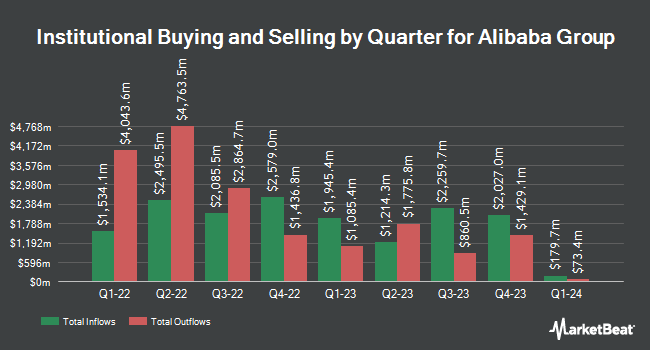

Parametrica Management Ltd increased its stake in shares of Alibaba Group Holding Limited (NYSE:BABA - Free Report) by 43.3% in the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 54,368 shares of the specialty retailer's stock after acquiring an additional 16,417 shares during the quarter. Alibaba Group comprises about 6.9% of Parametrica Management Ltd's portfolio, making the stock its 2nd largest holding. Parametrica Management Ltd's holdings in Alibaba Group were worth $5,770,000 as of its most recent filing with the SEC.

A number of other hedge funds and other institutional investors have also recently modified their holdings of BABA. Oppenheimer Asset Management Inc. raised its stake in shares of Alibaba Group by 11.5% in the third quarter. Oppenheimer Asset Management Inc. now owns 49,237 shares of the specialty retailer's stock valued at $5,225,000 after acquiring an additional 5,089 shares during the period. Angeles Investment Advisors LLC bought a new position in shares of Alibaba Group in the third quarter worth about $271,000. Community Bank & Trust Waco Texas bought a new position in shares of Alibaba Group in the third quarter worth about $264,000. Future Fund LLC bought a new position in shares of Alibaba Group in the third quarter worth about $754,000. Finally, Aptus Capital Advisors LLC bought a new position in shares of Alibaba Group in the third quarter worth about $206,000. Institutional investors own 13.47% of the company's stock.

Alibaba Group Stock Performance

Shares of Alibaba Group stock traded up $0.21 during midday trading on Wednesday, hitting $91.99. The company had a trading volume of 12,856,192 shares, compared to its average volume of 17,638,014. The stock has a market cap of $220.31 billion, a price-to-earnings ratio of 24.05, a PEG ratio of 0.41 and a beta of 0.35. The company has a quick ratio of 1.41, a current ratio of 1.41 and a debt-to-equity ratio of 0.17. The company has a fifty day simple moving average of $97.68 and a 200 day simple moving average of $85.39. Alibaba Group Holding Limited has a 12-month low of $66.63 and a 12-month high of $117.82.

Alibaba Group (NYSE:BABA - Get Free Report) last announced its quarterly earnings data on Thursday, August 15th. The specialty retailer reported $16.44 EPS for the quarter, beating the consensus estimate of $1.87 by $14.57. Alibaba Group had a net margin of 7.31% and a return on equity of 12.08%. The firm had revenue of $243.24 billion during the quarter, compared to analyst estimates of $248.32 billion. During the same period last year, the firm posted $2.47 EPS. Alibaba Group's revenue was up 3.9% on a year-over-year basis. As a group, analysts predict that Alibaba Group Holding Limited will post 8.51 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

Several research analysts have issued reports on the stock. Macquarie upgraded shares of Alibaba Group from a "neutral" rating to an "outperform" rating and set a $145.00 target price on the stock in a report on Monday, October 7th. Benchmark reiterated a "buy" rating and set a $118.00 target price on shares of Alibaba Group in a report on Friday, August 16th. Sanford C. Bernstein increased their target price on shares of Alibaba Group from $80.00 to $85.00 and gave the stock a "market perform" rating in a report on Friday, August 16th. JPMorgan Chase & Co. increased their target price on shares of Alibaba Group from $100.00 to $108.00 and gave the stock an "overweight" rating in a report on Friday, August 16th. Finally, Susquehanna lowered their price target on shares of Alibaba Group from $135.00 to $130.00 and set a "positive" rating on the stock in a report on Monday, August 19th. Three analysts have rated the stock with a hold rating and thirteen have given a buy rating to the stock. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $114.53.

Check Out Our Latest Research Report on BABA

Alibaba Group Company Profile

(

Free Report)

Alibaba Group Holding Limited, through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally. The company operates through seven segments: China Commerce, International Commerce, Local Consumer Services, Cainiao, Cloud, Digital Media and Entertainment, and Innovation Initiatives and Others.

See Also

Before you consider Alibaba Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alibaba Group wasn't on the list.

While Alibaba Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.