Algert Global LLC lifted its holdings in shares of Par Pacific Holdings, Inc. (NYSE:PARR - Free Report) by 63.8% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 303,970 shares of the company's stock after acquiring an additional 118,393 shares during the period. Algert Global LLC owned approximately 0.54% of Par Pacific worth $5,350,000 at the end of the most recent reporting period.

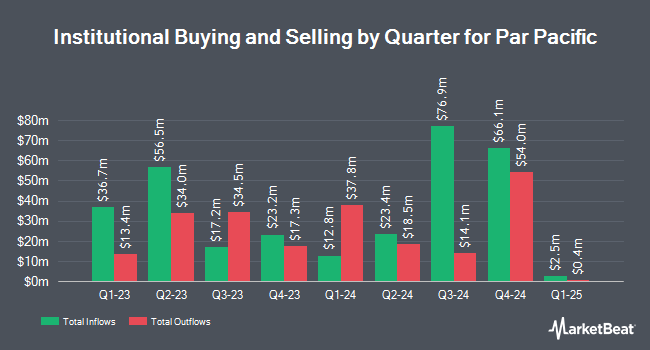

A number of other institutional investors and hedge funds also recently made changes to their positions in the business. SummerHaven Investment Management LLC raised its holdings in shares of Par Pacific by 2.0% in the second quarter. SummerHaven Investment Management LLC now owns 28,537 shares of the company's stock valued at $721,000 after purchasing an additional 563 shares during the last quarter. Simplicity Wealth LLC increased its stake in Par Pacific by 5.1% in the 2nd quarter. Simplicity Wealth LLC now owns 13,949 shares of the company's stock valued at $352,000 after buying an additional 677 shares during the last quarter. Linden Thomas Advisory Services LLC lifted its position in shares of Par Pacific by 1.6% during the 2nd quarter. Linden Thomas Advisory Services LLC now owns 43,892 shares of the company's stock worth $1,108,000 after buying an additional 703 shares in the last quarter. Headlands Technologies LLC boosted its stake in shares of Par Pacific by 215.1% in the 2nd quarter. Headlands Technologies LLC now owns 1,166 shares of the company's stock worth $29,000 after buying an additional 796 shares during the last quarter. Finally, State of Alaska Department of Revenue grew its holdings in shares of Par Pacific by 2.6% in the third quarter. State of Alaska Department of Revenue now owns 32,145 shares of the company's stock valued at $565,000 after acquiring an additional 810 shares in the last quarter. Institutional investors and hedge funds own 92.15% of the company's stock.

Analyst Ratings Changes

A number of brokerages recently commented on PARR. JPMorgan Chase & Co. upgraded Par Pacific from a "neutral" rating to an "overweight" rating and dropped their price target for the stock from $36.00 to $30.00 in a report on Wednesday, October 2nd. The Goldman Sachs Group decreased their price objective on shares of Par Pacific from $32.00 to $28.00 and set a "neutral" rating for the company in a report on Wednesday, October 9th. Tudor Pickering upgraded shares of Par Pacific to a "hold" rating in a research note on Monday, September 9th. Mizuho decreased their price target on shares of Par Pacific from $28.00 to $26.00 and set an "outperform" rating for the company in a research note on Wednesday, October 9th. Finally, Piper Sandler downgraded Par Pacific from an "overweight" rating to a "neutral" rating and dropped their price objective for the company from $37.00 to $23.00 in a research note on Friday, September 20th. Six equities research analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Hold" and an average price target of $28.00.

Read Our Latest Stock Report on PARR

Par Pacific Stock Performance

Shares of PARR stock traded up $0.03 during trading on Monday, reaching $17.63. 842,082 shares of the company's stock traded hands, compared to its average volume of 909,380. The firm's 50-day moving average is $17.46 and its 200 day moving average is $21.89. The company has a market capitalization of $986.40 million, a P/E ratio of 3.42 and a beta of 1.99. Par Pacific Holdings, Inc. has a 1 year low of $14.84 and a 1 year high of $40.69. The company has a current ratio of 1.69, a quick ratio of 0.66 and a debt-to-equity ratio of 0.84.

Par Pacific (NYSE:PARR - Get Free Report) last posted its earnings results on Monday, November 4th. The company reported ($0.10) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.12) by $0.02. The firm had revenue of $2.14 billion for the quarter, compared to the consensus estimate of $1.88 billion. Par Pacific had a return on equity of 10.06% and a net margin of 3.74%. The business's quarterly revenue was down 16.9% on a year-over-year basis. During the same quarter in the prior year, the business posted $3.15 earnings per share. Equities research analysts expect that Par Pacific Holdings, Inc. will post 0.95 EPS for the current year.

About Par Pacific

(

Free Report)

Par Pacific Holdings, Inc owns and operates energy and infrastructure businesses. The company operates through Refining, Retail, and Logistics segments. The Refining segment owns and operates refineries that produce gasoline, distillate, asphalt, and other products primarily for consumption in Kapolei, Hawaii, Newcastle, Wyoming, Tacoma, Washington, and Billings, Montana.

Recommended Stories

Before you consider Par Pacific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Par Pacific wasn't on the list.

While Par Pacific currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.