific by 215.1% in the second quarter. Headlands Technologies LLC now owns 1,166 shares of the company's stock valued at $29,000 after acquiring an additional 796 shares during the period. Meeder Asset Management Inc. acquired a new stake in Par Pacific in the second quarter valued at about $43,000. Quarry LP boosted its holdings in Par Pacific by 610.5% in the 2nd quarter. Quarry LP now owns 2,359 shares of the company's stock valued at $60,000 after purchasing an additional 2,027 shares in the last quarter. nVerses Capital LLC raised its stake in shares of Par Pacific by 41.7% during the 2nd quarter. nVerses Capital LLC now owns 3,400 shares of the company's stock worth $86,000 after buying an additional 1,000 shares in the last quarter. Finally, Innealta Capital LLC acquired a new stake in shares of Par Pacific in the 2nd quarter valued at approximately $104,000. Hedge funds and other institutional investors own 92.15% of the company's stock.

Par Pacific Price Performance

NYSE:PARR traded up $0.03 during trading hours on Friday, hitting $17.43. 446,081 shares of the stock were exchanged, compared to its average volume of 906,985. The firm's fifty day moving average price is $17.38 and its 200 day moving average price is $21.78. Par Pacific has a 52-week low of $14.84 and a 52-week high of $40.69. The company has a market cap of $975.21 million, a P/E ratio of 3.37 and a beta of 1.99. The company has a current ratio of 1.69, a quick ratio of 0.66 and a debt-to-equity ratio of 0.84.

Par Pacific (NYSE:PARR - Get Free Report) last announced its quarterly earnings data on Monday, November 4th. The company reported ($0.10) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.12) by $0.02. Par Pacific had a net margin of 3.74% and a return on equity of 10.06%. The company had revenue of $2.14 billion during the quarter, compared to analysts' expectations of $1.88 billion. During the same quarter in the prior year, the company earned $3.15 EPS. Par Pacific's revenue was down 16.9% compared to the same quarter last year. As a group, equities research analysts anticipate that Par Pacific will post 0.95 EPS for the current fiscal year.

About Par Pacific

(

Get Free ReportPar Pacific Holdings, Inc owns and operates energy and infrastructure businesses. The company operates through Refining, Retail, and Logistics segments. The Refining segment owns and operates refineries that produce gasoline, distillate, asphalt, and other products primarily for consumption in Kapolei, Hawaii, Newcastle, Wyoming, Tacoma, Washington, and Billings, Montana.

Featured Stories

Before you consider Par Pacific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Par Pacific wasn't on the list.

While Par Pacific currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.